Although the Bitcoin hype that helped push the asset’s price over $41,000 has seemed to calm down, the demand and interest for BTC still seem to be prevalent.

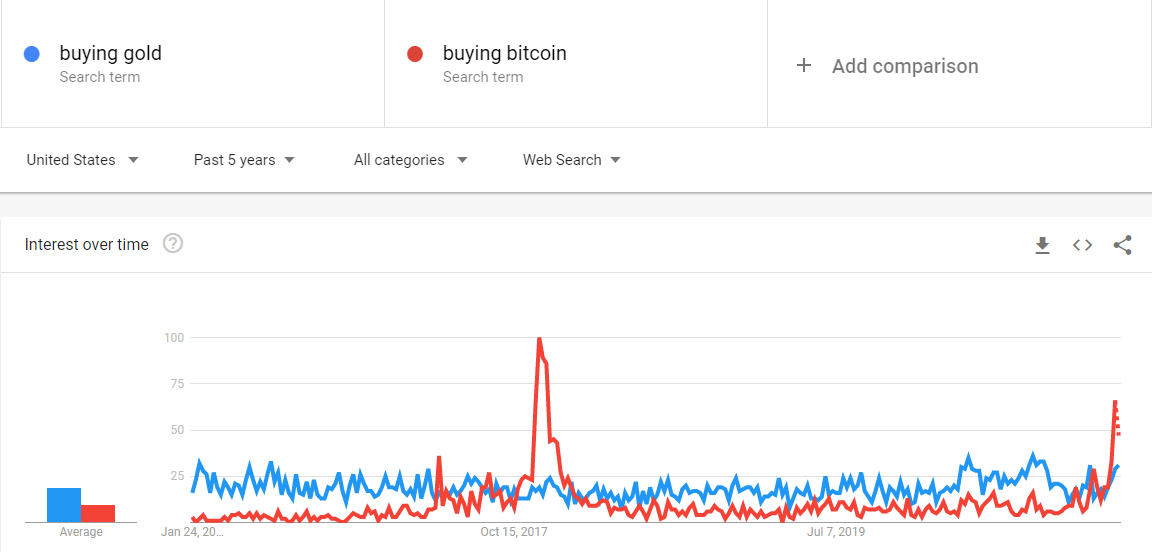

For the first time since the last major cryptocurrency bull run in 2017, the Google search term trend results for ‘buying gold’ and ‘buying Bitcoin’ are skewed heavily in favor of Bitcoin.

In fact, the current trend signifies that people are searching for ‘buying Bitcoin’ more than twice the amount they are searching for ‘buying gold.’

When looking at the five-year trend, we can see that the all-time high searches of Bitcoin took place in 2017. The current bull run has only been able to generate about 67% of the search volume that was previously experienced, despite prices being around 100% higher.

Bitcoin — The Safer Haven

This statistic shows that many people from all around the world are continuing to show massive interest in digital currencies over physical assets.

During a global economic, social, and financial crisis brought on by the Coronavirus pandemic, more people are looking for ways to safely protect their wealth. Gold has traditionally been viewed as one of the most stable safe-haven assets, but it appears that now, many are flocking to Bitcoin for their wealth preservation needs.

The ‘buying gold’ trend line has not changed much over the previous five years, while the ‘buying Bitcoin’ trend has had major volatility. This represents the current dynamic well, as many view gold as a safer traditional asset (subject to fewer fluctuations than Bitcoin), but also as a potentially inferior technology.

This data cannot accurately suggest investors’ outlooks on Bitcoin as a store of value, but it at least confirms that the interest has been rising significantly along with recent price increases.

Institutional Investors Running the Show

Although it’s likely that the popularity in the ‘buying Bitcoin’ Google trend search is due to average investors, the bull run experienced in 2020 is fundamentally different from crypto bull runs of the past.

For the first time, many large scale institutions are starting to view Bitcoin as a better form of ‘digital gold’ and a hedge against inflation, causing them to invest millions or billions of dollars into the asset. This increased interest can easily be responsible for increased interest among retail investors, as they may be taking cues or insights from globally dominant companies and organizations.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.