Bitcoin (BTC) finally broke out above $65,000 on Oct 20, reaching a new all-time high (ATH) price in the process.

This article will take a look at the historical significance of the BTC breakouts above $50,000, $55,000, and $60,000.

Bitcoin reaches $50,000

BTC broke out above $50,000 for the first time in its history on Feb. 16. However, right after it broke out, it dropped and created a long upper wick. This is seen as a sign of selling pressure, since the upward movement could not be sustained.

BTC regained strength shortly afterward and proceeded to increase for the next five days.

This led to an upward movement of 17%, culminating with a high of $58,321 on Feb. 21. After the high was reached, BTC initiated another correction.

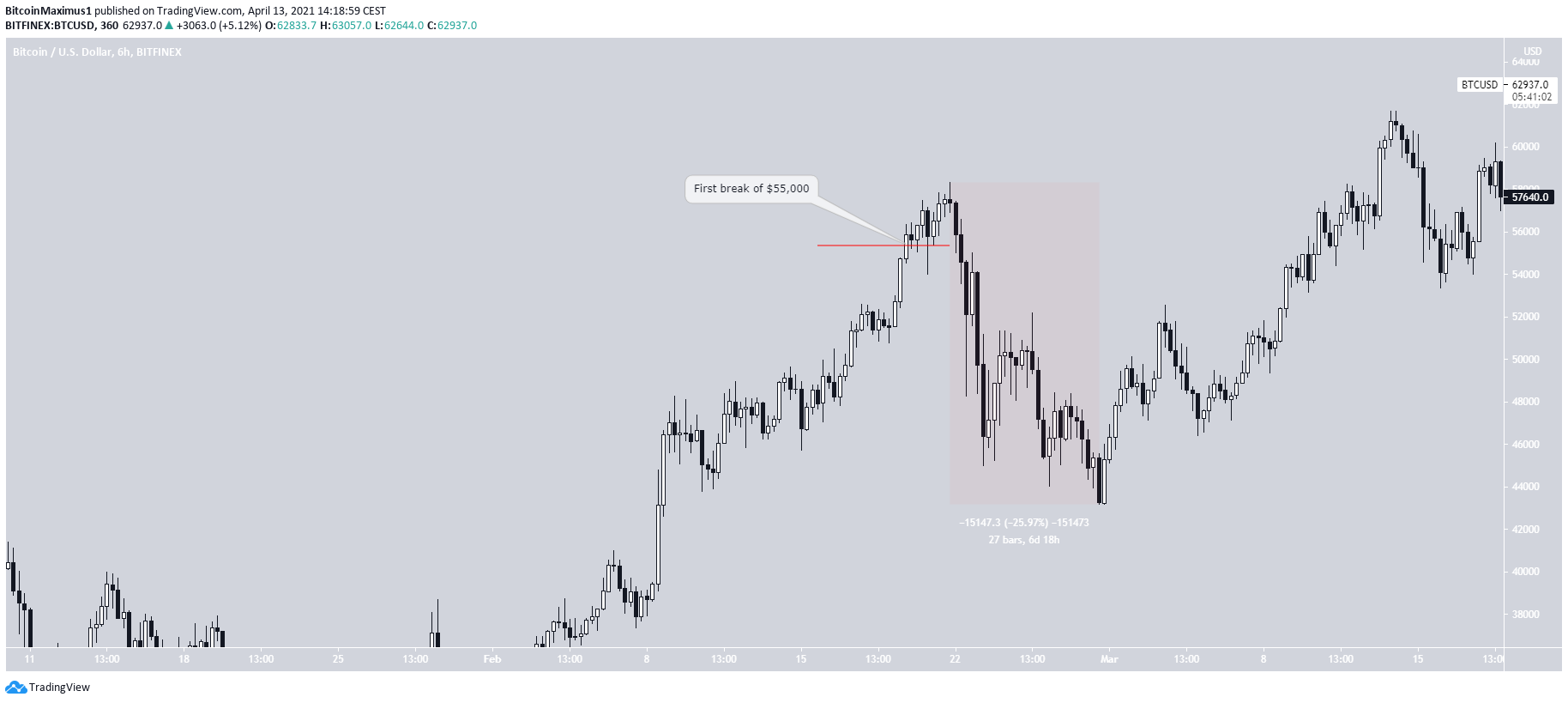

Bitcoin reaches $55,000

BTC reached $55,000 for the first time on Feb. 19. This was only two days prior to reaching the aforementioned high of $58,321. A significant downward movement followed afterwards, which caused BTC to drop by 26% in a period of nearly seven days. This led to a low of $43,171 being reached on Feb. 28.

Therefore, while BTC managed to break through $55,000, it failed to immediately reach $60,000, rather correcting considerably prior to doing so.

Bitcoin reaches $60,000

On March 13, BTC managed to reach $60,000 for the first time. This led to the then ATH price of $61,699 on March 14. The all-time high stood until April 13.

What followed after this move was another significant decrease, which was more gradual than that after the $55,000 high was reached.

BTC decreased by 18% in nearly twelve days, culminating with a low of $50,350 being reached on March 25. Afterwards, BTC began another upward movement that led to a high of $64,640, barely missing the $65,000 mark.

Afterwards, BTC moved downwards in one of the sharpest corrections to date, culminating with a low of $28,805 on June 22. This amounted to a drop of nearly 56% in 70 days.

The correction after the April 14 all-time high resembles that of Jan 8, when the price decreased from $41,969 to $28,989 in a span of 14 days. This amounted to a downward movement of 31%.

Therefore, even though the Jan correction was considerable, it paled in comparison to the one in April.

Breakout Above $65,000

BTC has been moving upwards since the aforementioned June 22 low. The rally accelerated after a higher low was created on July 20.

On Sept 7, BTC was rejected by the 0.618 Fib retracement resistance level at $51,150 and fell sharply (red circle). At the time, it seemed like BTC had completed its bounce and was moving downwards.

However, it regained its footing on Sept 21 and initiated another upward movement.

Afterwards, it broke out above the $57,200 resistance area on Oct 14. This was the final resistance area prior to a new all-time high.

Measuring from the June 22 low, it took BTC 120 days to reach a new all-time high. Measuring from the April 14 high, it took 189 days for a new all-time high to be reached.

Conclusion

To conclude, BTC has been consistently reaching new all-time highs since moving above $20,000 on Dec 16.

More recently, the breakouts above $50,000 and $55,000 were followed by small downward movements. However, the sharp correction after $60,000 was broken resembles that of Jan 8, when $40,000 was first broken.

Afterwards, it took BTC more than six months to reach a new all-time high.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

What do you think about this subject? Write to us and tell us!

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.