Bitcoin (BTC) has proven its safe haven status by reclaiming the $30,000 zone. Meanwhile, gold has been downtrend after hitting an all-time high in May.

In times of crises, assets with limited supply, such as gold and Bitcoin, are considered a store of value and safe haven for the investors’ wealth.

Gold Enters Downtrend

Central banks have been rapidly increasing interest rates since 2022. Today, the Bank of England announced a 50 basis point interest rate hike, making it the 13th consecutive hike.

Furthermore, the bank might continue to increase the interest rate if needed. While the US Federal Reserve (Fed) finally ended its streak of raising interest rates, it has not neglected the possibility of further hikes in the upcoming months.

Due to these, the precious metal market has suffered significantly. Jim Wyckoff, senior analyst at Kitco.com, told MarketWatch:

“Central banks are in focus late this week, and they are still leaning hawkish on their monetary policies. That is bearish for the precious metals markets, both from a demand perspective and as it makes the competing asset class of government bonds more attractive as yields are rising.”

Today, gold has fallen by almost 1%. While its price has clearly entered a downtrend, forming lower highs and lower lows.

Bitcoin Retains Safe Haven Status

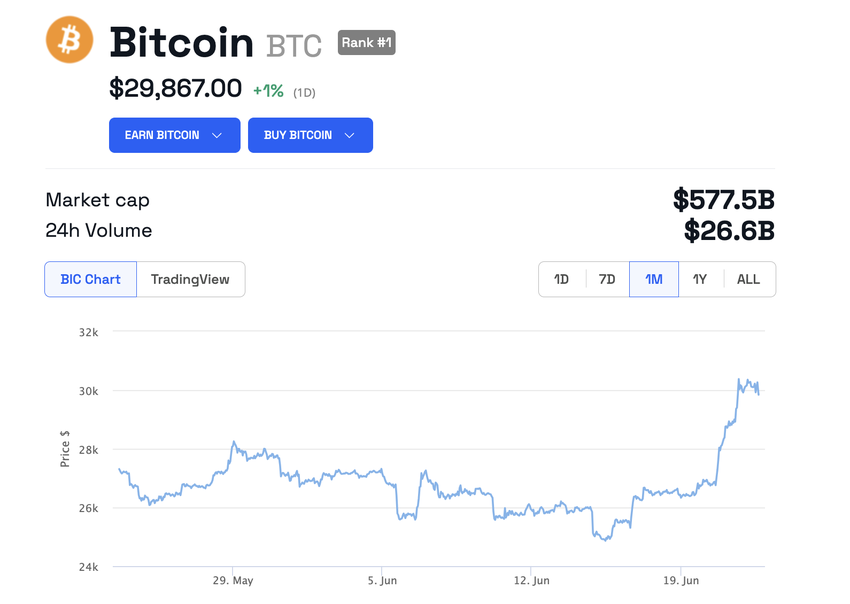

While gold and Bitcoin are both considered safe havens, Bitcoin has been outperforming recently. As of writing, Bitcoin is trading at $29,867, hovering around the $30,000 zone since yesterday.

On Wednesday, it reclaimed the $30,000 zone for the first time since April 2023. Primarily, this is because the world’s largest institutional asset manager, BlackRock, filed for a Bitcoin spot Exchange Traded Fund (ETF).

Learn about the best Bitcoin exchanges here.

Moreover, other asset managers such as Fidelity, Invesco, WisdomTree, Valkyrie, and BitWise have also applied with the Securities and Exchange Commission (SEC) for Bitcoin spot ETFs.

Got something to say about Bitcoin’s safe haven status or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.