A large volume of Bitcoin options contracts are set to expire today as the month draws to a close. Will this be enough to move crypto markets which have been in a state of torpor for weeks?

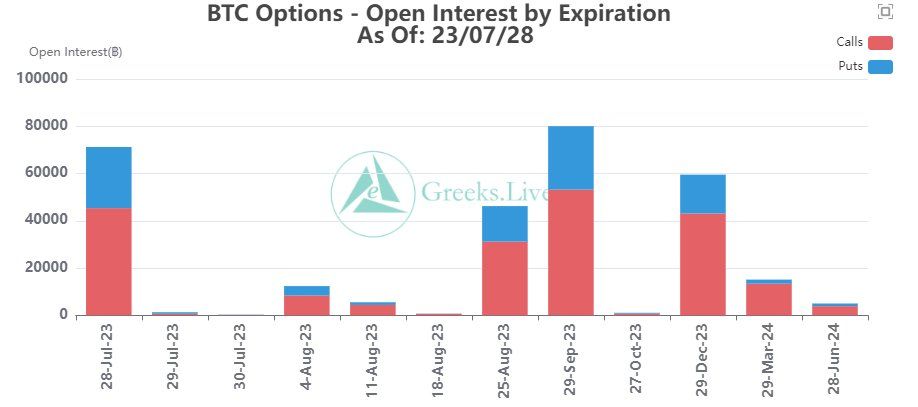

The largest Bitcoin options expiry event for the next two months will occur on July 28 as 71,000 BTC contracts expire.

Bitcoin Options Expiry Impact

This week’s expiry event has a notional value of $2.08 billion making it one of the largest for some time. Furthermore, the max pain point is $29,000 which is pretty close to the current spot market price for Bitcoin.

The max pain point is the price level with the most open contracts. It is also the level at which most losses will be made when the contracts expire.

Today’s expiring stack of BTC options contracts has a put/call ratio of 0.57. This means that there are almost twice as many call contracts being sold as puts.

The ratio is derived by dividing the number of short seller contacts (puts) by the number of long seller contracts (calls). Moreover, values below 1 mean more call contracts which often indicates bullish sentiment for the underlying asset.

Volatility remained low this week, with Monday’s decline putting this month’s delivery price right at the max pain point, commented Greeks Live.

It added that implied volatility (IV) is also at record lows. IV is a measure of the expected volatility for a crypto asset over the next 30 days by analyzing derivatives contract activity.

“Monthly expiration hasn’t even brought much shifting of positions, and the whales are being very cautious out of the gate, the bears need to be more patient and simmer with time.”

Find out where to trade Bitcoin derivatives here.

Additionally, there are 600,000 Ethereum options contracts expiring today with a notional value of $1.12 billion.

The max pain point for the ETH contracts is $1,850 and the put/call ratio is 0.37. Therefore, sellers are trading a lot more call contracts for Ethereum at this level.

BTC Price Outlook

Bitcoin prices have retreated 1% on the day to $29,187 at the time of writing. Volumes have dried up, and it has remained at this level for most of this week.

BTC failed to hold above $30K last weekend and has not revisited that price level during the week. This suggests that resistance is too strong and a downside could be the easier path for its next move.