The Bitcoin (BTC) price was rejected by the $12,000 area on Sept 1 and has been retracing since.

The price is likely to make another attempt at breaking out, which is expected to be successful this time around.

Bitcoin Resistance Turns Support

The Bitcoin price increased considerably on Sept 1, creating a bullish engulfing candlestick that took the price above the $11,740 area. This same level has acted as resistance since the bearish engulfing candlestick on Aug 25 and is now expected to act as support in the future.

The closest resistance area is found at $12,340, while support would likely be found at $11,340.

Daily technical indicators are bullish, as outlined in BeInCrypto’s analysis from Sept 1, and the stochastic RSI has finally made a bullish cross and moved upwards and outside of its oversold territory.

Short-Term Weakness

The price has been increasing since Aug 27, when it reached a local low of $11,112.

The upward move continued until late Sept 1, when the price reached a high of $12,062 and has been decreasing since. At the time of press, BTC was trading near the $11,725 level, which is likely to initiate a reversal.

The level is both a minor support level and the 0.618 Fib of the most recent upward move.

There is some hidden bullish divergence in the RSI, and the stochastic RSI is oversold. However, there is no clear reversal sign in the hourly time-frame as of yet.

Wave Count

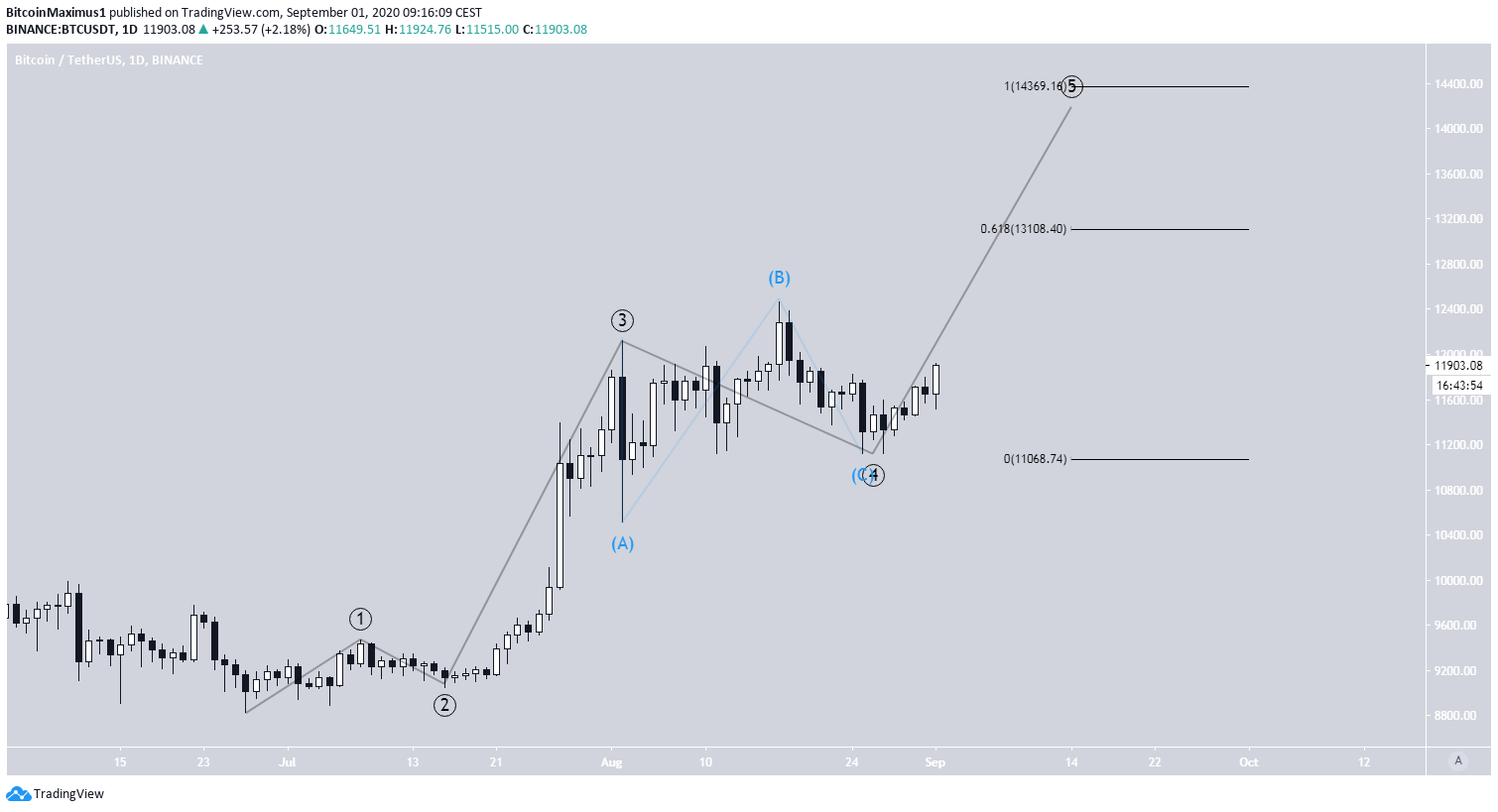

in BeInCrypto’s Sept 1 analysis, we stated that the price has likely begun wave 5:

Using the length of waves 1-3, we can make the assumption that wave 5 will end near $13,100 or $14,169, the 0.618, and 1 Fib levels of waves 1-3. A decrease below $11,117 would invalidate this wave count.

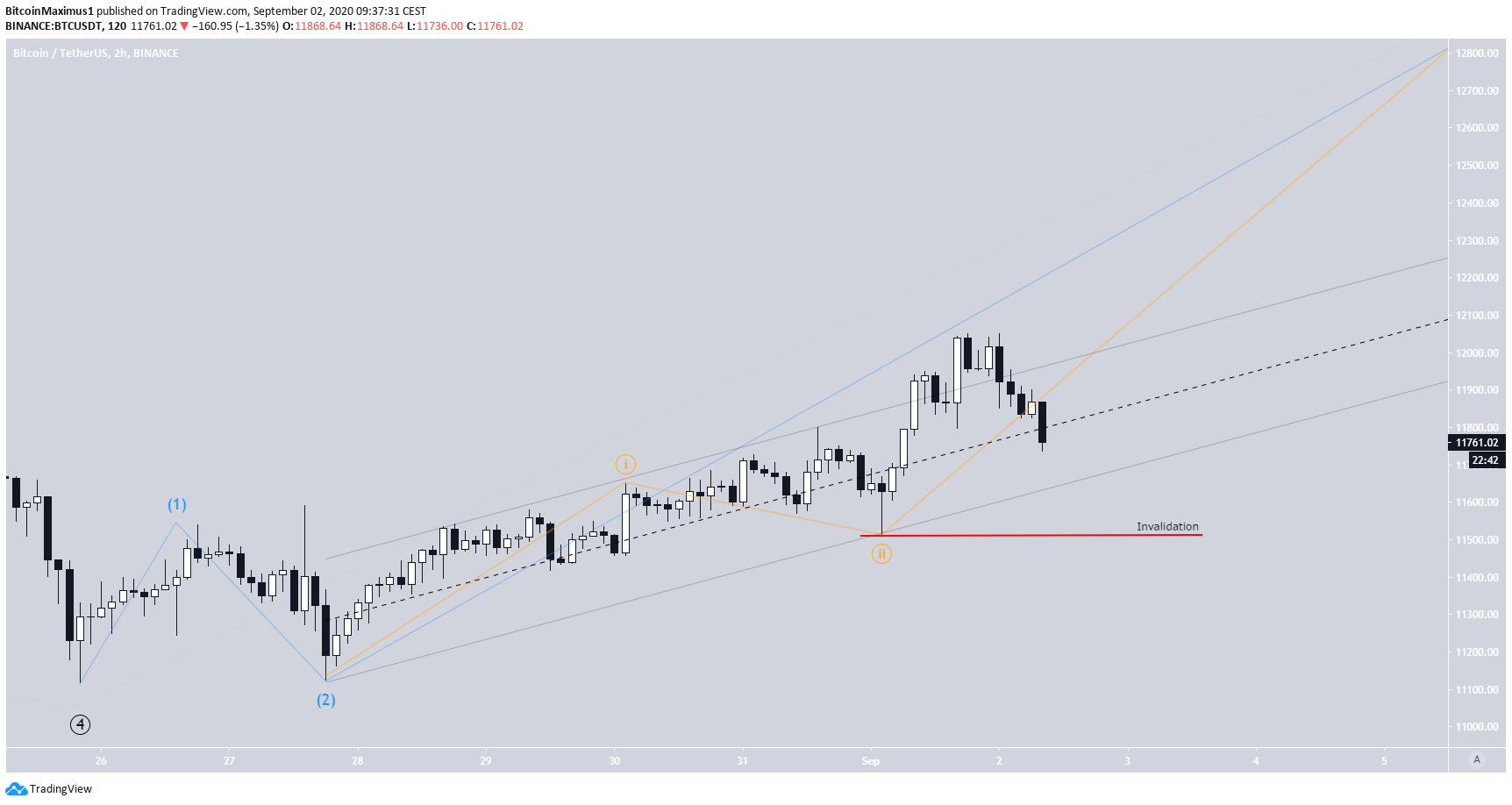

This fifth wave is created by a smaller five sub-wave formation (in blue) seen below. The price is inside the third sub-wave, which has become extended, containing another five-wave formation (in orange).

A decrease below the minor sub-wave 2 bottom at $11,515 and the support line of the parallel channel would invalidate this particular sub-wave count.

To conclude, the retracement for BTC is likely to end near $11,700 and the price is expected to resume its upward movement afterward.

For BeInCrypto’s previous Bitcoin analysis, click here!