Bitcoin (BTC) was subject to a colossal decrease on May 19, falling from a daily open of around $43,000 all the way to a low of $30,000.

However, it has bounced back considerably, creating a long lower wick with a magnitude of 22%.

BTC bounces at support

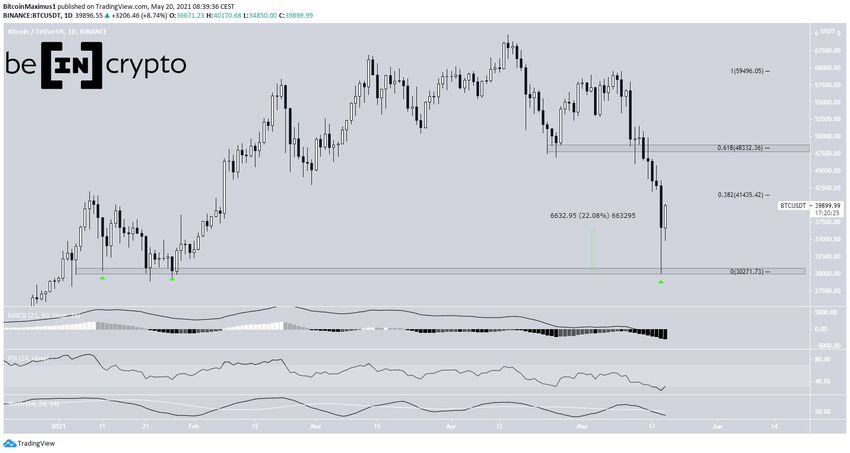

BTC decreased significantly yesterday, reaching a low of $30,000. This validated the $30,000 area as support once more. The area had previously not been reached since Jan. 27, 2021.

However, BTC bounced with strength the same day, creating a long lower wick with a magnitude of 22%.

Despite this bounce, technical indicators do not show any bullish reversal signs yet.

There is resistance at $41,430, in the form of the 0.382 Fib retracement level. However, the main resistance area is found at $48,330 — the 0.618 Fib retracement level of the most recent decrease. This is also a horizontal resistance area.

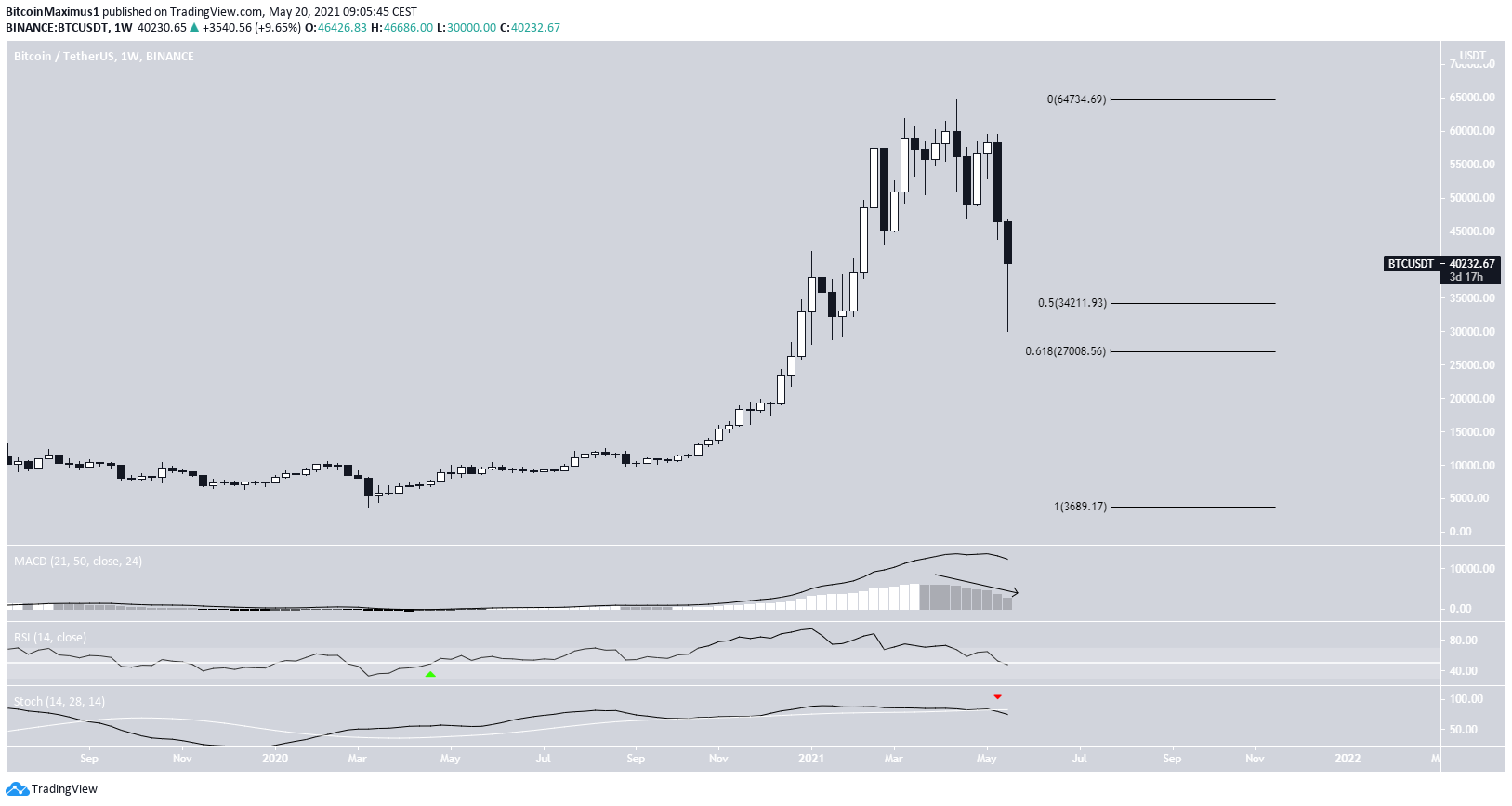

The weekly chart supports the validity of the bounce, which was made between the 0.5-0.618 Fib retracement levels of the entire upward movement measuring from the March 2020 bottom.

However, similar to the daily time frame, technical indicators are bearish.

The Stochastic oscillator has made a bearish cross, the first since September 2019. In addition, the MACD has given a bearish reversal signal. The RSI is currently right at the 50-line. It hasn’t fallen below 50 since April 2020.

Future BTC movement

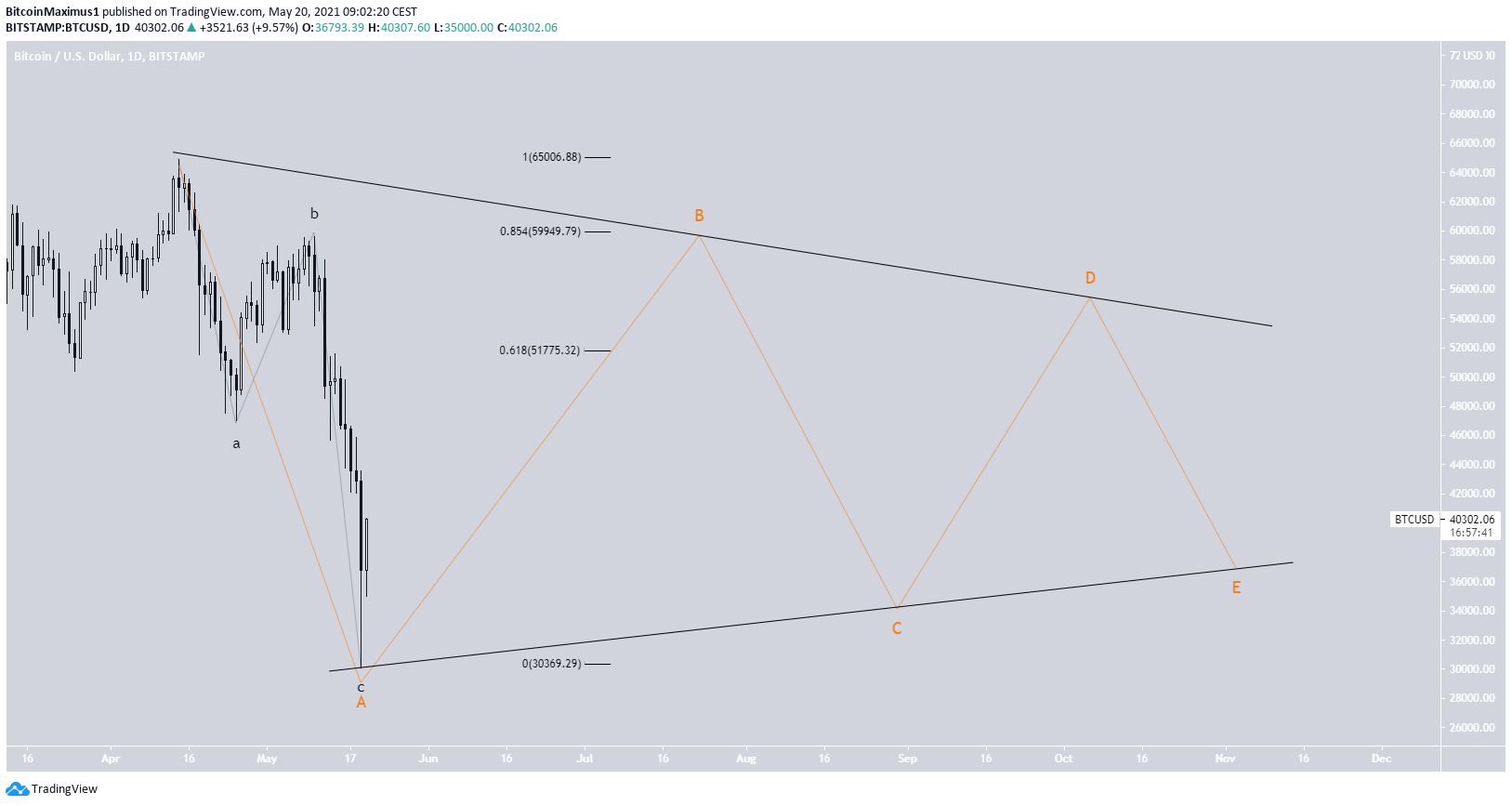

An interesting development in yesterday’s movement is the ratio between the decrease from the all-time high on April 14 (A) and the one that began on May 10 (C).

The movements have an exact 1:1.61 ratio, which is common in such corrective structures. However, it’s also a common ratio between waves 1:3, which could mean that this is a bearish impulse.

Nevertheless, the decrease being a correction remains the most likely scenario.

A price movement above the $47,004 low (red line) would likely confirm that this has all been a correction. It could also pave the way for BTC to head toward new highs.

Long-term count

The most likely count suggests that this is still the first potion of the decrease. Since this is probably a long-term wave four (red), the correction could develop into a triangle.

Though a flat correction could also be possible, the first portions of the movement (A and B) are identical in both scenarios.

The B wave (orange) is expected to increase at least to the 0.618 Fib retracement resistance at $51,775 and potentially could go all the way to $60,000.

The correction suggests that the portion of the upward movement that began in March 2020 has ended. Therefore, the price is now in wave four (red) which as stated above, is likely to develop into a triangle.

When measuring the time it took to complete wave two, we can indicate that the current correction could continue at least until the end of July and possibly until November.

Conclusion

Bitcoin is likely in a long-term corrective wave. This would be confirmed by an increase above $47,000. If so, the price is likely to continue consolidating through July.

For BeInCrypto’s previous bitcoin (BTC) analysis, click here.