Initiating a Long For Bitcoin Cash

For a comprehensive list of our trades, please follow the link below:

Today, we will be looking to initiate another trade for Bitcoin Cash.

We are looking to enter the trade somewhere in the low $300s with a target close to $400.

Since our short was closed at $320, this can be used as the entry for the new long.

If you missed that short, an outline of how to proceed is given below.

We want to get a price that is close to the support line of the triangle.

This allows us to place a tight stop loss, giving us a good risk/reward ratio.

Let’s go through the numbers.

The main outline of the trade is this: we enter the trade at $320 with a target of $391 and a stop loss of $299.

The stop loss is placed well below the support line of the triangle, and slightly below a support area.

Furthermore, $300 should act as a psychological resistance. Therefore, we will place the stop slightly below it.

This trade setup gives us a 1:3.5 Risk/Reward ratio. This means that if we reach our target 1/3.5 times (28%) we will break even.

Now, say that we get a closer entry, as described in the picture below.

In the scenario presented above, we will enter at $310, adjacent to the support line.

The target and stop loss are left unchanged ($390 and $299).

In this case, the stop loss is very close, merely 3.25% away from our entry point. This is almost two times smaller than that in the first trade, which was 6.50%.

This increases our Risk/Reward ratio to 6.77.

I believe this example emphasizes the importance of entry points. An entry point that is lower by 3.2% (10$) will double our risk/reward ratio.

However, there is a trade-off that comes with this increased profitability.

It is possible that the price will not decrease all the way to $310. Rather, it can make a low in the mid $310s, before beginning to increase.

In this case, we would be left without executing the trade while the price potentially breaks out and reaches our target.

Therefore, while waiting for optimal entry prices can greatly increase our risk to reward ratio, it can also leave you hanging with an unfulfilled order.

For a short summary, please refer to the table below

Money Management

In our trades, we will follow a rule stating that we cannot risk more than 2% of our total portfolio in a trade.

We will be doing this trade with 3% of our total portfolio. In an account of $10,000, this would mean a total of $300. 0.95 BCH will be bought at an entry of $315. We chose $315 as our entry point since it is the average of our two entry points at $310 and $320 respectively.

We will be risking 0.116% of our portfolio. With the same account total, this amounts to $11.6

The Risk/Reward ratio in this trade (5) is above average.

The reason for not placing more capital in this trade is mostly because BTC is in a precarious position.

It seems as if BTC is either beginning a new uptrend or is giving its final upward bounce before the price continues its downtrend.

In both scenarios (rapid increase/rapid decrease) the price of BCH would likely fall. Therefore, since volatility is returning to BTC, I would preach caution when initiating a trade with any other alternate coin.

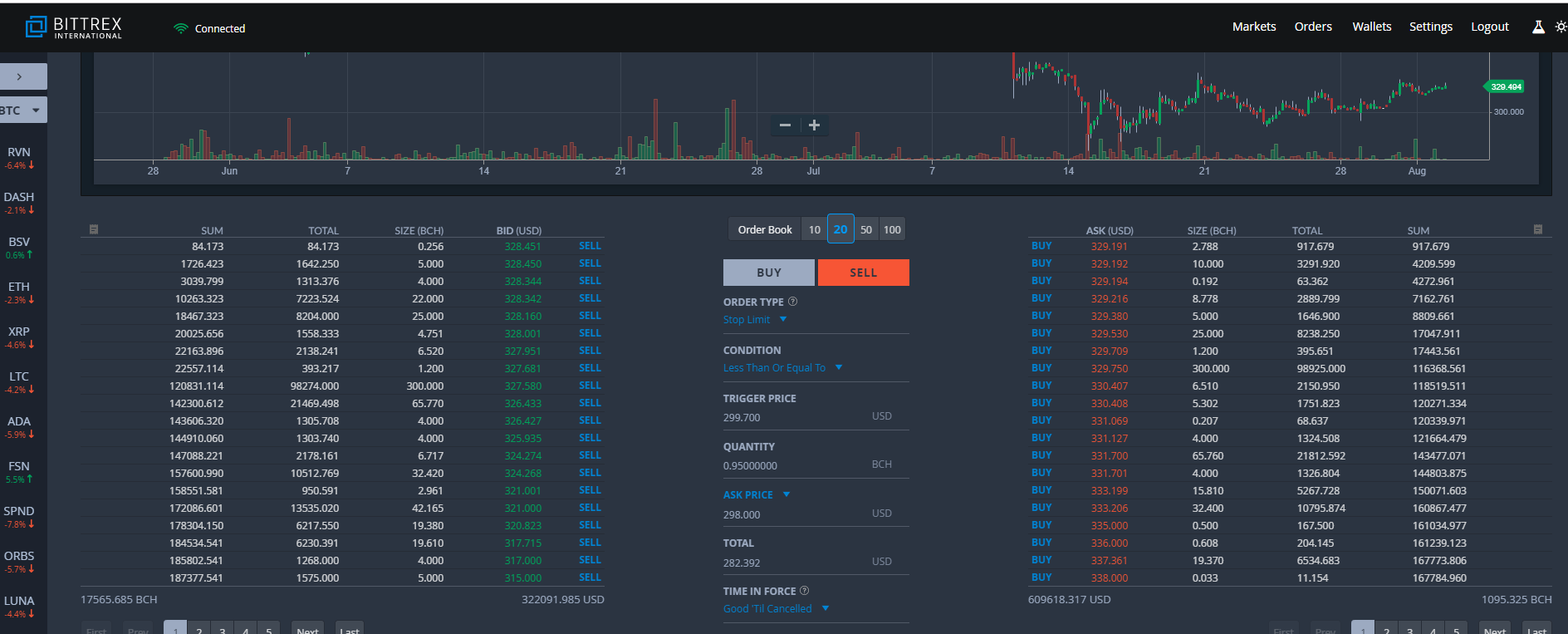

Now, for those of you who do not know how to place a conditional trade with a stop loss, a simple guide is given below.

The trigger price refers to the price that would have to be reached for our stop loss to trigger.

In our case, the trigger price is at $299.8, while the Ask price is at $298.

This means that once BCH reaches $299.8, we will automatically issue an order to sell at $298.

It is important to keep some cushion between the trigger and ask prices since we do not want the price to decrease with massive volume and leave our trade order unfulfilled.

This is especially important if the trade is done with significant amounts of capital

However, a relatively small trade of less than one BCH should have no trouble being filled at $298.

For those interested, we will go into detail explaining the reasoning for this trade below.

Trade Analysis

The main reason for initiating this trade is given by the use of the Fibonacci retracement tool and the daily moving averages (MA).

After reaching a high of nearly $525, when we initiated our first short, the price has retraced all the way to the $0.618 fib level.

This is a likely place for the beginning of a reversal.

After making a low near $275, BCH began to increase.

On August 1, a bullish cross transpired between the 10- and 20-day moving averages.

This is often a sign that an uptrend has begun.

Since February, a bullish cross between the aforementioned MAs has transpired four times:

- March 15

- May 9

- June 19

- August 1

Each time, an upward move of varying magnitude has followed.

The increases have been of 170%, 75% and 25%.

An increase of only 25% would take us to our target of $390.

The reason for deciding to wait for a drop to trigger our entry and not entering immediately is given by the RSI.

In time-frames of up to four hours, it has begun generating significant divergence.

BCH also made a double top of $333 on July 30 and August 2, very close to the resistance line.

Combined with the divergence, this makes us believe that the price will drop towards the support line, providing a better entry point for our trade.

Previous BCH Trade

July 16 – Closing The Short

The price has reached our target of $325. Therefore, we will close the trade.

If the trade was initiated with 5% of your portfolio, this would have presented a 1.5% increase on your total portfolio and a $150 profit.

The final target represented a profit of 35%.

July 1 – Short Update

The price is currently trading near $400. This is also a minor support area.

It is currently in the process of making a double bottom.

Even though this price is still quite far away from our original target, it would still be a good position to take some profit.

The reasons for this are that it is possible (even though) not likely that the price will begin an upward move from this level.

We also still have close to 20% profit, which is still admirable, considering our stop loss of less than 4%.

Therefore, I would take profit with around 25% of the total trade size. We initiated a trade with $200, so here I will buy back with $40. This amounts to 0.1 BCH.

June 25: Initiating a Short

At the current price, I do not think that this could be a very profitable trade setup.

This is mostly because the price in in an ascending wedge. While the wedge is a bearish pattern, it has an ascending resistance line.

Therefore, it is tricky to place a stop loss that I feel will not be triggered by a fakeout and is a short distance away from the current price.

$525 seems like a good place to place a stop loss. It is slightly higher than the highs of $517 reached on June 21 and is above the resistance line until at least.

On the other hand, the reasons that I like the trade come mainly from the readings of the technical indicators.

The price has been trading inside a bearish pattern for almost two months. For the entire duration, two momentum indicators have created a bearish divergence in a long-term time-frame.

For the entire analysis, you can click here.

So, if the price breaks down, it could begin a rapid decrease.

This would mean that there could be a very hefty risk to reward ratio, especially if we can get in at an entry of close to $510.

A lot of this could depend on the price of Bitcoin. If it continues its massive rally, then it would not be likely for the price of BCH to fall. The opposite would be true if the price begins to decrease.

Money Management

In our trades, we will follow a rule stating that we cannot risk more than 2% of our total portfolio in a trade. Therefore, since the stop loss presented above is slightly lower than 4%, it is possible to initiate this trade with more than 50% of your portfolio without breaking the rule.

However, that is not recommended, mostly because the underlying trend is bearish.

We will be doing this trade with 5% of our total portfolio. In an account of $10,000, this would mean a total of $500. 1 BCH would be sold at an entry price of $507.

We will be risking 0.191% of our portfolio. With the same account total, this amounts to $19.1.

The risk to reward on this trade is quite attractive. Therefore, based on your preference this trade can be done with more equity. However, since the current underlying trend is quite bullish, I do not like to bet against it.

I would quite comfortably allocate more than 10% of the total portfolio to this trade if it was a bullish descending wedge instead, or the BTC trend was bearish.

However, that is not true, so we will allocate the current percentage.

1/3 * $507

1/3 * 517

1/3 $525.1

1/3 $530.1

On the right-hand side of the table, the entry points are quite far away from each other, unlike in trades past.

This is because of the current price position. While we are looking for prices above $505, the current short-term trend and psychological resistance at 500 makes it possible that the price will not reach them. We do not want to be stuck without initiating the trade altogether.

We want to at least initiate this trade with a portion of our portfolio, so we place our first entry order at $497.

This is below $500, so we believe that this order will be triggered.

Disclaimer: This article is not trading advice and should not be construed as such. Always consult a trained financial professional before investing in cryptocurrencies, as the market is particularly volatile.

Images are courtesy of Shutterstock, TradingView.