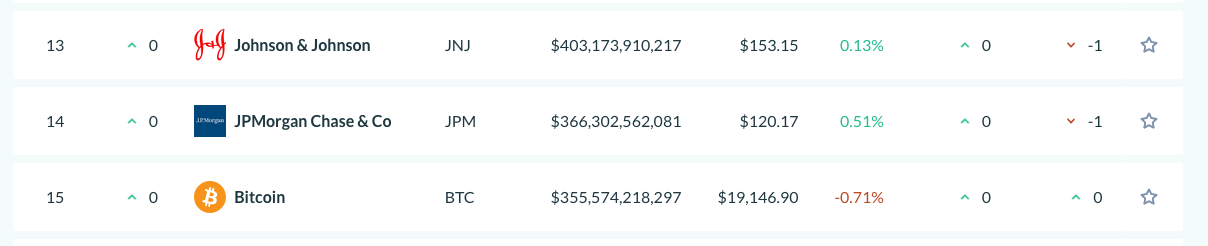

Based on both the market capitalization of BTC and JPMorgan, Bitcoin only needs to add a little over $10 billion in market cap to overtake the banking giant.

Bitcoin is closing in on its all time high price and is closely being tracked across the entire financial space. The largest cryptocurrency is now getting ready to pass and contend with some of the largest non blockchain-related companies in the world.

According to AssetDash, which ranks the top assets by market capitalization, JP Morgan has a current market cap of $364.4 billion compared to Bitcoin’s $353.8 billion.

$10 billion may sound like a large sum to overtake JP Morgan, but with a $350 billion market cap and current daily trading volume of well over $20 billion, the increase may only have to be incremental.

JP Morgan Analysts Point to Higher Bitcoin Market Cap

According to JP Morgan analysts, if US, European, and Japanese pension and insurance firms invest just 1% of their net holdings into bitcoin, BTC’s market cap would grow by some $600 billion.

Similarly, as more large institutions start to purchase BTC as a hedge against inflation, it could set a precedent. MicroStrategy’s recent announcement of an additional $650 million purchase via debt is one such example.

Now, as one of the largest insurance firms in the world jumps into the fray, the door has been opened for other insurance firms and pension funds, JPM analysts say:

“MassMutual’s Bitcoin purchases represent another milestone in the Bitcoin adoption by institutional investors”

As a company with close to $700 billion in total assets under management, a $100 investment represents a drop in the bucket and possibly not even close to the 1% of its allocated funds.

A Mainstream Hedge Against Inflation

For pension and insurance funds, the US dollar has traditionally been the safe-haven currency to denominate their assets in.

In terms of inflation, many organizations have begun to look outside of traditional currency and precious metals markets to ultimately dabble in cryptocurrency, especially with Bitcoin.

With hidden inflation hitting a number of countries worldwide, are these organizations looking to Bitcoin’s deflationary properties as a way to protect their assets’ long-term value?

The answer appears to be yes, but additional large-scale institutions may need to get involved before it can truly be defined as a real hedge against inflation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.