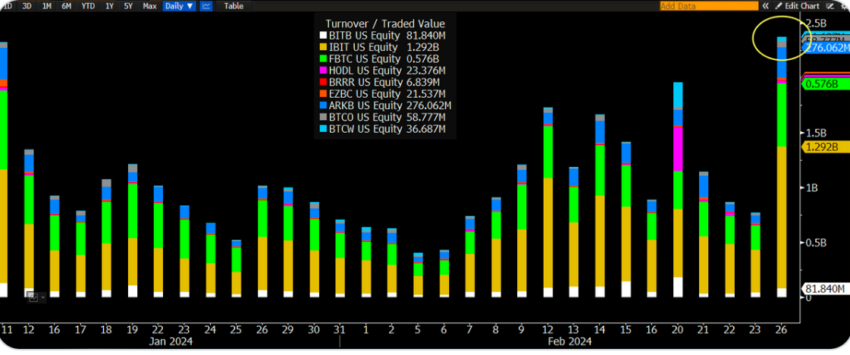

On February 26, Bloomberg ETF analyst Eric Balchunas noted record-high volumes in nine Bitcoin exchange-traded funds (ETFs), aligning with Bitcoin’s price nearing approximately $55,000 USD.

Balchunas acknowledged uncertainty about the cause behind the volume surge but highlighted that such spikes typically occur after weekends.

Bitcoin ETF Volumes Soar, Amid Price Surge

In a recent X (formerly Twitter) post, Balchunas disclosed that nine of the 11 recently launched spot Bitcoin ETFs achieved a record volume of $2.4 billion in inflows within a 24-hour period.

This figure represents the net inflows across the nine spot Bitcoin ETFs, indicating the cash inflows minus outflows.

“It’s official..the New Nine Bitcoin ETFs have broken all time volume record today with $2.4b, just barely beating Day One but about double their recent daily average.”

Additionally, Balchunas observed that BlackRock’s iShares Bitcoin ETF experienced a significant surge, contributing around $1.3 billion to the total net inflows of $2.4 billion, representing roughly 55% of the overall inflows.

However, aside from BlackRock, the other Bitcoin ETFs that contributed to this were from Fidelity, Franklin Templeton, Invesco, VanEck, WisdomTree, Hashdex, Bitwise, and Valkyrie.

Read more: What Is A Bitcoin ETF?

At the time of publication, Bitcoin has seen a 24-hour price rise of approximately 9.49%. Its current price is $56,339.

On February 2, BeInCrypto reported that the combined 11 spot Bitcoin ETF applicants hold approximately 3.3% of the current Bitcoins supply.

Bitcoin ETF Popularity Leads to Bitcoin Price Rise

Meanwhile, the growing popularity of Bitcoin ETFs could positively affect Bitcoin’s price since the ETFs are backed by actual Bitcoin.

Read more: How To Buy Bitcoin (BTC) on eToro: A Step-by-Step Guide

Institutions offering the ETFs must support the shares with real Bitcoin.

However, before Bitcoin ETFs received approval in January, speculation arose regarding whether the ETF products would indeed be backed by the asset. Some argued that failure to do so could have been catastrophic for Bitcoin.

“If the Bitcoin ETFs are just “cash in, cash out,” it seems like they are just paper Bitcoin no? Probably the worst thing that could happen and may result in endless price suppression.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.