The Bitcoin dominance rate (BTCD) is showing short-term signs of weakness, but the long-term trend still remains bullish.

BTCD has been decreasing underneath a descending resistance line since July 30. More recently, the line caused a rejection on Oct 20 (red icon), causing a sharp fall below 40%.

However, BTCD reversed trend and has been moving upwards since Jan 13.

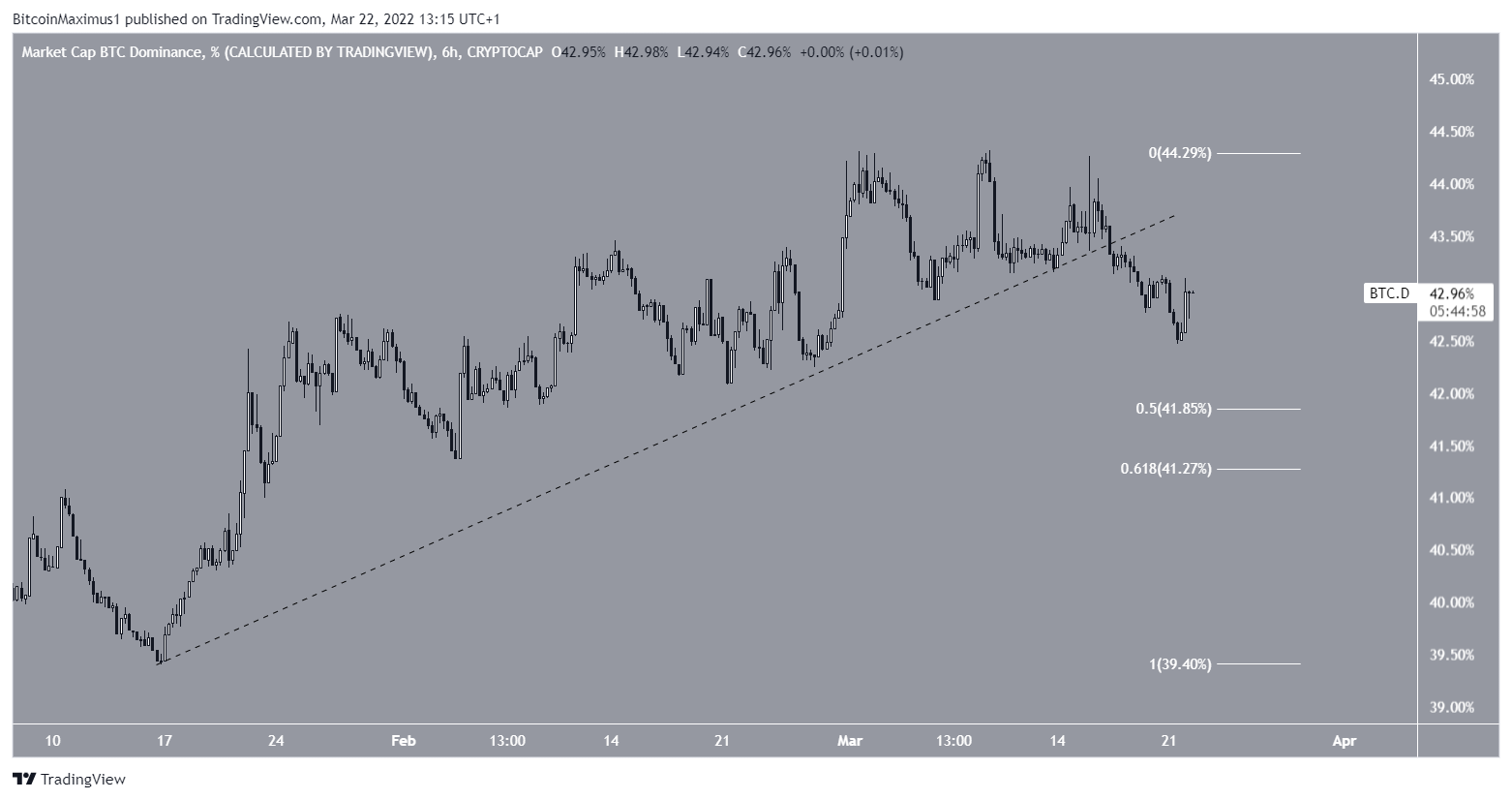

Despite the apparent increase, another rejection occurred on March 9. The rejection was caused by the 0.5 fib retracement resistance level at 44% and occurred prior to the descending resistance line.

Now, the line coincides with the 44% resistance area. Therefore, until that is broken, the trend cannot be considered bullish.

Short-term rejection

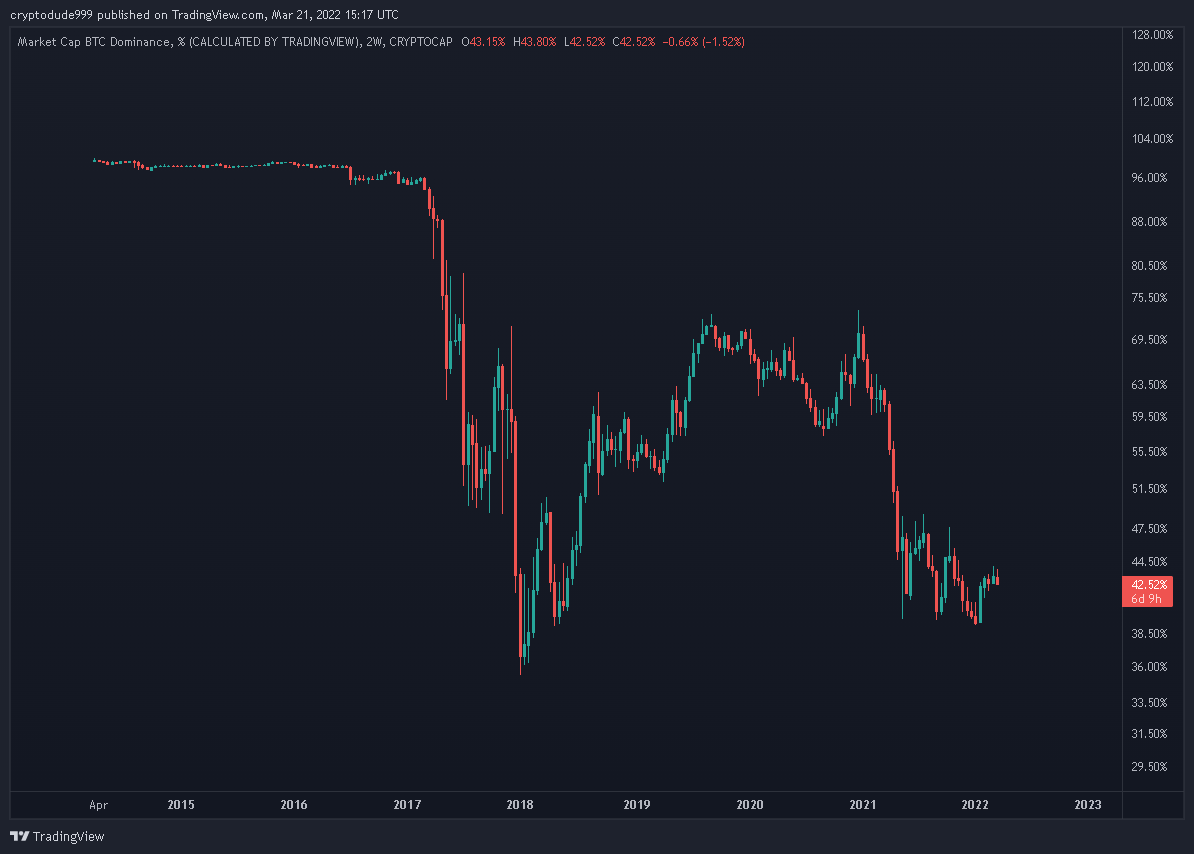

Cryptocurrency trader @cryptodude999 stated that there is weakness in BTCD which could lead to several altcoins rallying.

The daily chart shows that the decrease was preceded by bearish divergence in both the RSI and MACD (green lines). Such divergences often precede downward movements, as was the case with BTCD.

Furthermore, the RSI has fallen below 50, which is another sign of a bearish trend.

If the downward movement continues, the 0.5 fib retracement support level at 41.60% would be expected to provide support.

The six-hour chart shows that BTCD has already broken down from an ascending support line (dashed). Therefore, it is in the process of decreasing towards the 0.5-0.618 fib retracement support level at 41.25 to 41.85%.

Long-term BTCD movement

Despite the relative bearishness from the daily time-frame, the weekly chart remains bullish. The reason for this are the bullish divergences that have developed in the MACD and RSI (green lines). The divergences have been developing for over a month and a significant upward movement has yet to occur.

Therefore, a long-term upward movement towards 52.25% after the current short-term decrease ends is not out of the question. This is the 0.382 fib retracement resistance level.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.