Today, the crypto market anticipates the expiration of nearly $1.85 billion in Bitcoin (BTC) and Ethereum (ETH) options.

Market participants are closely monitoring these expirations, which could lead to increased volatility and price fluctuations.

Macroeconomic Factors and Options Expiry: How They Shape Crypto Prices

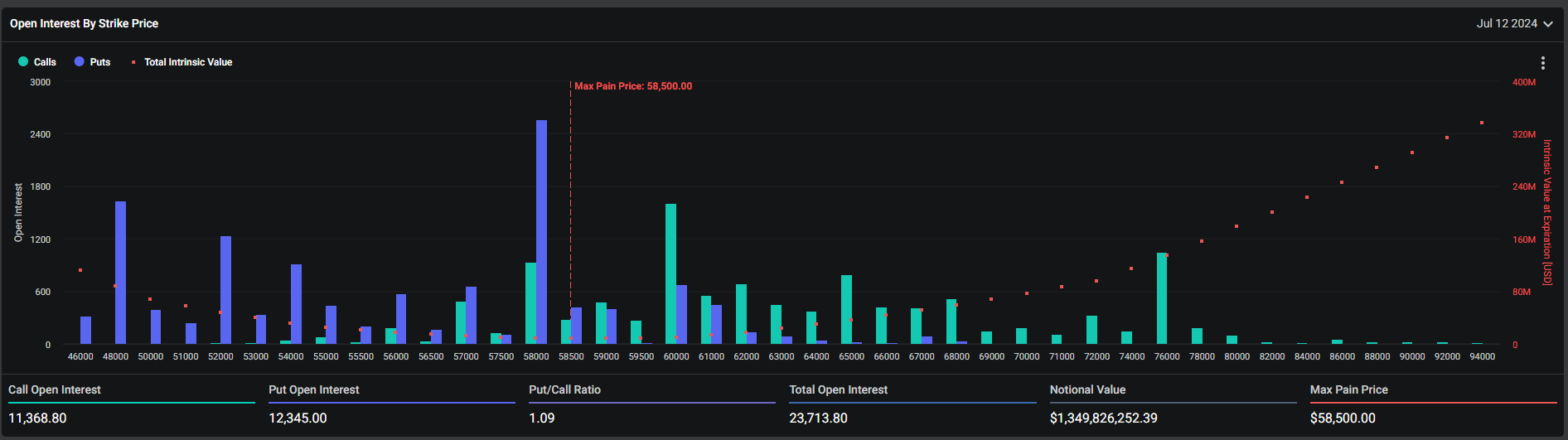

According to Deribit’s data, 23,832 Bitcoin contracts, worth approximately $1.37 billion, are set to expire today. This tranche is higher than last week’s figures, which were 18,339 contracts. These expiring contracts have a put-to-call ratio of 1.09, with a maximum pain point of $58,500.

Read more: An Introduction to Crypto Options Trading

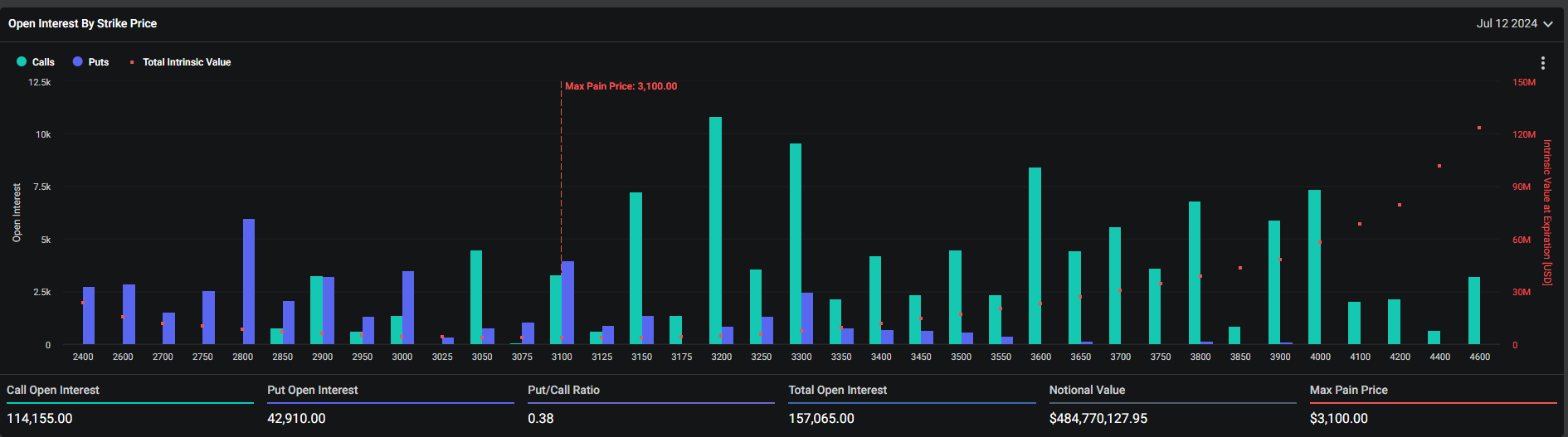

In the crypto options market, the maximum pain point represents the price level that inflicts the most financial discomfort on option holders. Meanwhile, the put-to-call ratio suggests a prevalence of purchase options (calls) over sales options (puts).

In addition to Bitcoin options, 156,792 Ethereum contracts will also expire today, holding a notional value of over $488.05 million. Ethereum’s put-to-call ratio is 0.38, with a maximum pain point of $3,100.

This week, the crypto market has been influenced by broader economic factors. On July 11, the Bureau of Labor Statistics (BLS) released the US Consumer Price Index (CPI) data, showing a 3% year-over-year (YoY) inflation rate for June. This figure was lower than market expectations.

Bitcoin briefly reached $59,000 during recent economic updates, while Ethereum was trading at $3,105, showing a slight increase. This positive development occurred despite market pressure from significant Bitcoin sell-offs by the German and US governments. Adam, an analyst at the crypto options tool Greeks.live, provided insight into the current sentiment in the crypto options market.

“The overall [implied volatility] IV level has rebounded significantly. If you choose a higher IV, you can open a sell order. The large amount of funds delivered in the quarter will smash the IV back at any time,” he wrote.

Read more: 9 Best Crypto Options Trading Platforms

Historically, sharp price movements from options expiration tend to be temporary, with markets stabilizing soon after. However, traders should remain careful in analyzing technical indicators and market sentiment to navigate this volatile period effectively.