Yields on short-term Treasuries fell Tuesday as fears of a US government debt default receded following the weekend’s bipartisan debt ceiling deal that omits a famous crypto tax loophole.

At 05:33 ET, the yield on the 10-year Treasury dropped 10 basis points to 3.72%, while yields on the two-year Treasury dropped seven basis points to 4.514%.

Raising Debt Ceiling Would Affect Bank Liquidity, Analysts Warn

This reaction came after President Joe Biden and House Speaker Kevin McCarthy agreed in principle to lift the US debt ceiling amid fears the government would technically default in early June.

Congress must pass any proposed changes to the debt limit. The House Rules Committee will review the new agreement today.

Any delays in the deal could threaten the US ability to stave off a technical default by June 5. A default would increase the US Treasury’s cost of borrowing.

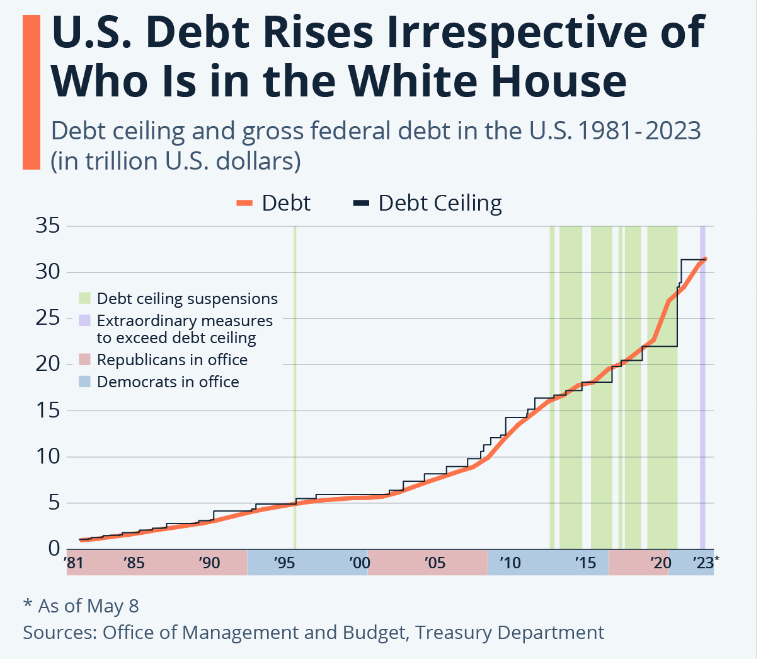

Conversely, increasing the debt ceiling would cause the government to issue more Treasury instruments in exchange for investors’ cash. These loans are then added to the national debt.

Analysts worry that the increased issuance of Treasury bills would cause short-term liquidity issues at banks. Investors buy Treasury bonds in exchange for interest repayments.

They would need to spend about $500 billion if the government raises the debt ceiling.

Crypto Retains Political Allies, But Regulations Remain Elusive

Biden said that any deal to raise borrowing limits would not allow “wealthy tax cheats and crypto traders” to take advantage of a tax loophole allowing wash trading to reduce tax payments.

The latest debt ceiling proposal suggests the US president didn’t make good on that promise.

Instead of closing the crypto loophole, the proposal suggests rescinding certain tax payments for families and small businesses.

Crypto miners may once again flock to the US after revelations surfaced that the new debt ceiling deal also excludes excise tax for crypto mining firms.

Still, Governor Ron DeSantis of Florida said the current government would snuff out crypto within the next four years if left unchecked.

DeSantis recently entered the 2024 presidential race and is joined by Robert F. Kennedy and Vivek Ramaswamy in running pro-Bitcoin campaigns.

However, as Compass Point Research noted on Friday, crypto bills currently may only become law in two to three years.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.