The crypto market is showing strong signs of further decline. The Bitcoin price is battling the lower $19,000 barrier, while Ethereum fell below the $1,300 mark. XRP, despite bullish news from the Ripple vs SEC battle, hasn’t been able to maintain prices over $0.50.

As signs of another downtrend loom over the crypto market, top coins such as Bitcoin, Ethereum, and XRP are losing ground. BTC, ETH, and XRP falling below their short-term support levels could trigger another round of sell-offs.

Bitcoin price to go lower?

The $19,100 mark has acted as a solid support level for the Bitcoin price for most of the last two months. At press time, the BTC price was sitting at $19,053, noting a mere 0.59% daily loss and a 3.5% weekly loss.

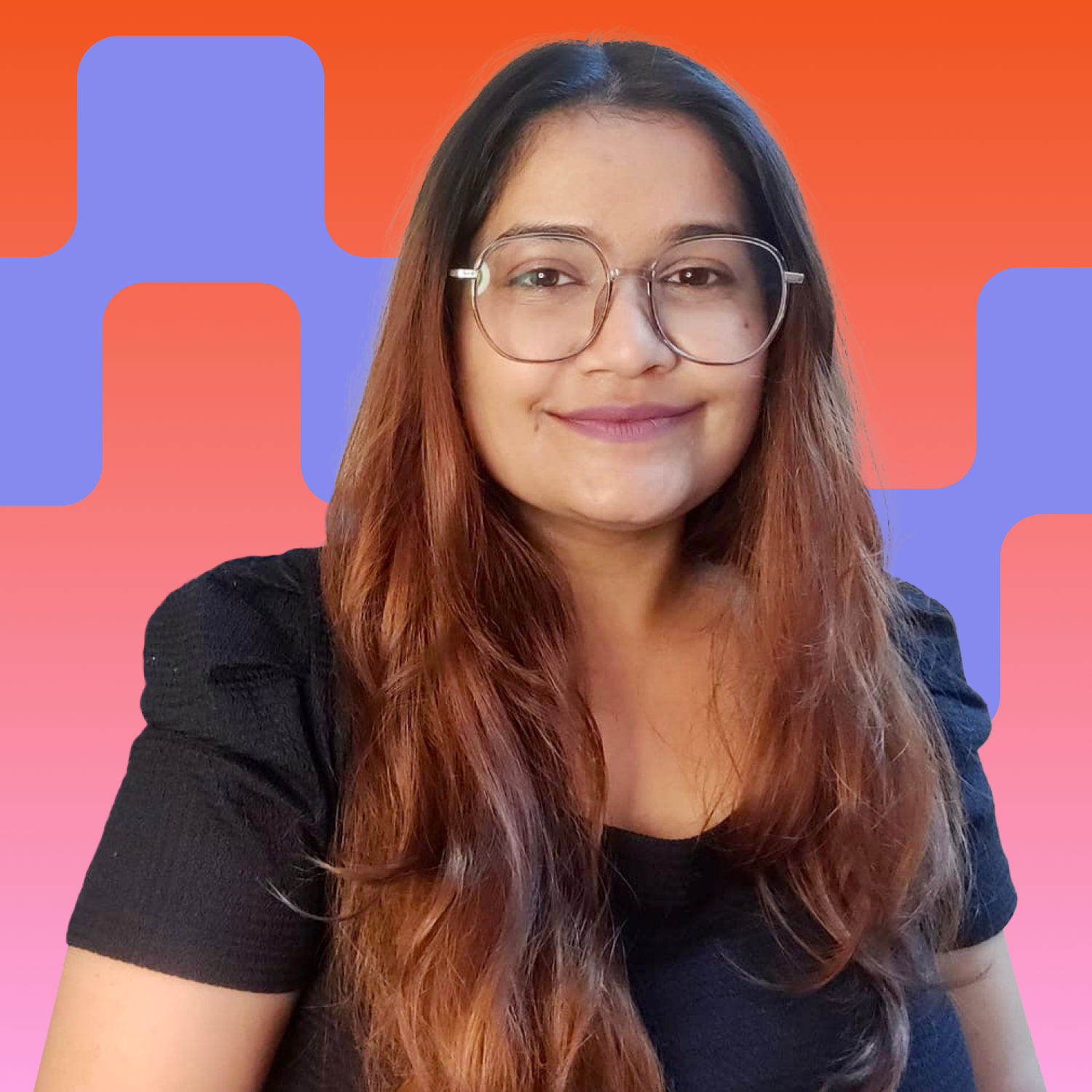

Bitcoin recently saw a massive surge of coins moving off of exchanges noting its largest daily amount (40,572 BTC) in four months. With the supply of coins on exchanges down to 8.48%, the same decreased chances of a future sell-off.

The Bitcoin price falling below the $19,000 mark could cause a cascading effect since there’s a considerable supply barrier around this level. However, a CryptoQuant analyst believes that there is currently no indication of a 2018-like dump event.

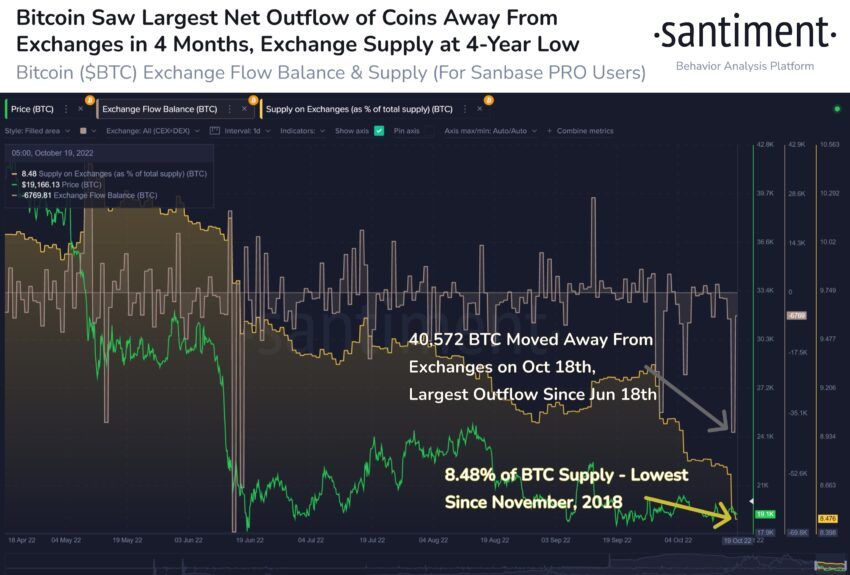

Notably, at the end of Q3/2018, when the BTC price started to decrease in volatility and moved sideways, there was a sudden increase in the number of addresses sent to spot exchanges. On the contrary, this cycle has witnessed coins move away from exchanges despite a larger bearish sentiment.

Compared to the current period, except for the peaks on this data system that have demonstrated sharp price declines, the number of addresses that deposited BTC to spot exchanges is at its lowest level in years.

Ethereum price action shaky

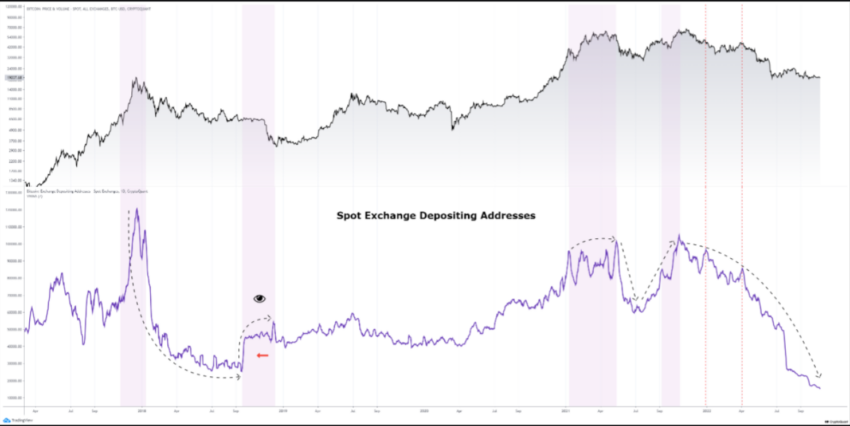

The Ethereum price fell below the crucial $1,300 mark, noting a 0.50% drop in the past 24 hours. However, ETH whales continued accumulation as per data from Santiment. Notably, since Sept. 11, Ethereum billionaire whale addresses holding 1 million or more ETH have collectively added 3.5 million more coins.

The recent accumulation has increased Ethereum billionaire whale addresses’ cumulative bags by over 14%, with 132 such addresses in existence currently.

One worrying trend, however, was Ethereum’s active addresses sinking to 4-month lows as weak hands continued to drop post-Merge. This also presented a higher level of disinterest from participants as price action remains stagnant. Oct. 17 was the first day that there were less than 400,000 active addresses on the network since June 26.

The ETH price faced rejection at the psychological $1,300 level on Oct. 20. Even though ETH has been attempting to keep above the $1,300 level, at press time, it was trading for $1,288. A fall below $1,280 could potentially cause the decline to accelerate.

The Relative Strength Index on the daily chart appears to be flat and is in the oversold territory. The RSI’s moving averages are dually rejecting the indicator. Further sell-side pressure could pull the ETH price back to the lower $1,200 zone.

However, in case of a bearish invalidation, ETH could move to the $1,380 mark if bulls continue to buy during the weekend.

XRP price sinking as court case nears a close

At the time of press, the XRP price was trading at the $0.4468 mark, down 2.63% on the daily and 10.17% on the weekly charts. XRP has been in a long-drawn downtrend since Oct. 10, despite Ripple nearing a close in its regulatory battle with the SEC.

On-chain accumulation metrics presented a healthy outlook for XRP as Ripple whales accumulated close to 300 million XRP over the last few months. However, technical indicators could govern XRP’s short-term price momentum, with retail volumes still trending lower.

The next liquidity levels for XRP, as price action trends lower, could be around the $0.40 and potentially $0.38 mark. A break below $0.38 could spell trouble for the coin and extend bearish price action to the lower $0.32 level.

If the bearish prediction fails and bulls take over the weekend price action, XRP could rise to the next resistance mark at $0.48.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.