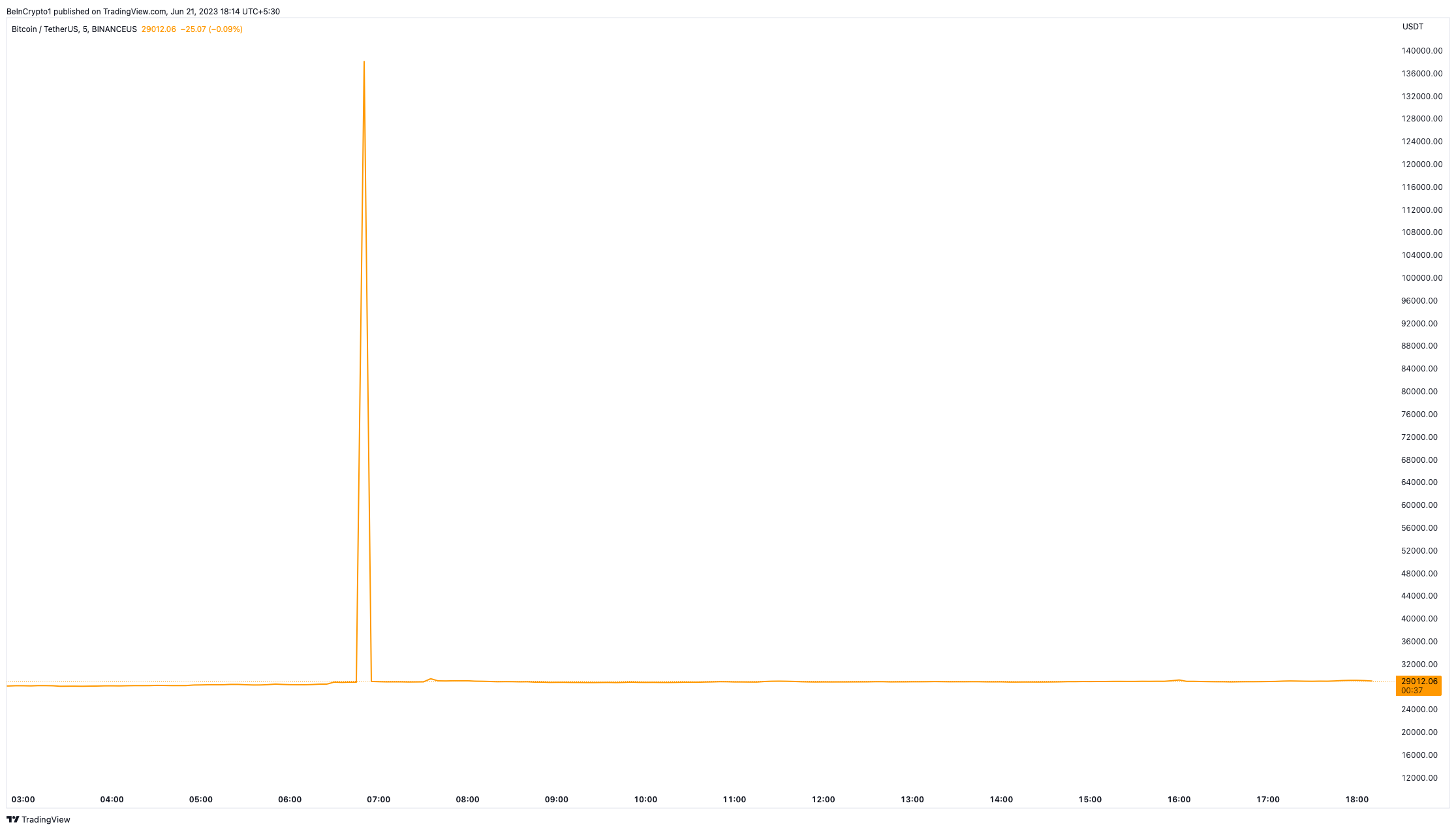

The recent Bitcoin flash rally on Binance.US to $138,000 represents a new degree of volatility in the cryptocurrency market.

Beneath the surface, this anomalous event reveals a significant issue. A severe liquidity crunch is plaguing crypto exchanges.

Liquidity Crisis Strikes the Crypto Market

The crypto market is notorious for its volatility. Still, the short-lived spike observed on Binance.US surpasses typical fluctuations. This event was confined to Binance.US, making it an anomaly compared to other crypto exchanges.

Almost as quickly as the BTC flash rally emerged, it evaporated. Subsequently, leaving the Bitcoin price to revert to parity with other crypto exchanges. This raised speculation about the potential role of liquidity, or rather the lack thereof, in this aberrant price movement.

To understand the gravity of the situation, it is essential to appreciate the role of liquidity in financial markets. At its core, liquidity reflects the degree to which an asset can be bought or sold without causing significant price movement.

The level of liquidity in a market is directly proportional to the activity of its buyers and sellers.

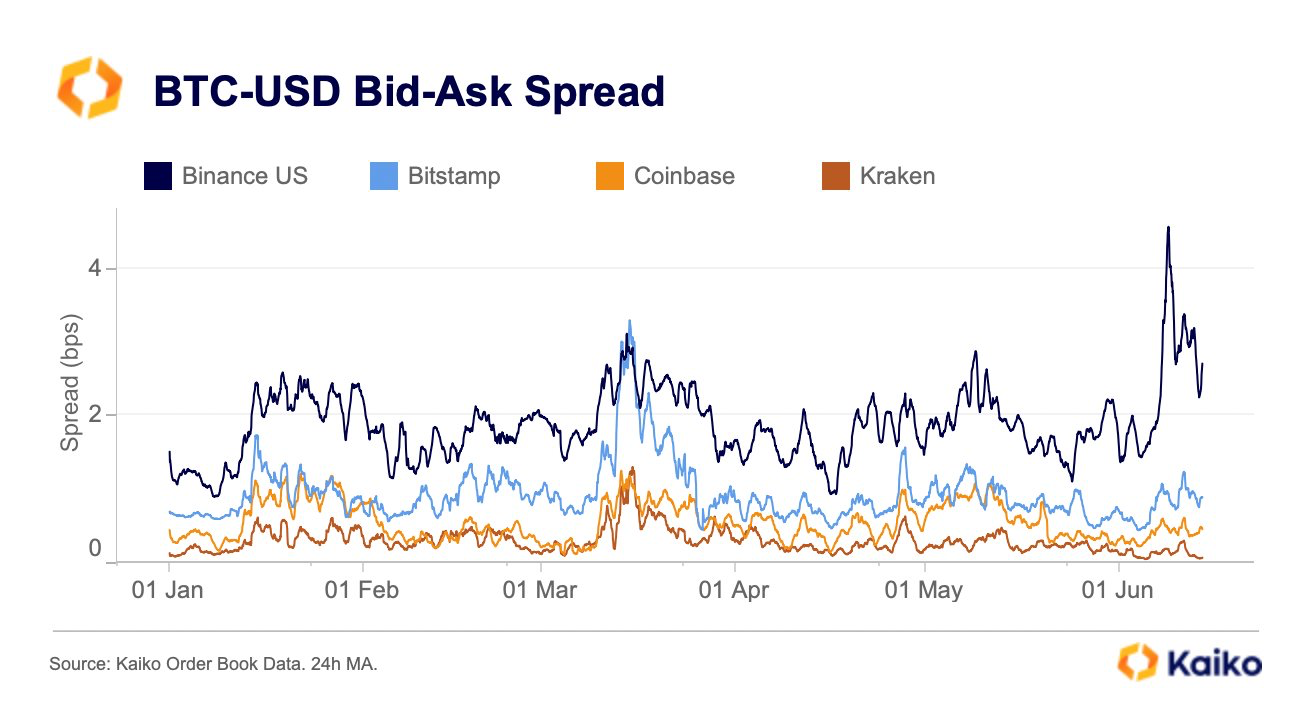

In the cryptocurrency market, liquidity tends to be fragmented across multiple platforms, complicating the process of price discovery. This fragmentation can generate market inefficiencies. Therefore, posing the risk of losses to traders due to thin order books, slippage, larger spreads, and extreme volatility.

The net effect of these factors can deter investors from trading. Indeed, liquidity issues have become a growing concern for Binance.US, with traders flocking to other exchanges. And the recent events have exacerbated an already challenging situation.

Bitcoin Flash Rally to $138,000 on Binance.US

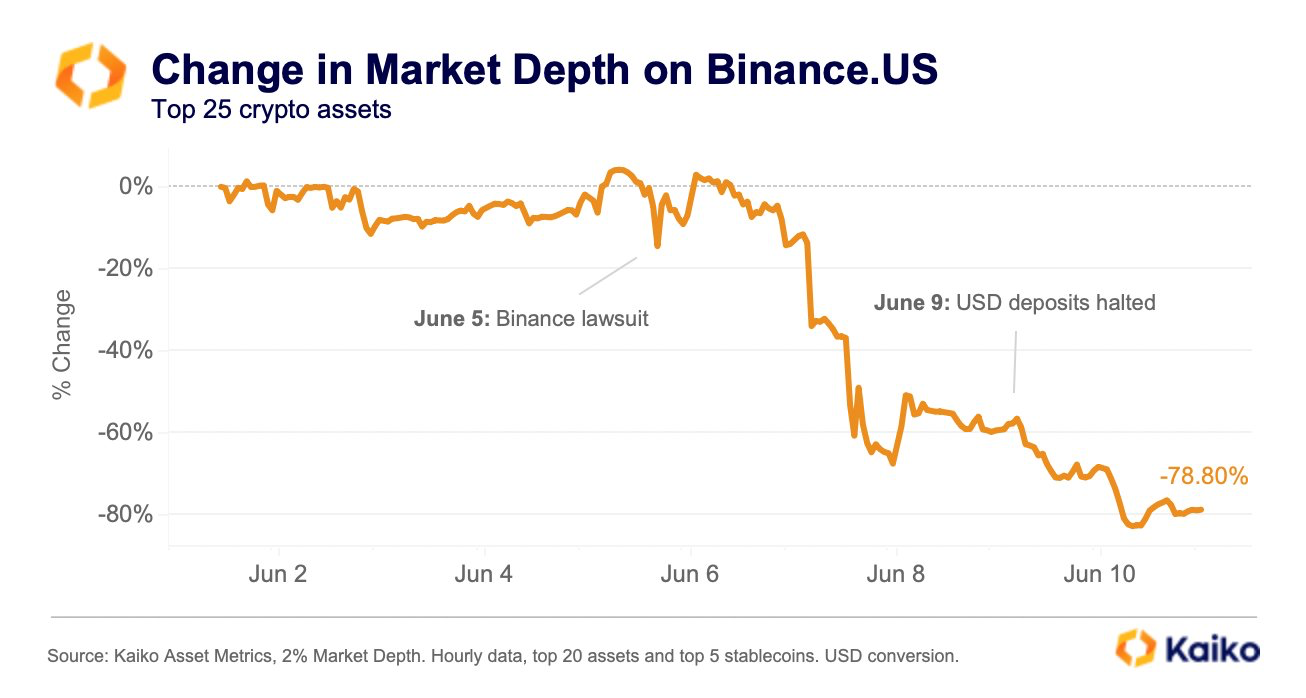

According to research firm Kaiko, the exchange’s market depth, a measure of liquidity, has plummeted 78.8% compared to May. The company implies a mass exodus of market makers and traders from the platform.

Some market participants have suggested that this recent event could be attributed to the United States Securities and Exchange Commission’s (SEC) lawsuit against Binance.US. The legal action may have triggered panic among market makers, prompting them to withdraw their liquidity from the exchange.

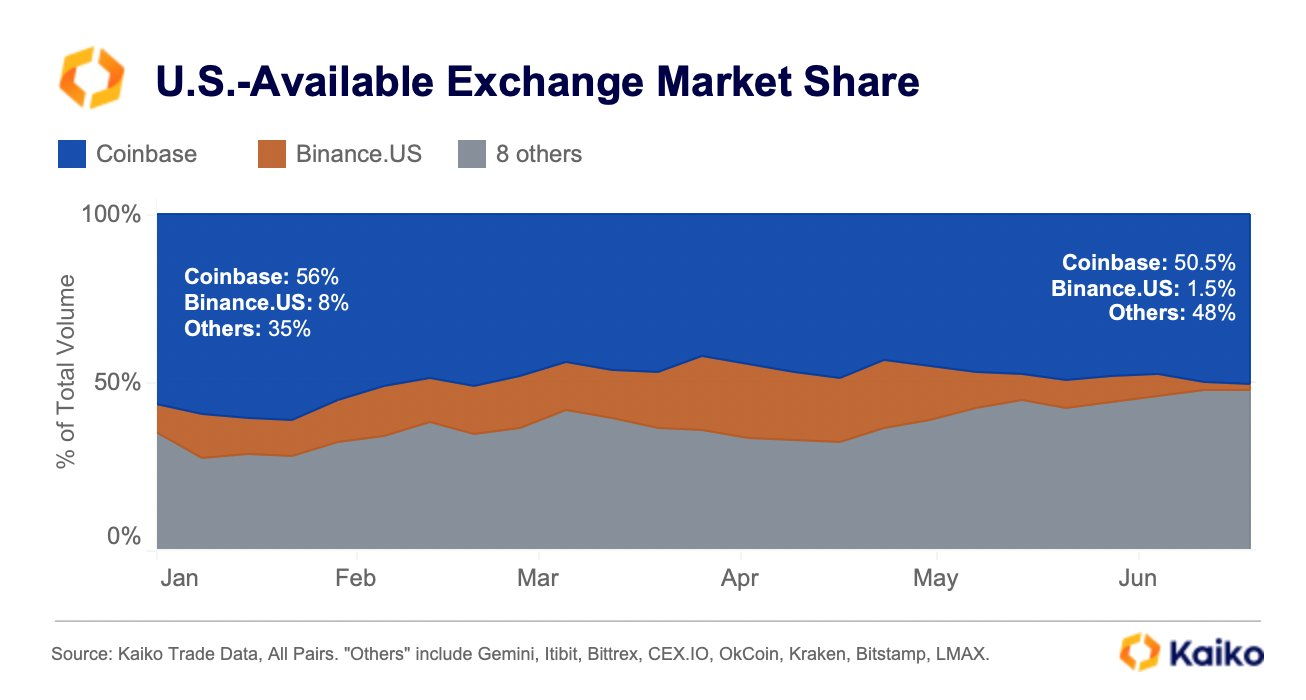

Further compounding these liquidity challenges, Binance.US has experienced a significant decline in its market share. From holding a formidable 20% of the US market in April, the exchange’s share has plummeted to just 1.5% today.

Read more: 7 Best Binance Alternatives in 2023

This decline correlates with the closure of prominent networks like Signature Bank and Silvergate Bank. Both banks have been instrumental in the cryptocurrency liquidity ecosystem.

As a result, the market has witnessed wider bid-ask spreads, low trading volumes, and price volatility, all of which are indicative of a liquidity crisis.

The $138,000 BTC flash rally on Binance.US is a stark illustration of the potential consequences of low liquidity. Lack of sufficient liquidity seems to have triggered the flash rally, causing a market order for Bitcoin to fill at an unrealistic “joke bid” price.

With a dearth of sale orders at reasonable prices, the exchange was forced to execute the extraordinarily high joke bids, causing the price to skyrocket abruptly.

This incident mirrors an event on Binance.US in October 2021. At the time, Bitcoin’s price flash crashed 87% below its market value on other crypto exchanges due to a bug in an institutional customer’s trading algorithm.

“One of our institutional traders indicated to us that they had a bug in their trading algorithm, which appears to have caused the sell-off that was reported this morning,” said a Binance.US spokesperson.

Trading Bitcoin on Binance.US Proves Risky

The recent BTC flash rally on Binance.US, propelled by a case of low liquidity, presents a cautionary tale for crypto traders. Liquidity challenges further exacerbate the inherent volatility in the crypto market. Consequently, leading to sudden and dramatic price movements that can significantly impact the value of traders’ holdings.

The implications of trading Bitcoin on Binance.US, given its liquidity issues, extend beyond the potential for unexpected price swings.

The cessation of banking relationships with Signature Bank and Silvergate Bank has likely compounded these liquidity issues. Therefore, it raises questions about the platform’s capacity to handle large transactions efficiently, particularly those involving substantial withdrawals or deposits.

Read more: Best Bitcoin Exchanges and Platforms in 2023

While trading on any crypto exchange involves a degree of risk, low liquidity can lead to slippage. This is a discrepancy between the expected price of a trade and the price at which the trade is executed. In a low liquidity environment, even small market orders can cause significant price changes, like what happened on Binance.US.

For those considering trading Bitcoin on Binance.US, it is essential to be aware of these risks.

Traders should consider diversifying their trading activities across multiple exchanges to mitigate the risk associated liquidity. Additionally, setting limit orders, rather than market orders, can help manage the risk of slippage.