Bitcoin’s (BTC) price faced immense volatility over the weekend, dropping to $66,680 at one point. As the coin recovers, traders in the market are taking positions to profit from the price action.

Drawing insights from derivatives market activity, this analysis pinpoints price levels that could cause a cascade of liquidations and focuses on BTC’s potential price movement.

Bitcoin Price Spike Threatens Major Bear Liquidations

Bitcoin’s see-saw movement in the last two days could be linked to Donald Trump’s appearance and speech at the 2024 Bitcoin conference in Nashville. Before the event, traders were optimistic that the U.S. former president’s presence could accelerate the coin’s price.

However, the opposite happened as it was a “sell the news” event. At press time, BTC’s price is $69,450 and is close to reaching $70,000 in almost 50 days. Some comments online suggest that this movement could be the one that takes the coin back to its all-time high.

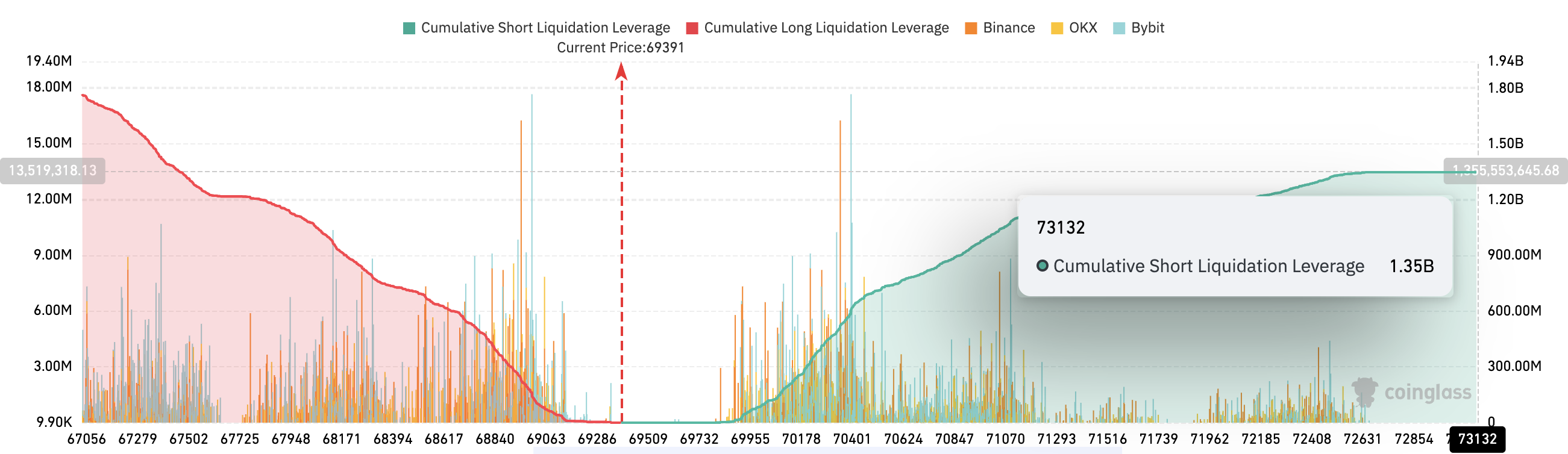

But what will happen if Bitcoin’s price surpasses $73,000? According to the Bitcoin Exchange Liquidation Map, short positions valued at $1.35 billion will be liquidated if BTC reaches $73,132.

Read more: Who Owns the Most Bitcoin in 2024?

Liq. map, as it is commonly called, shows the cascading effect on open positions when prices hit a certain level. Therefore, a price increase for the coin could force exchanges to close the positions of traders betting on a decrease.

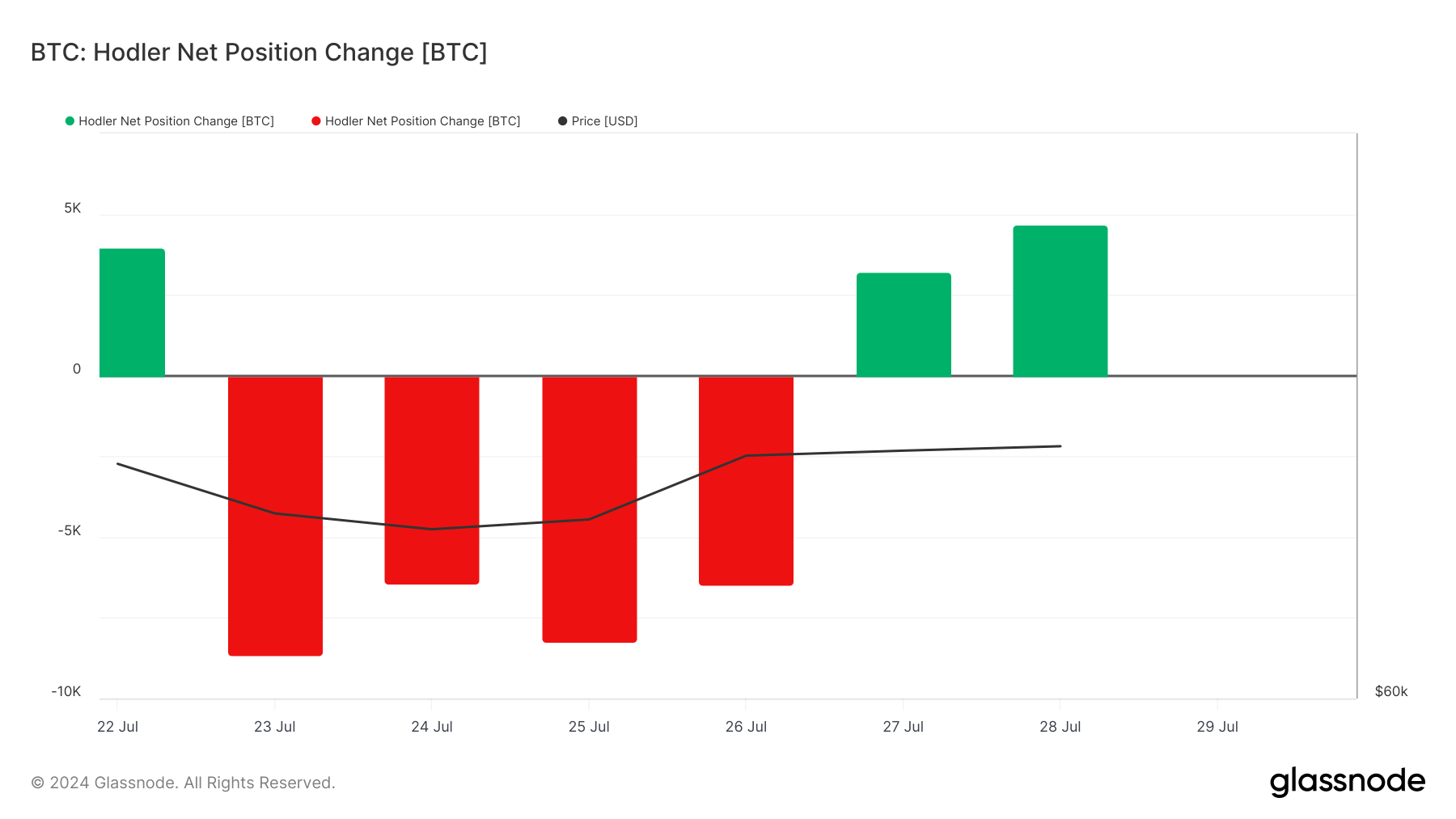

While it remains uncertain how quickly Bitcoin will retest its previous highs, the Hodler Net Position Change shows that a price increase is likely. This change shows whether long-term investors are accumulating or cashing out.

Between July 23 and 26, long-term holders cashed out a total of 29,781 BTC, putting downward pressure on the price. However, on July 28, investors bought 4,689 BTC in addition to the 3,213 coins purchased on July 27. If this continues, Bitcoin may resist a move to the downside and keep up with its upswing,

BTC Price Prediction: $71,000 Before $68,000?

The daily BTC/USD chart reveals that the coin has formed a rising wedge pattern. This pattern is bearish and signals a possible reversal during an uptrend. From the chart shown below, the rising wedge could help BTC surpass $70,000 and possibly reach $71,967.

However, Bitcoin may initiate a downtrend once the converging trendlines meet. If that happens, the next level for BTC to reach could be around $68,022. Also, bulls may try to defend the region and trigger a rebound. If successful, BTC will resume its uptrend. However, failure to defend the zone could send the coin down to $64,925.

The Relative Strength Index (RSI) also supports a drawdown, especially as it approaches overbought levels. The RSI uses price changes and size to measure a cryptocurrency’s momentum.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

Readings at 70.00 or above indicate overbought levels, while rating at 30.00 suggests oversold levels. As of this writing, the RSI on Bitcoin’s chart shows a bullish momentum, indicating that the price may continue to appreciate.

However, it also reveals that the coin is not free from a decline if the reading increases. Should Bitcoin price decline to $68,000, long positions worth $1.13 billion will be liquidated.