The crypto market will witness $5.01 billion in Bitcoin and Ethereum options contracts expire today. This massive expiration could impact short-term price action, especially as both assets have recently declined.

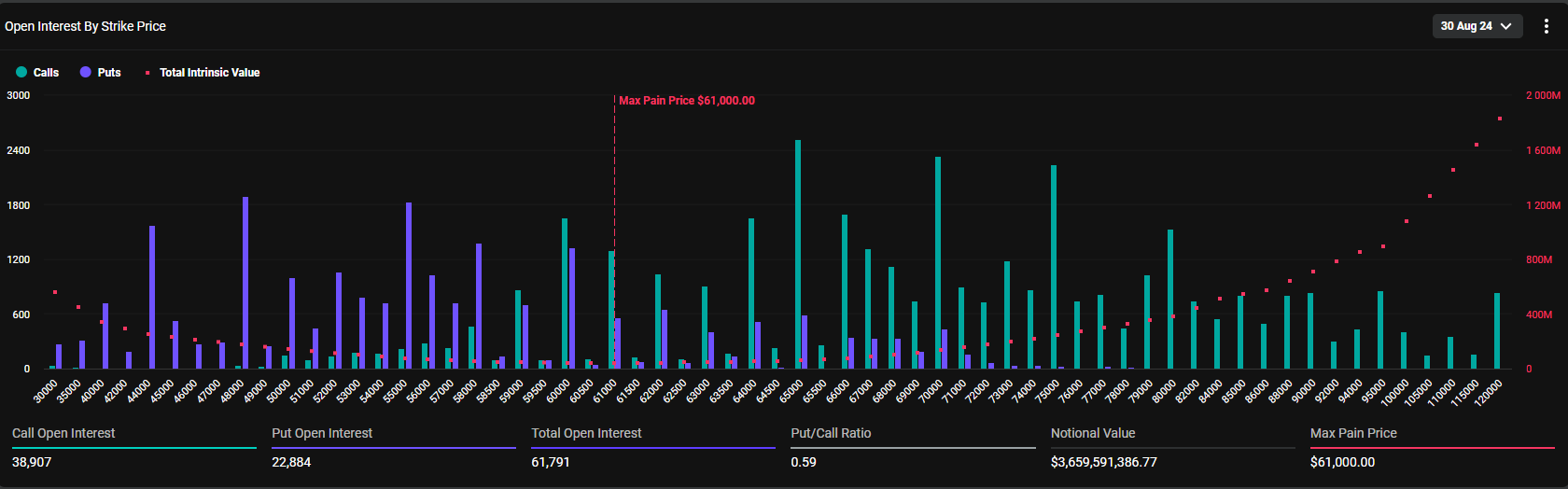

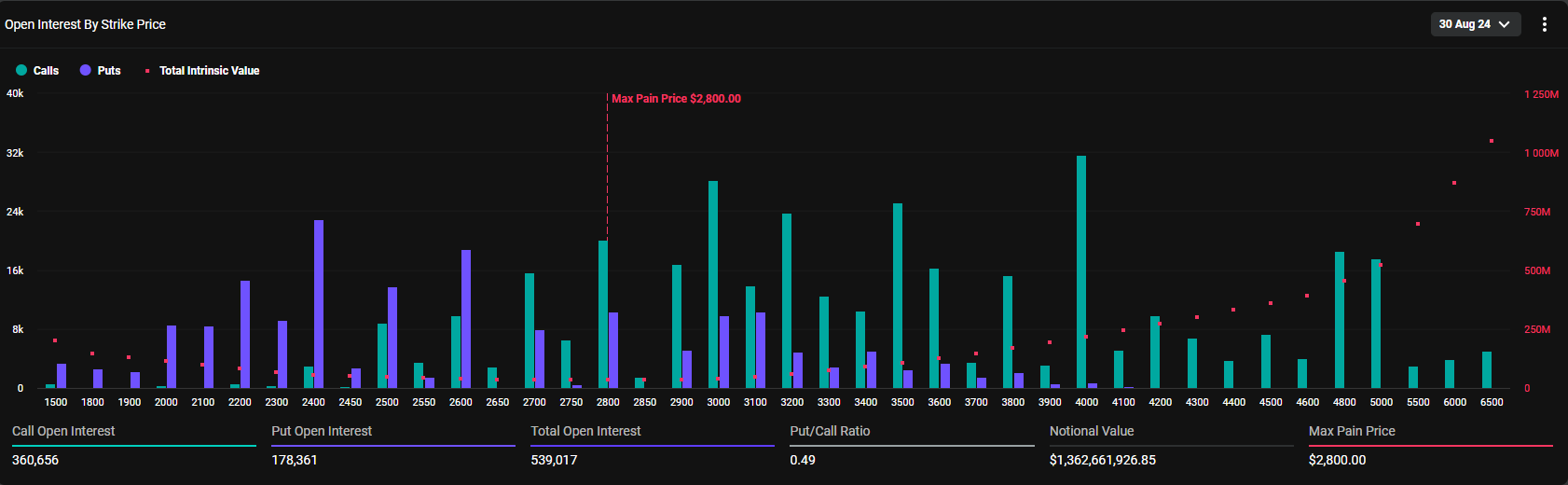

With Bitcoin options valued at $3.67 billion and Ethereum at $1.36 billion, traders are bracing for potential volatility.

High-Stakes Crypto Options Expirations: What Traders Should Watch Today

Today’s expiring options mark a significant increase from last week. According to Deribit data, Bitcoin options expiration involves 61,793 contracts, compared to 18,440 contracts last week. Similarly, Ethereum’s expiring options total 538,872 contracts, up from 141,410 contracts the previous week.

Read more: An Introduction to Crypto Options Trading

These expiring Bitcoin options have a maximum pain price of $61,000 and a put-to-call ratio of 0.59. This indicates a generally bullish sentiment despite the asset’s recent pullback. In comparison, their Ethereum counterparts have a maximum pain price of $2,800 and a put-to-call ratio of 0.49, reflecting a similar market outlook.

The maximum pain point is a crucial metric that often guides market behavior. It represents the price level at which most options expire worthless. Additionally, the put-to-call ratios below 1 for both Bitcoin and Ethereum suggest optimism in the market, with more traders betting on price increases.

According to Greeks.live analysts, recent price declines and external factors, such as Nvidia’s earnings, have led to a slight uptick in implied volatility (IV). However, they note that IV has generally decreased over time, reflecting a pullback trend.

“Options data shows that [realized volatility] RV has fallen from a high of 100% on August 9 to 40% currently, with BTC’s actual volatility levels dropping dramatically, which is also a significant factor driving IV down,” the analysts added.

Greeks.live analysts also observed an increase in long positions in block options trading. This condition indicates that some large-scale traders are preparing for future price rises.

The latest data shows that Bitcoin’s trading value has dropped by 3.26% to $59,157 from the $61,150 mark on August 29. Similarly, Ethereum has fallen by 2.55%, now trading at $2,525, down from the previous $2,592 during the same period.

Read more: 9 Best Crypto Options Trading Platforms

Options expirations often cause short-term price fluctuations, creating market uncertainty. However, markets usually stabilize soon after as traders adapt to the new price environment. With today’s high-volume expiration, traders and investors can expect a similar outcome, potentially influencing future crypto market trends.