On July 30, Bitcoin (BTC) seemingly began another rally but was stopped before reaching the previous high, creating a long upper-wick in the process.

The price has broken down from a short-term ascending support line and looks to be heading towards the closest support areas.

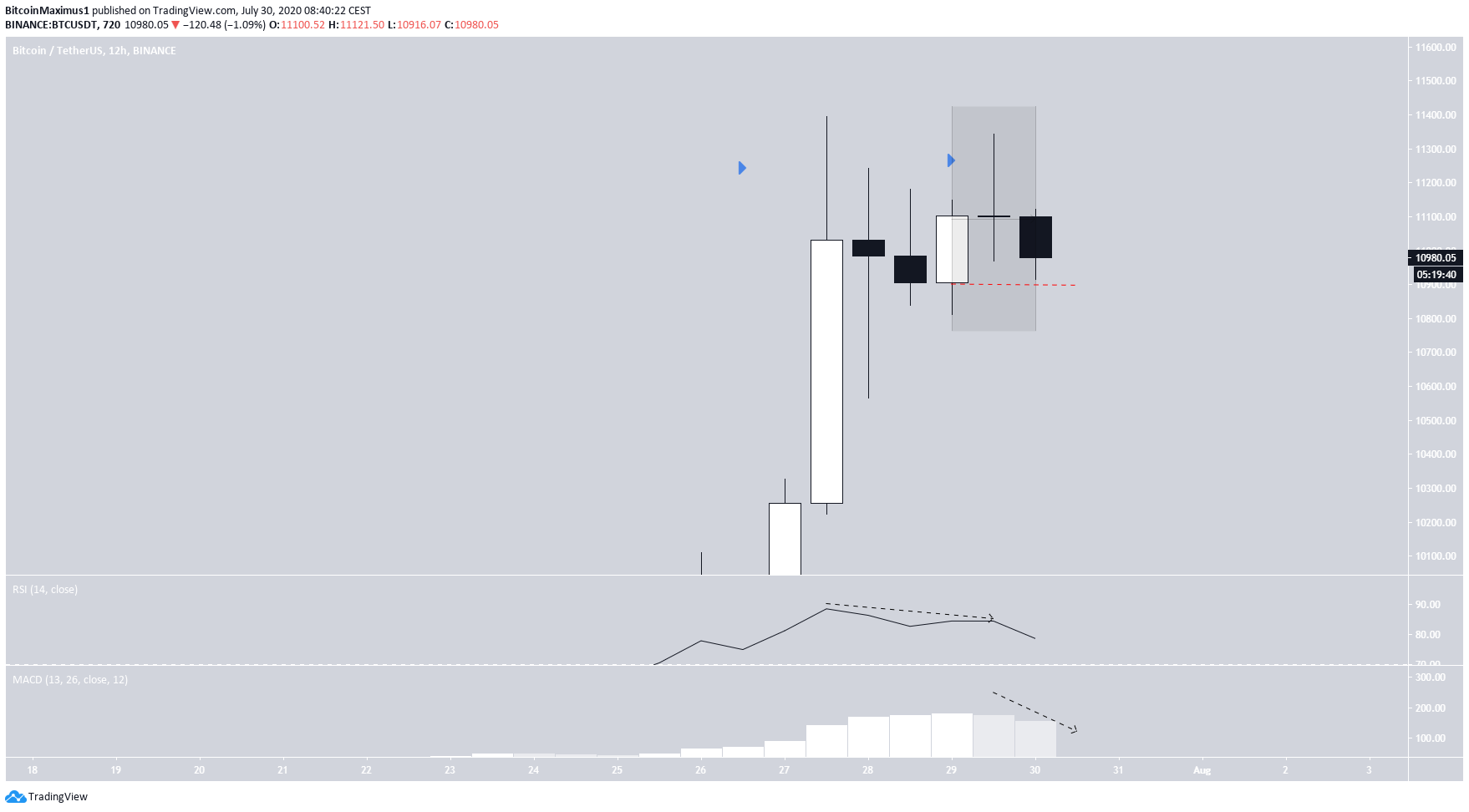

Bitcoin Evening Star Confirms Weakness

The Bitcoin price reached a high of $11,394 on July 27. After a brief pause, the price began another upward move yesterday. However, it only reached a high of $11,342 before decreasing once more. This movement has left several long upper-wicks in place, a sign of selling pressure. Furthermore, the most recent three 12-hour candlesticks are in the process of creating an evening star pattern, which would be completed with a close below $10,900. Technical indicators are showing that the upward movement has lost momentum. The MACD has begun to decrease, and the RSI has generated bearish divergence inside the overbought area. These are signs that the price will likely decrease and strengthen the possibility of an evening star being completed.

Wave Count

Assuming that BTC is in the process of retracing, the long-term wave count suggests that the price is currently in wave 4 (black), which could transpire inside an a-b-c correction (green). The correction has potentially just begun, so it is too early to try and define the pattern. The 0.5 Fib level of the entire upward move is found near $10,189, making this a likely level for the correction to end. The upward move lasted for 11 days, and the correction is currently only in its second day. After the correction is completed, BTC would be expected to increase towards a higher-high to complete wave 5.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored