Bitcoin (BTC) has broken out from a short-term diagonal resistance level and appears to be in the first steps of creating a bullish structure.

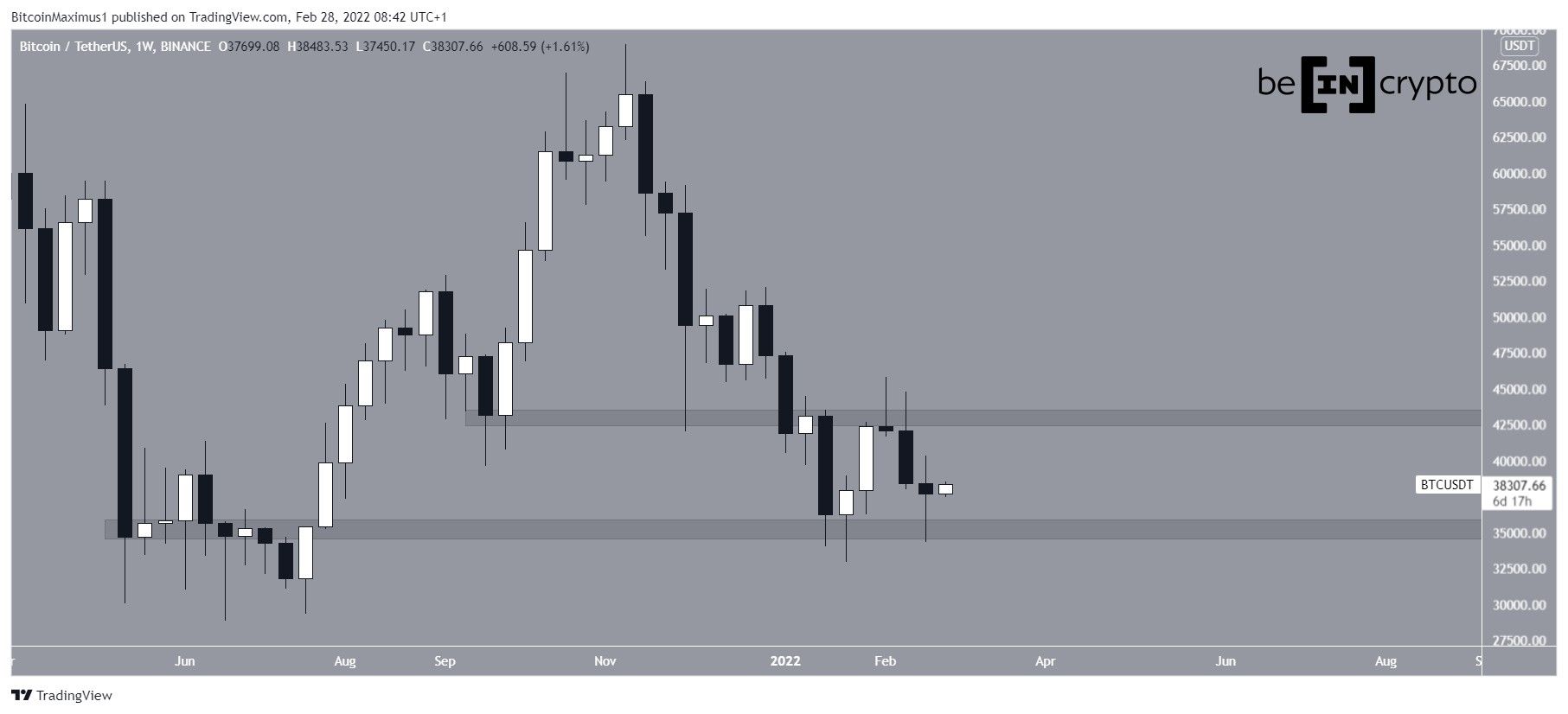

Bitcoin began the week of Feb 20-27 with a sharp fall but rebounded shortly after and created a long lower wick. Such wicks are considered signs of buying pressure.

The bounce also served to validate the $35,200 horizontal area as support.

SponsoredIf BTC continues to increase, the next closest resistance area would be found at $43,000.

Ongoing BTC bounce

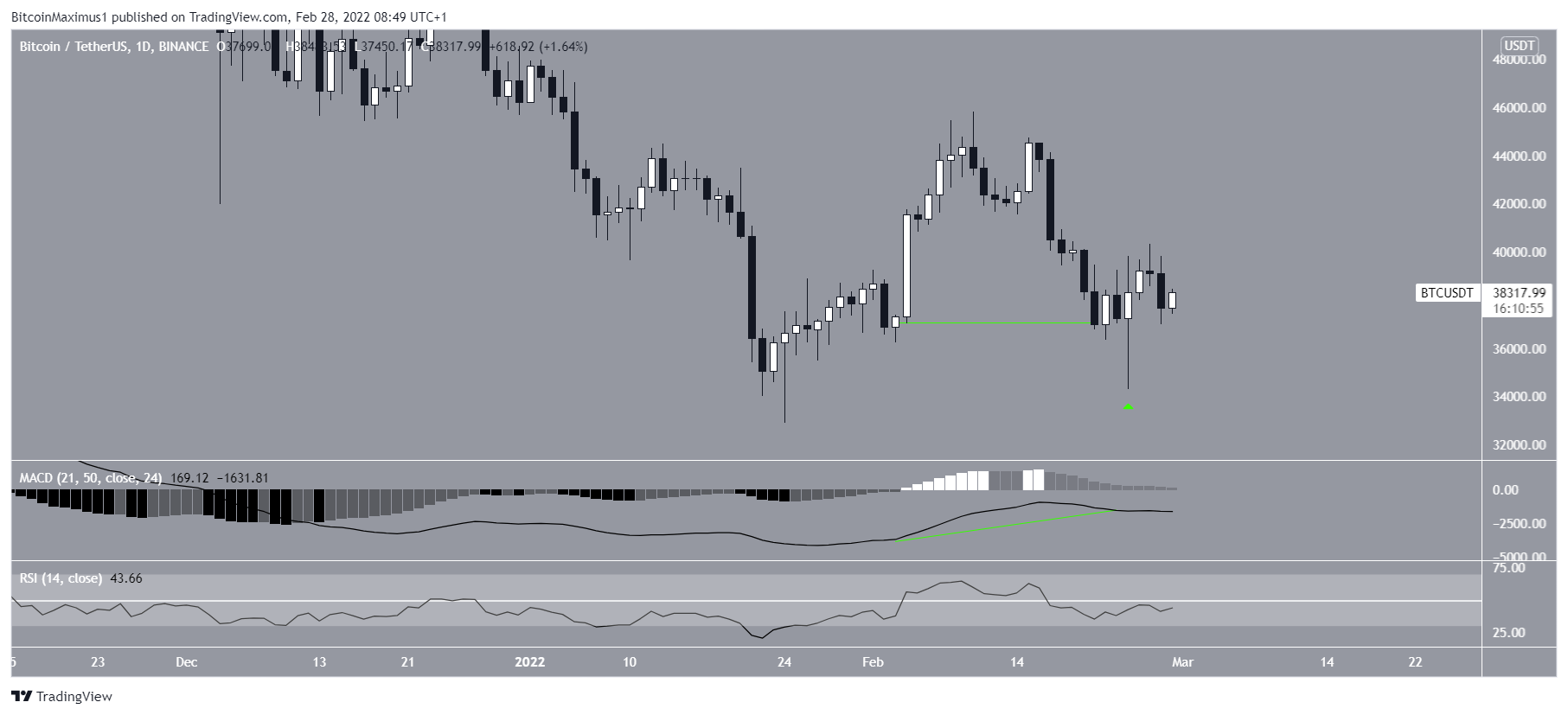

The daily chart shows that virtually the entire upward move transpired on Feb 24, when BTC created a bullish hammer candlestick (green icon) with a very long lower wick.

Despite this seemingly bullish price action, technical indicators provide mixed readings.

The MACD and RSI are both increasing, and the former has even generated some bullish divergence (green line).

SponsoredHowever, the MACD is still negative and the RSI is below 50. This means that despite the potential bullish reversal, neither of the indicators has crossed the threshold that would confirm that the trend is bullish.

The six-hour chart shows that BTC has broken out above a descending resistance line that had previously been in place since Feb 16.

After the breakout, BTC was rejected by the 0.5 Fib retracement resistance level at $40,100.

However, it dropped back a bit and created a higher low on Feb 27.

SponsoredSimilar to the daily time frame, both the MACD and RSI are increasing. However, the former is still negative and the latter is on the 50-line.

If BTC manages to move above the $40,100 resistance area, the next resistance would be found at $43,350. This target is the 0.786 Fib retracement resistance level and a horizontal resistance area.

SponsoredWave count analysis

The long-term wave count is still unclear.

However, the short-term count suggests that BTC has just completed the B wave of an A-B-C corrective structure. This was done with the Feb 24 bounce at the 0.5 Fib retracement support level (black).

If waves A and C have a 1:1 ratio, the price would increase all the way to $43,000. This would also coincide with the long-term resistance level.

Following this, another downward move could occur.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here