Today, approximately $1.96 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are set to expire, creating significant anticipation in the crypto market.

Expiring crypto options could usually lead to notable price volatility. Therefore, traders and investors closely monitor the developments of today’s expiration.

Historical Trends Signal a Rebound as Crypto Options Near Expiry

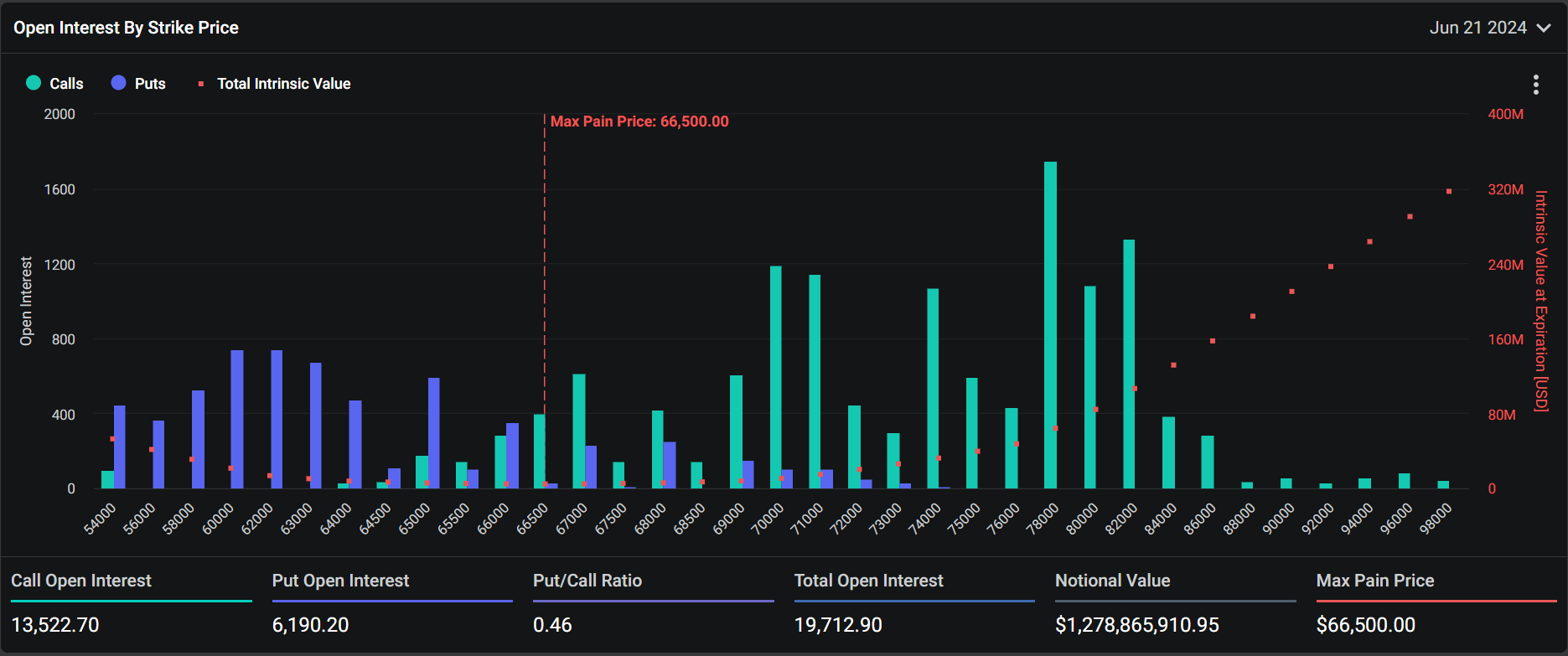

Today’s expiring Bitcoin options have a notional value of $1.27 billion. These 19,712 expiring contracts have a put-to-call ratio of 0.46 and a maximum pain point of $66,500.

In the context of options trading, the maximum pain point represents the price level causing maximum financial pain to option holders. Meanwhile, the put-to-call ratio suggests a prevalence of purchase options (calls) over sales options (puts).

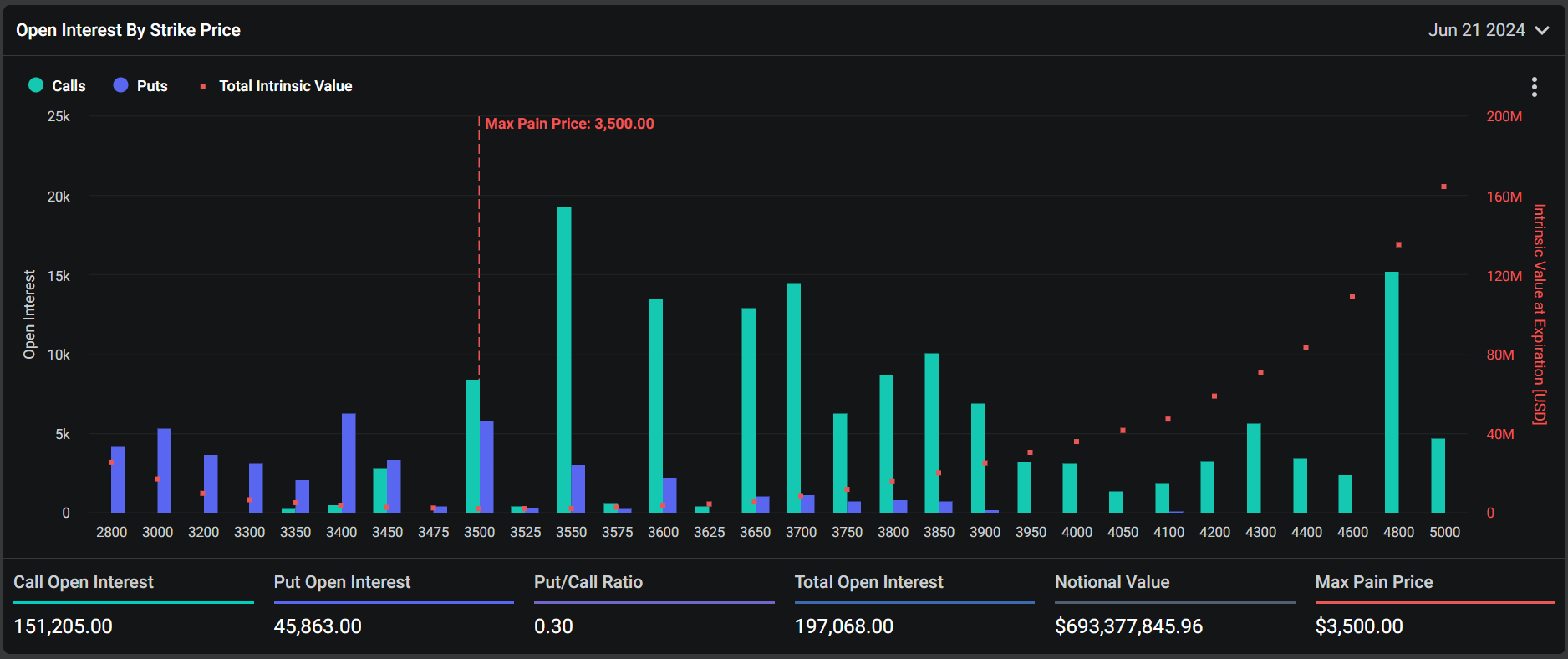

On the other hand, Ethereum has 197,068 contracts with a notional value of $693.37 million. These expiring contracts have a put-to-call ratio of 0.30 and a max pain point of $3,500.

Read more: An Introduction to Crypto Options Trading

Analysts at Greeks.Live noted an increase in forward options volume, especially in block calls. Despite high realized volatility (RV), the implied volatility (IV) has remained stable. This situation indicates no major market movement is expected before the quarterly delivery.

“The trend in the second quarter this year was weaker, aligning with historical experiences. The third quarter usually struggles, with the end of the quarter often marking the market rebound,” analysts at Greeks.Live stated.

Read more: 9 Best Crypto Options Trading Platforms

This week, Bitcoin fluctuated between $64,258 and $66,782, while Ethereum traded within the $3,387 to $3,632 range. At the time of writing, Bitcoin trades at $64,924, a 2.7% decrease over the past seven days. Ethereum trades at $3,526, marking a 1.5% increase.

While options expirations can cause temporary market disruptions, they typically lead to stabilization. Analysts’ recent insights highlight the historical patterns traders may consider when strategizing their positions. Ultimately, traders should remain vigilant, analyzing technical indicators and market sentiment to navigate the anticipated volatility effectively.