The intersection of politics and finance often results in significant market shifts, and the crypto market is no exception. As the United States Congress prepares for a pivotal vote to raise the debt ceiling, Bitcoin and Ethereum register notable fluctuations.

These market changes outline potential implications for the cryptocurrency industry.

Crypto Market Awaits Debt Ceiling Vote

On Wednesday, the crypto market, especially Bitcoin and Ethereum, encountered a downturn in response to the impending vote on the proposal to increase the US debt ceiling, alongside the potential of another surge in interest rates by the Federal Reserve due to robust labor market data.

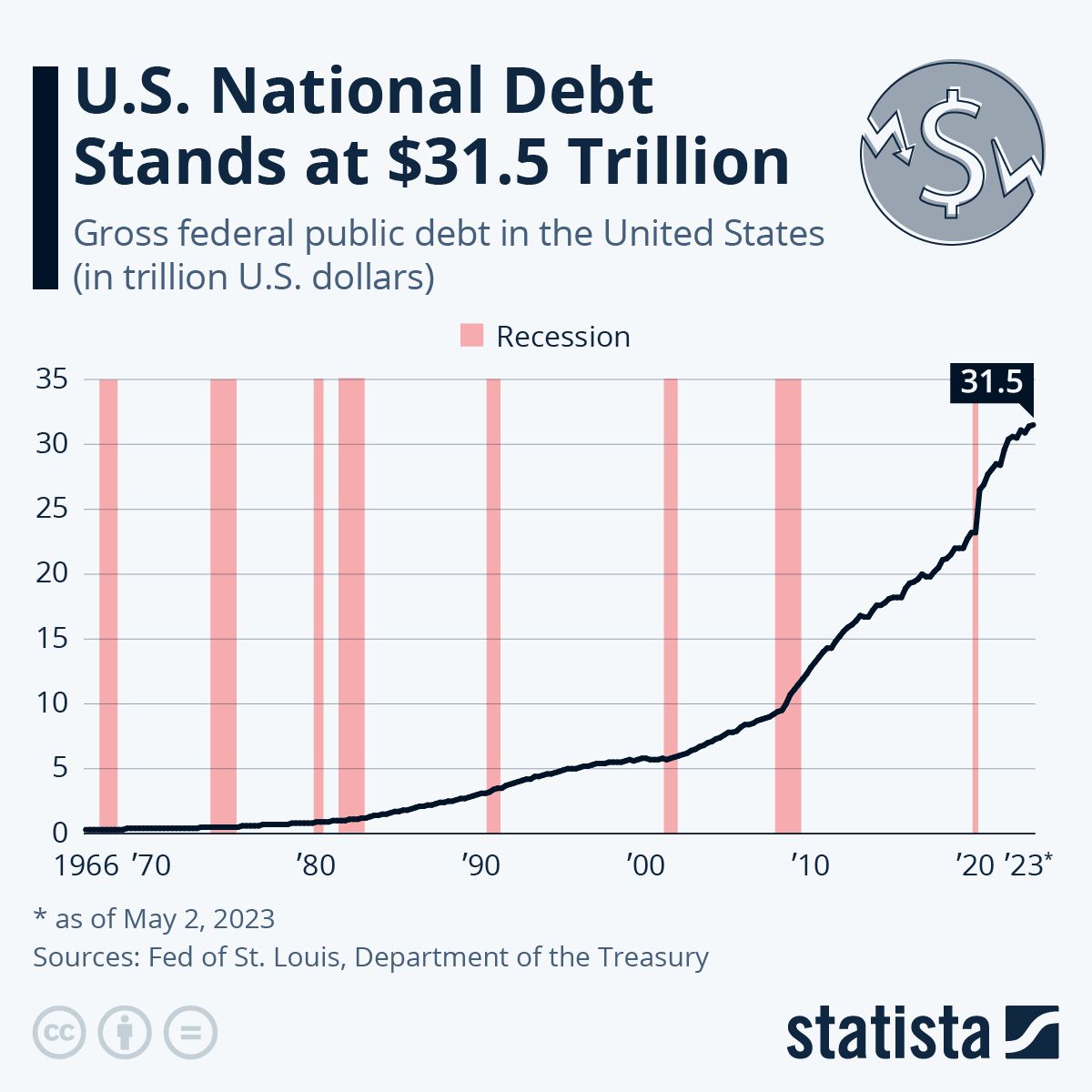

Legislation aiming to augment the $31.5 trillion US debt ceiling while implementing fresh federal spending cuts progressed to the House of Representatives on Tuesday. The bill is slated for deliberation and a consequent vote later on Wednesday.

Should the House approve the legislation, it would proceed to the Senate, where discussions might extend into the weekend, with the June 5 deadline swiftly approaching.

“Although indicators suggest that the agreement will eventually pass, there are some rumblings from Congress members who express opposition. Until the agreement is finalized, an air of uncertainty will persist,” commented Joe Saluzzi, co-manager of trading at Themis Trading.

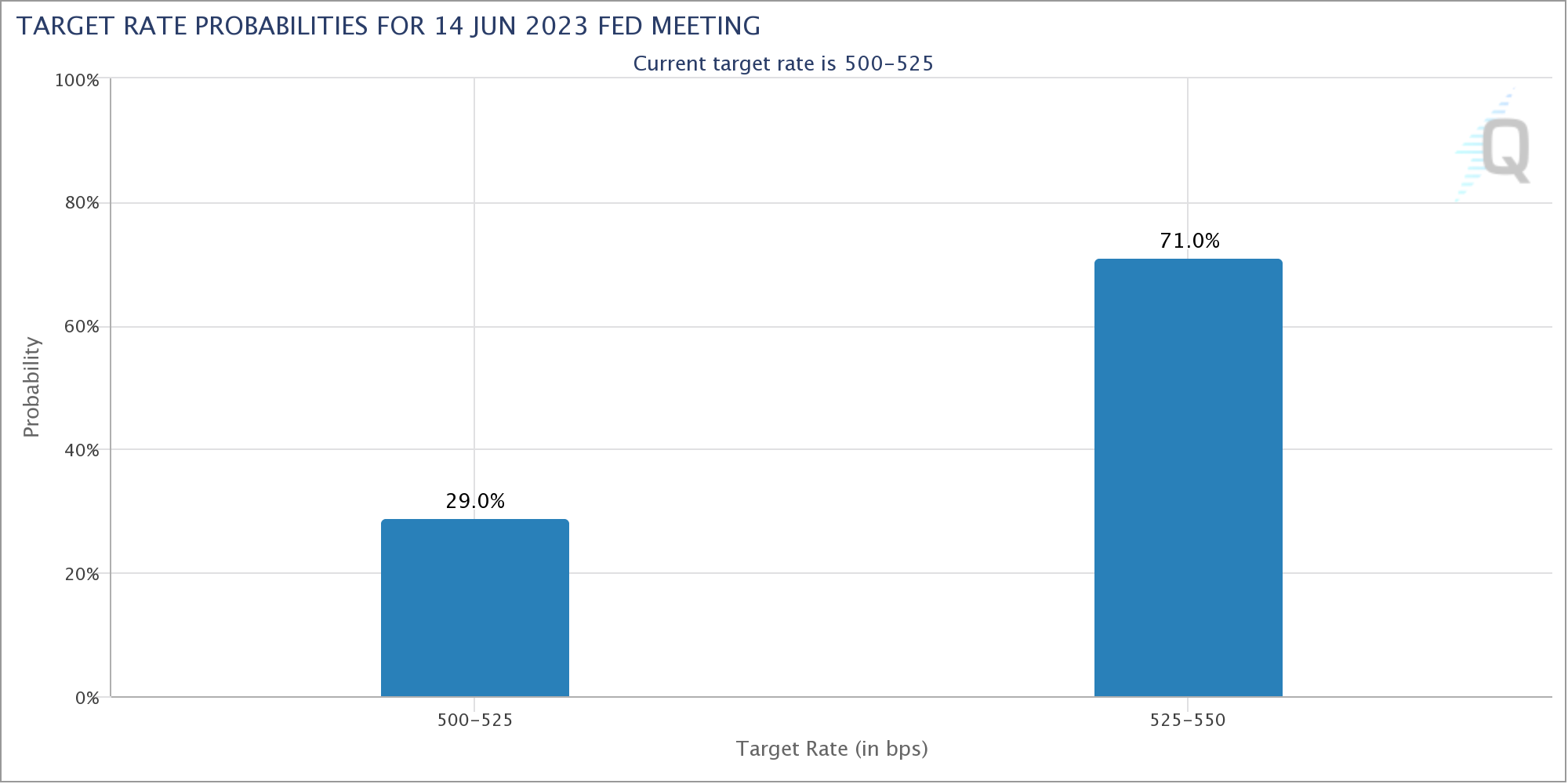

April’s data revealed an unanticipated uptick in US job vacancies, indicating continued vigor in the labor market that could potentially prompt the Federal Reserve to implement another interest rate hike in June.

“I think the Fed is going to have to decide between two policy mistakes: hit the brakes too hard and risk a recession or tap the brakes in a stop-go pattern… And risk having inflation well into 2023,” said economist Mohamed El-Erian.

Current market predictions place the likelihood of a 25-basis point hike at the Fed’s June 13-14 meeting at approximately 71%.

As the week progresses, investors eagerly anticipate the Labor Department’s much-observed job report for May, slated for release on Friday. This report could provide insights into the resilience of the US economy in the face of high-interest rates and inflation.

Bitcoin and Ethereum React to Debt Limit Bill

The debate surrounding the debt ceiling has cast a shadow over the crypto market. However, indications of advancements previously propelled Bitcoin up by 5.26% to a high of $28,500 on Sunday, and Ethereum ascended by 5.53% to $1,930 in May.

However, the tide turned on Wednesday as the crypto market reversed due to waning optimism around the debt ceiling rally.

Bitcoin, the leading cryptocurrency, saw a decrease of 3%, trading at $26,830. Concurrently, Ethereum also took a hit, dipping 2.89% to $1,845.

The two digital currencies are seemingly bracing for their inaugural losing streak in 2023. Bitcoin is on course for an 8% slump, which would mark its worst month since November 2022. Ethereum is down 2.5% for the month. If this downward trend continues until the end of the day, May will be ETH’s poorest-performing month since December 2022.