Following Monday’s crypto market crash, approximately $2.5 billion in Bitcoin (BTC) and Ethereum (ETH) options are expiring today.

The expiration may influence market conditions, with investors monitoring potential shifts.

$2.5 Billion in Options Contracts Expiring: Will Crypto Markets Sustain Their Recovery?

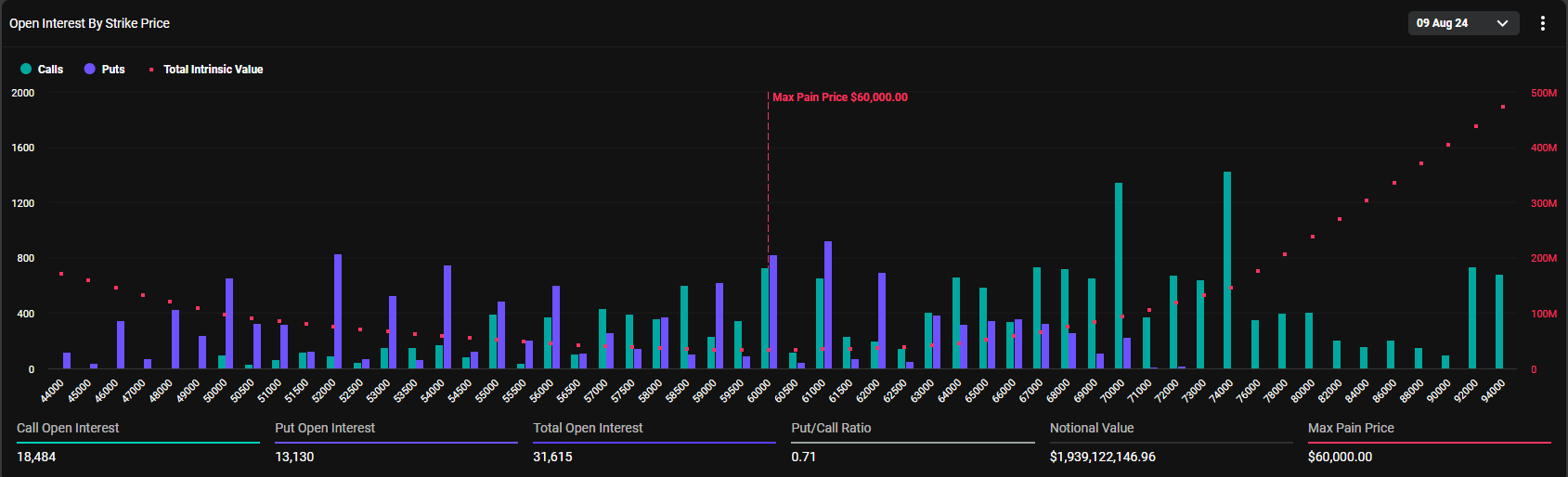

According to Deribit, $1.94 billion in Bitcoin options are set to expire. The maximum pain point of these contracts stands at $60,000.

These options include 31,615 contracts, slightly fewer than last week’s 36,732. The put-to-call ratio of 0.71 indicates a general bullish sentiment despite the recent volatility.

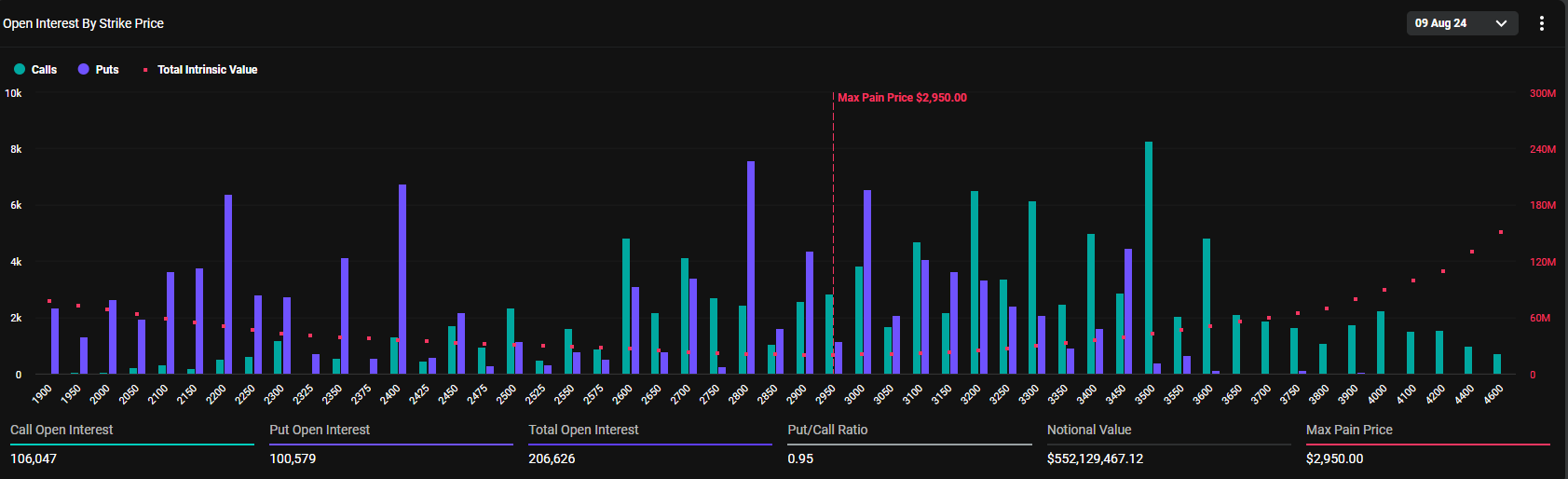

Ethereum has $552.13 million in options expiring, involving 206,626 contracts. This figure is an increase from the previous week’s 183,756 contracts. The maximum pain point for these options is $2,950, and the put-to-call ratio is 0.95.

Read more: An Introduction to Crypto Options Trading

The maximum pain point in the crypto options market represents the price level that inflicts the most financial discomfort on option holders. Meanwhile, the put-to-call ratio indicates a higher prevalence of purchase options (calls) over sales options (puts).

Analysts from crypto options trading tool Greeks.live provided insights on today’s contract expiration. They noted that the implied volatility (IV) of all major terms remains high, exceeding 60%. Meanwhile, the current Bitcoin 7-day realized volatility (RV) is at 100%, far surpassing the IV level.

“There is an aggregation effect in volatility, leading to a longer aftershock of large fluctuations, so IV has strong support, and sellers can gradually build positions,” Greeks.live’s analysts commented.

BeInCrypto reported that Bitcoin and Ethereum prices dropped significantly during Monday’s market crash. The severity is evident in the liquidations, which surpassed $1 billion, according to Coinglass data.

However, the very next day after the crash, the crypto market started to recover. At the time of writing, Bitcoin has climbed back above the $60,000 level. It is now trading at $61,494, marking a nearly 10% increase in just 24 hours.

Similarly, Ethereum has surged almost 12%, now trading at $2,671 after briefly reaching the $2,700 mark.

Read more: 9 Best Crypto Options Trading Platforms

Historically, options contract expirations tend to cause sharp but temporary price movements. The market usually stabilizes shortly after. Ultimately, traders should stay vigilant, analyzing technical indicators and market sentiment to manage potential volatility effectively.