Bitcoin (BTC), Ethereum (ETH) and XRP prices struggled to all move above their next key resistance levels despite short-term bullish momentum in play.

Bitcoin price action has been in a larger downtrend while Ethereum and XRP prices struggle to gain some bullish momentum. However, short-term bullish price action pushed BTC price to $17,094 at press time. ETH gained a mere 1% on the daily, while XRP price was down by 0.57%.

Price-wise, ETH and XRP followed the top crypto. However, on-chain data presented some peculiar trends for these three coins.

Bitcoin Price Can Witness More Losses

The BTC short-term on-chain participants continued to sell at a loss with a short-term Spent Output Profit Ratio (SOPR) below one. This signaled a lack of faith among traders making the $18,000 mark a strong resistance for the BTC price. The $18,000 mark would be the rough average cost of entry for short-term participants, according to a CryptoQuant analyst.

Furthermore, the analyst highlighted that traders should be careful since the yield curve inversions often precede recessions, and the current 10-year Treasury rate (3.75%) was below the three-month rate (4.22%).

Since the investors who bought BTC after Dec. 2020 were now in loss, long-term holder SOPR would take some time to turn positive. Thus, short-term SOPR is a better indicator of the current market trend.

One negative trend that the BTC price had was positive net flows, presenting more exchange inflows than outflows on Dec. 1. Bitcoin net flows stood at $16.80 million.

Another recent analysis from CryptoQuant suggested that while the BTC price was going up, the Network Value to Transactions (NVT) sell area was triggered. The same could lead to Bitcoin price dropping in the next ten days.

The NVT golden cross flashes a warning signal when it crosses above the 2.20 level. Currently, it is at 2.44, and it can still go to 2.77 (last value), which could lead to some short-term price drops.

Ethereum Outflows Continue

At the time of writing, the Ethereum price gained a mere 0.40% on the daily window as ETH traded at $1,269.05.

The Nov. losses weren’t as grave for ETH as Bitcoin and some other altcoins since Ethereum held above the $1,000 psychological support. Daily on-chain exchange flow suggested that net flows were negative for ETH, with around $6.7 million in outflows on Dec. 1.

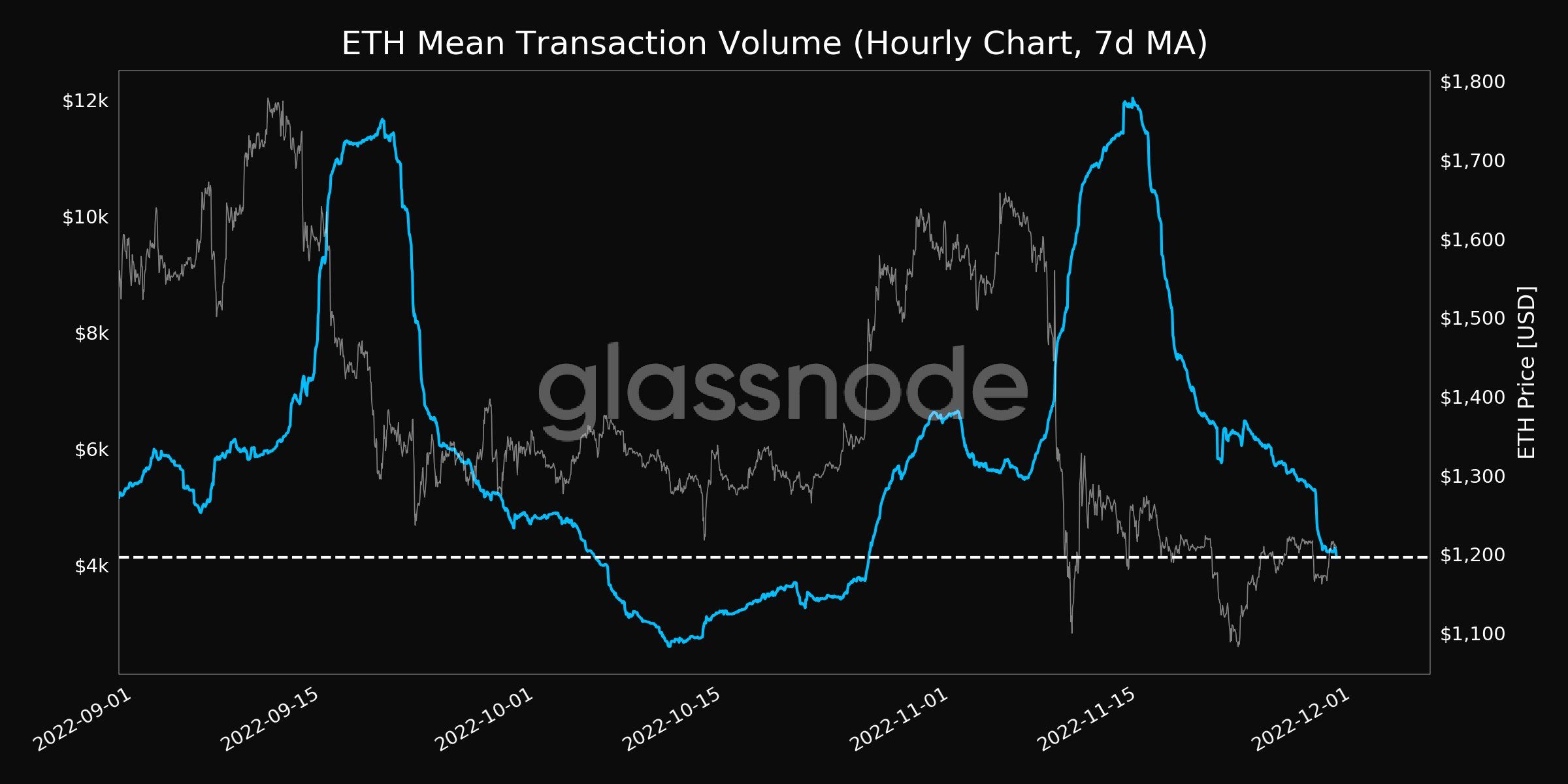

ETH NVT was at monthly highs, meaning investors were pricing ETH at a premium as market cap growth outpaced utilization of on-chain transactions. That said, the futures market data presented some short-term bullishness for ETH, with Open Interest appreciating by 5.44%, standing at $4.80 billion at press time.

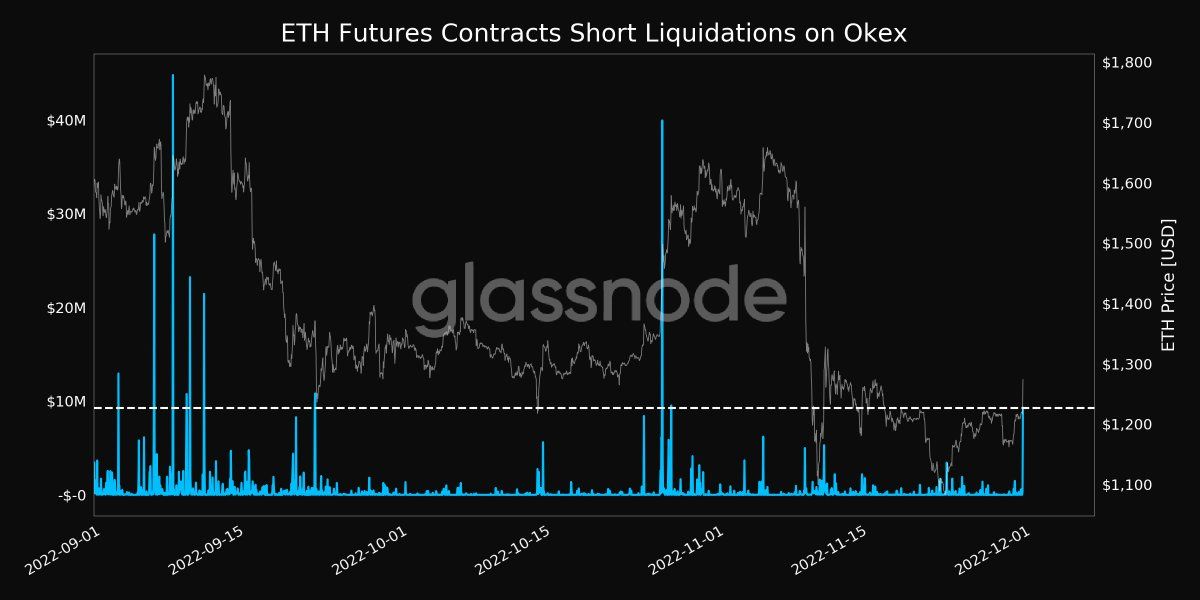

ETH funding rates were also positive at +0.0099%, according to data from Coinalyze. Some bullish statistics came from Okex, where short liquidation reached a one-month high, which could aid some short-term bullish momentum for ETH.

However, ETH median transaction volume (7d-MA) reached a one-month low which meant network vibrancy was relatively low.

For ETH bulls, the next target can be the $1,350 resistance/support. However, the Bitcoin price pullback could further extend losses for ETH and the rest of the market.

XRP Whales on the Move

XRP price traded at $0.3971 at the time of writing, losing 0.99% on the daily chart but up by over 2% on the weekly.

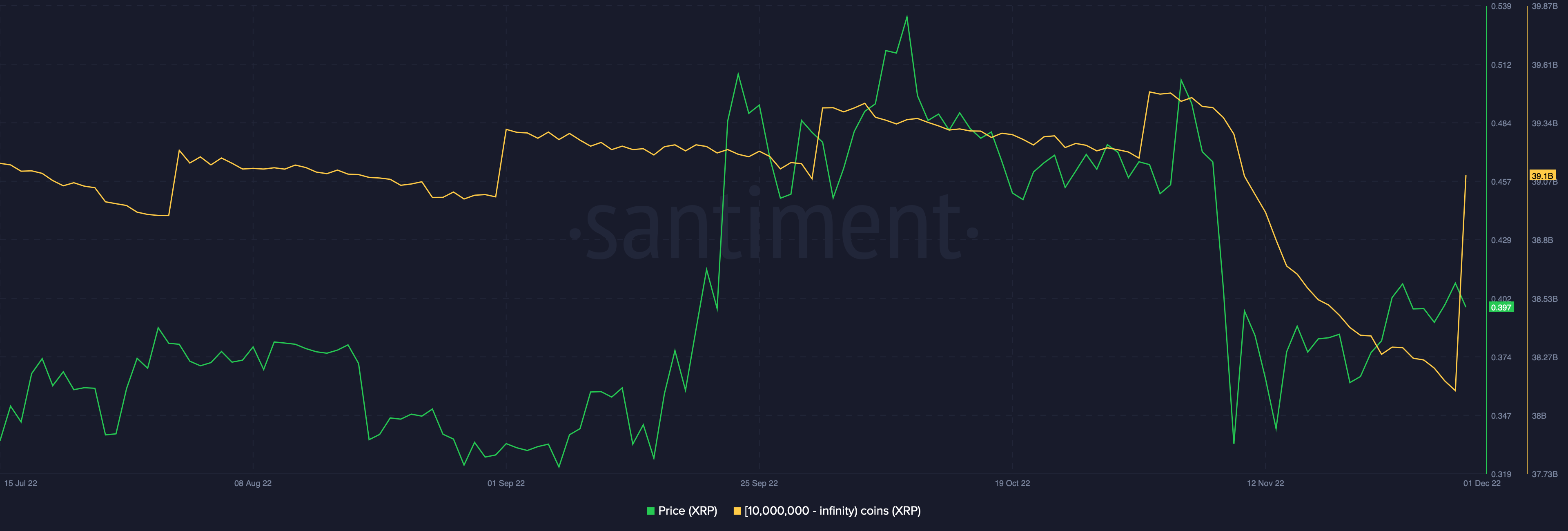

Age consumed metric for XRP showed that over 580 billion XRP was moved on Dec. 1.

A lot of old XRP coins have been on the move lately, which could point toward possible redistribution. However, there was a major uptick in XRP whale holdings. Notably, the largest XRP whale cohort with 10 million to infinity coins added over one billion coins in the last day

While whales adding XRP can push prices in the positive direction, XRP price still has a long way to go with the ongoing regulatory battle.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.