Even though the Bitcoin Dominance Rate (BTCD) has been increasing over the past week, it has yet to move above a crucial resistance level, below which the trend is still considered bearish.

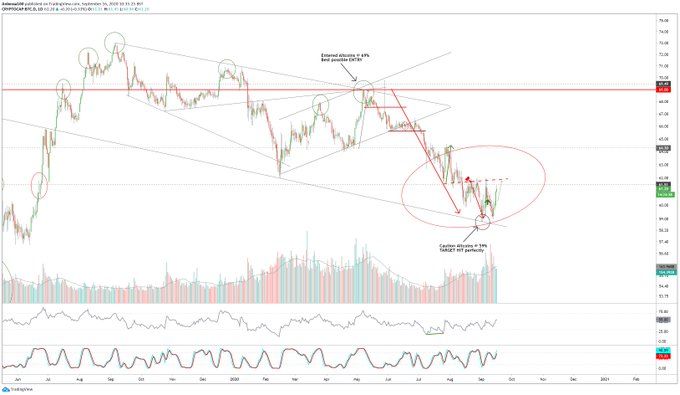

In September 2019, the BTCD reached a high of 73.02% but has been decreasing under a descending resistance line since.

The rate has now fallen below the 62% area, a zone which acted as resistance twice in 2018 and 2019 and afterward as support in January 2020.

Bitcoin Dominance in a Tough Spot

If the BTCD does not reclaim this area, it would suggest that it has fallen back within its previous range and could decrease all the way to 53%. Technical indicators show some signs of reversal. There is a bullish divergence in the weekly RSI, which is also inside its oversold region. The last time there was divergence, albeit bearish, the rate had just reached the aforementioned top of 72% and began the current decrease. However, that was a triple divergence, while the current occurrence is a double. Neither the MACD nor the Stochastic Oscillator is giving any signs of a reversal. On the contrary, the latter has rejected a bullish cross.

Strong Resistance Overhead

Cryptocurrency trader @anbessa100 outlined a Bitcoin dominance chart which shows that the rate has been moving upwards since it reached a low of 59% last week. However, she predicts that the rate will soon hit resistance and decrease.

Relationship To BTC

The shorter-term chart is bearish. The BTCD has begun to decrease after the RSI generated bearish divergence. The MACD is also decreasing and the Stochastic Oscillator has made a bearish cross. If the 0.618 Fib level of the recent increase (60.10%) does not hold, it would greatly reduce the chances of the upward movement resuming, while a decrease below 59% would almost confirm that the rate is going lower.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored