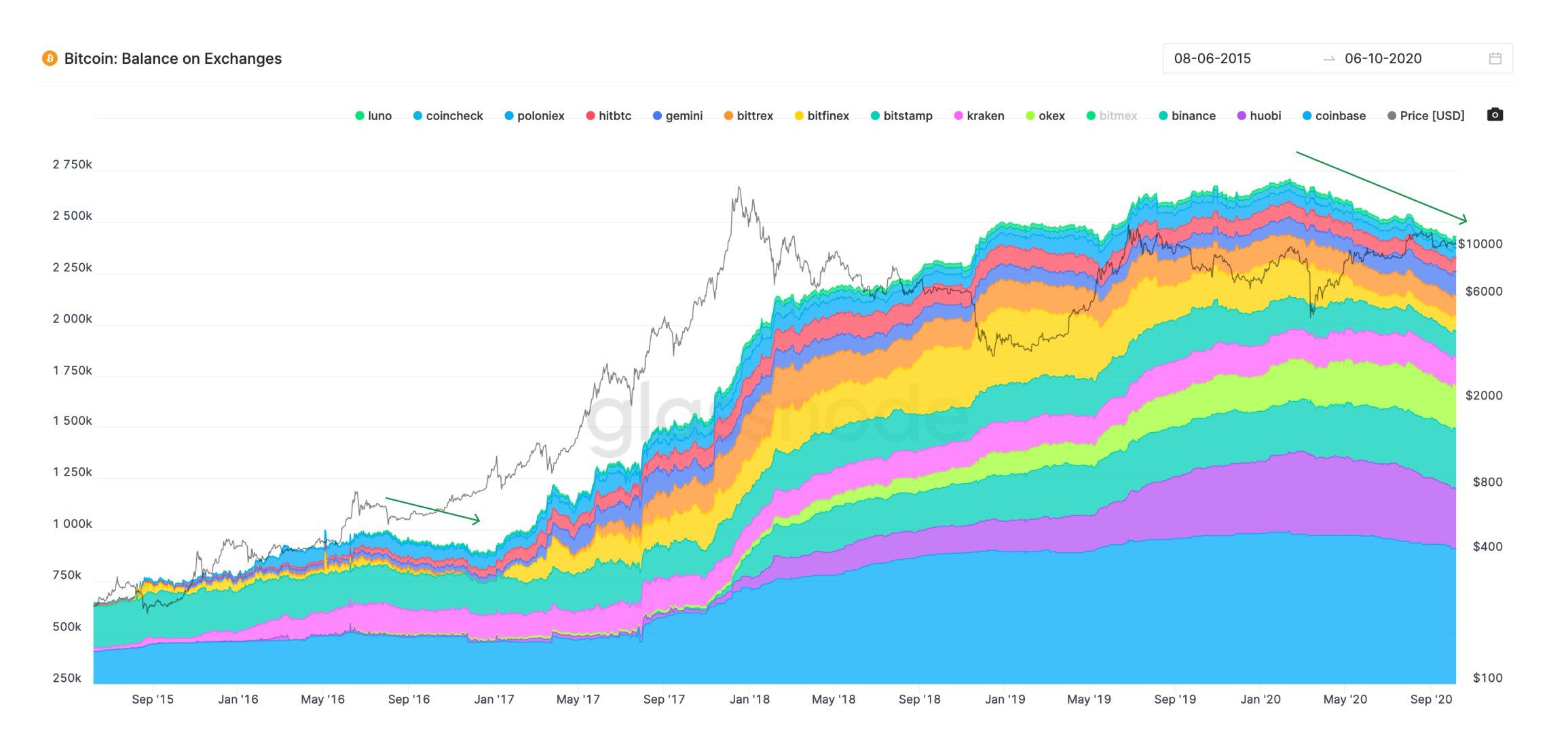

Spot exchanges are seeing a significant decline in Bitcoin (BTC) balances, indicating the entry of new buyers.

Several factors appear responsible for the spike in new activity. However, the bitcoin price action continues to remain locked in a sideways accumulation pattern.

Is the Decline in Exchange-held Bitcoin Balances Bullish?

Tweeting on Oct. 7, Bitcoin analyst and statistician Willy Woo remarked that the reduction in the BTC sum held by spot exchanges is a sign of new buying activity. According to Woo, these new market entrants, having acquired bitcoin, are “hodling” their coins in cold storage wallets.

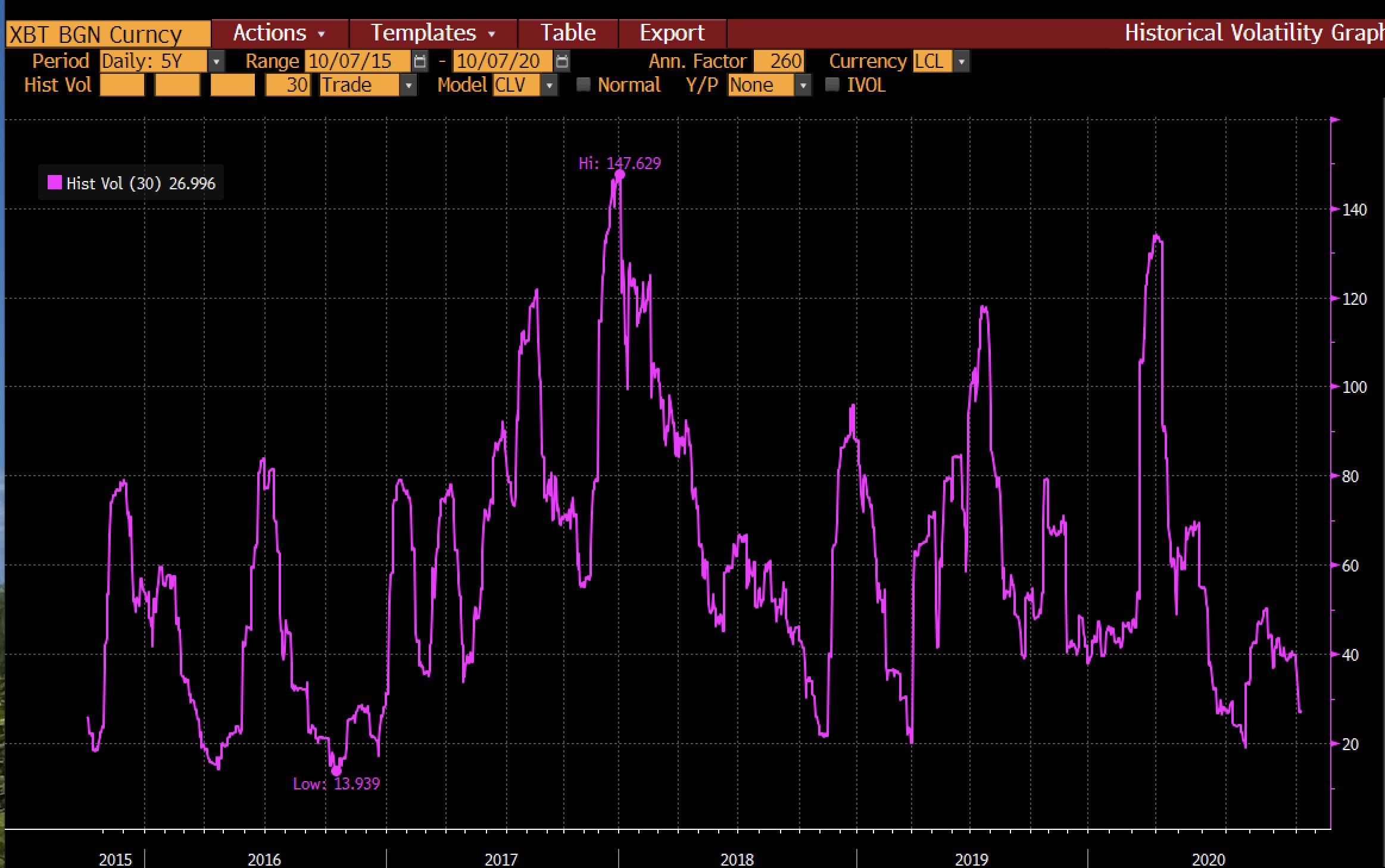

Shrinking Volatility Points to Imminent Price Breakout

If history repeats itself, then the current exchange balance drop might be a precursor to another end-of-year price rally. For now, BTC continues to trade within a tight price range while maintaining the $10,000 price bottom. However, given the shrinking volatility, some commentators say bitcoin is due for a price breakout.

Bitcoin 30-day historic volatility has been falling fast and is in the 20’s. In the past, it has hit 20% volume 7 times. 6 times prices exploded higher immediately and volume hit 80% in a few months. 1 time (Nov 2018) prices fell sharply. Either way, a big move is coming soon.As of press time, bitcoin is trading at $10,600, down about 1% over the last 24-hour trading period.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Osato Avan-Nomayo

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

READ FULL BIO

Sponsored

Sponsored