The Bitcoin dominance rate (BTCD) has been increasing since Jan 15 and is approaching a crucial resistance level at 44.5%.

In the period between May 2021 – Jan 2022, BTCD consolidated above the 40% horizontal support area. More recently, it bounced above this level on Jan 15.

While doing so, both the RSI and MACD generated very significant bullish divergences. Such pronounced divergences very often precede bullish trend reversals.

If the upward movement continues, the closest resistance area would be at 52.25%. This is the 0.382 Fib retracement resistance level.

BTCD approaches descending resistance line

Cryptocurrency trader and investor @eliz883 tweeted a chart of BTCD, stating that an increase above 44% could take the rate all the way to 50%.

A closer look at the daily charts supports the findings from the weekly overview.

Technical indicators in the daily time-frame are bullish, since both the RSI and MACD are moving upwards.

The RSI, which is a momentum indicator is also above 50. Such readings are often associated with bullish trends.

The MACD, which is created by a short- and a long-term moving average (MA), is positive and increasing.

Both of these are considered signs of a bullish trend.

Therefore, they support a BTCD increase towards at least 44.5%, which is the 0.618 Fib retracement resistance level and coincides with a descending resistance line.

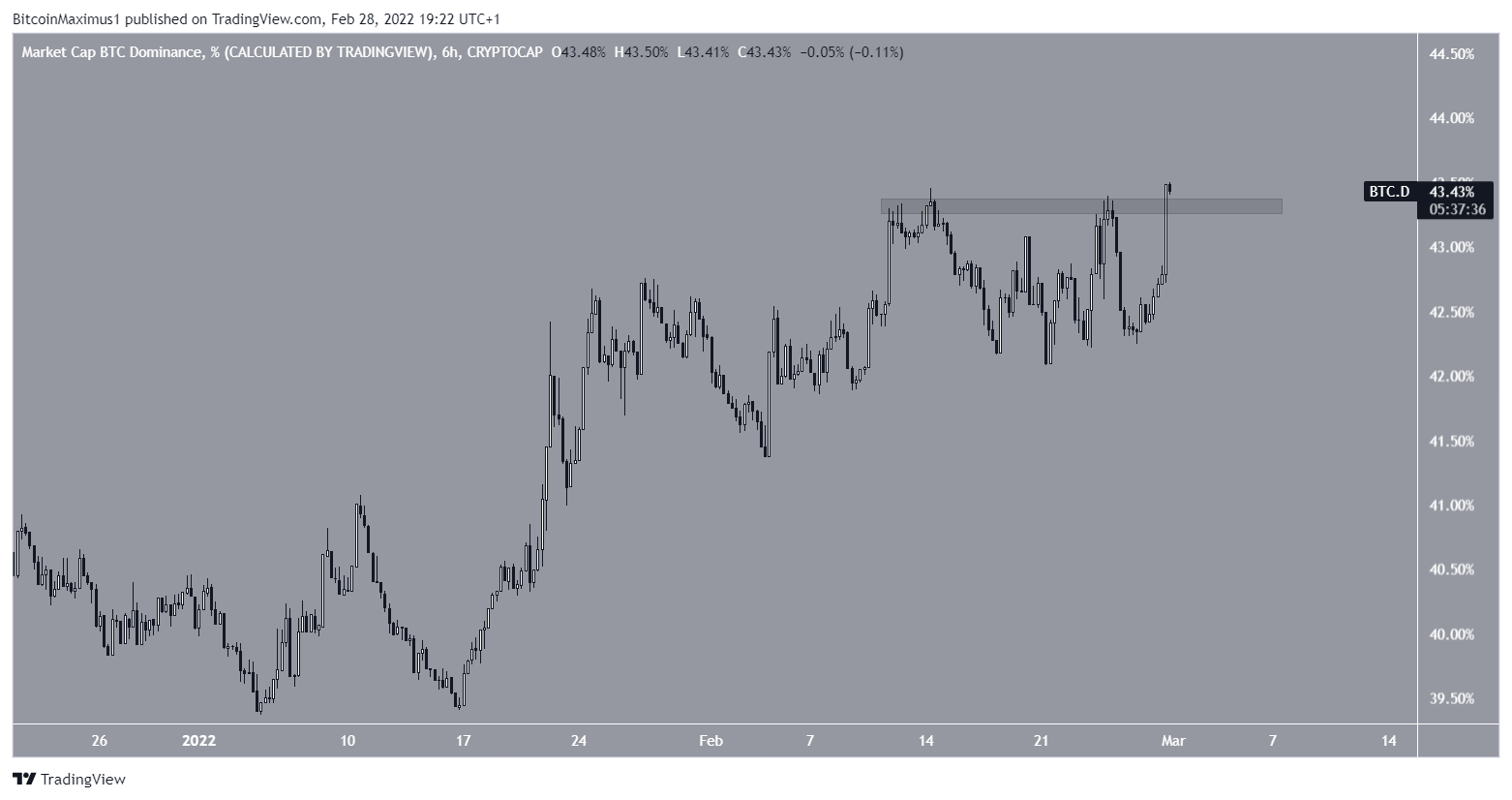

Short-term movement

Finally, the two-hour chart shows that BTCD has moved above the minor resistance area at 43.5%, reaching a new yearly high in the process.

Therefore, readings from the weekly, daily and two-hour charts are in alignment, painting a bullish outlook for BTCD.

As a result, an upward movement towards at least 44.5% seems to be the most likely scenario moving forward.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.