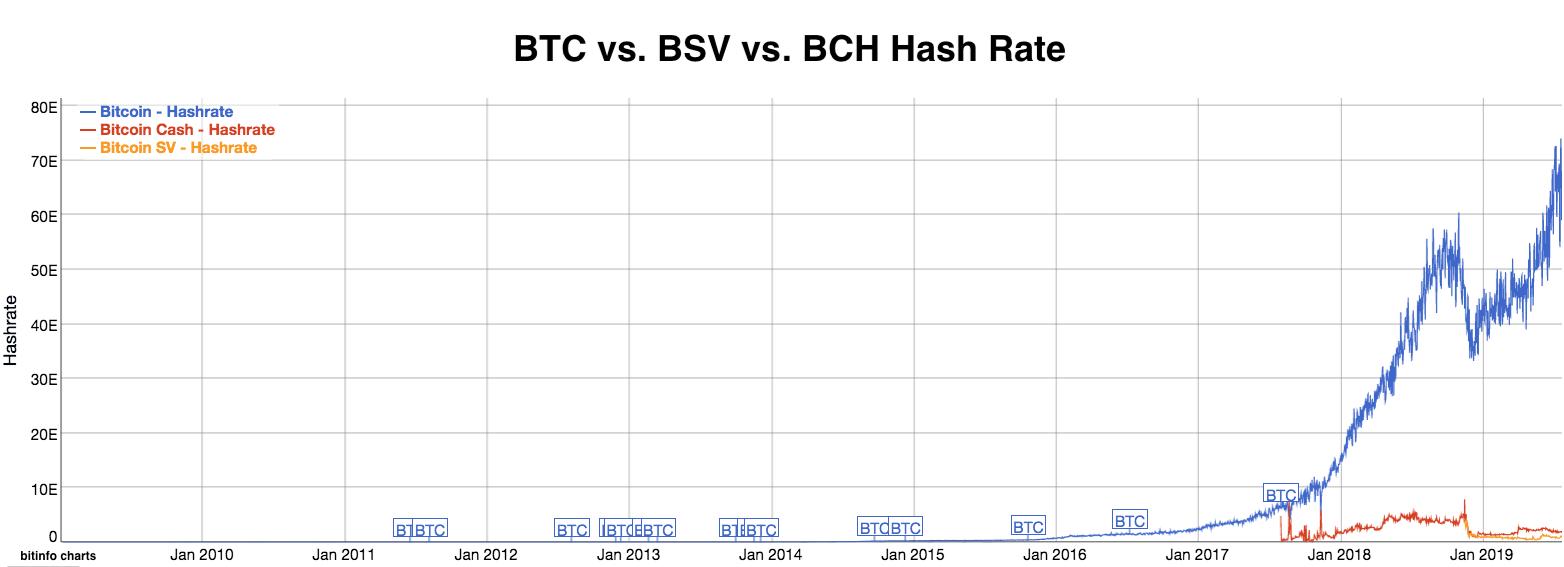

The differential between Bitcoin’s (BTC) hash rate and that of its hardfork alternatives continues to increase. The indicator appears to suggest that the forked chains may be faltering dramatically, with 97 percent of the entire hash rate is currently allocated to the original Bitcoin chain.

A blockchain’s hash rate is calculated as the number of computational ‘hashes’ being made per second and is an excellent barometer of its health status. The greater the hashrate, the greater the number of transactions, and consequently, the greater the market activity.

Increasing Hash Rate Divergence

The statistics indicate that Bitcoin’s hashrate is on the rise, already up more than 20 percent from its 2018 high. On the contrary, the Bitcoin Cash (BCH) hashrate is down a startling 60 percent from its all-time high while Bitcoin SV (BSV) hash rate is down a remarkable 80 percent. While the forked chain’s founders both believe otherwise, the divergence indicates a transactional bias toward the original Bitcoin. BSV and BCH are rapidly diverging from the far more dominant Bitcoin which indicates that the overall market is losing trust and moving away from the forks.

Hashrate and Price

Though recently experiencing some setbacks, the price of Bitcoin has also far-outpaced the price of its hard fork competitors. BCH has remained relatively flat over much of the year, while BSV saw a huge moonshot to all-time highs in May, but has since fallen back 42 percent. The correlation is important — an increasing hashrate indicates market activity. Because of the virtuous nature of adoption within blockchain platforms, increased activity naturally leads to an increased price. As the hashrate divide continues to widen, so will the corresponding price differential.