Bitcoin (BTC) is in the process of making another attempt at breaking out above the $19,400 area after a brief deviation above the level yesterday.

Bitcoin is expected to be successful in doing so and will likely move towards the resistance levels outlined below.

Bitcoin Deviates Above Range High

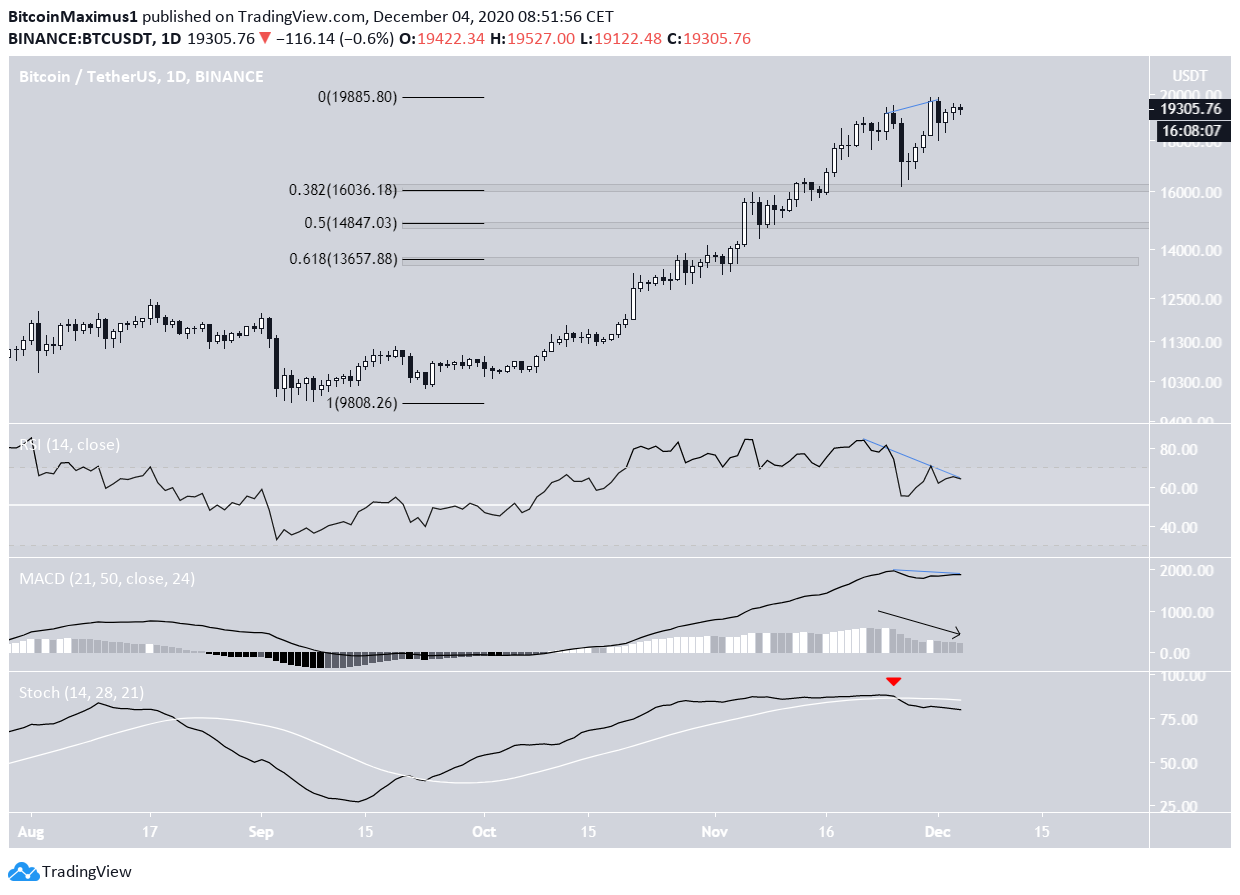

The BTC price has increased rapidly since the beginning of September. On Dec. 1, the price reached a high of $19,888, which was a new all-time high price.

However, technical indicators in the daily time-frame are showing significant weakness. Both the RSI and MACD have generated bearish divergences. Furthermore, the Stochastic oscillator has made a bearish cross, the first time it has done so since the upward move began in September.

If BTC were to begin decreasing, its three main support levels would be found at $16,036 , $14,847, and $13,657 (the respective 0.382, 0.5, and 0.618 Fib retracement levels).

A closer look at the movement reveals that BTC is facing resistance from $13,400. Bitcoin was already rejected from this line on Nov. 25, before gathering and breaking out above it on Dec. 1

However, BTC has fallen back below this area, making the alleged breakout a deviation above the range high (red circle). Currently, the price is once again facing resistance from this level.

Ending Diagonal

The count presented in yesterday’s analysis suggests that BTC is in sub-wave 5, which could go all the way up to $21,733-$21,949.

While this could very well be the correct count, the movement since the Dec. 1 rejection and drop (highlighted in the image below) presents an alternate count.

Bitcoin has been trading inside what looks to be an an ascending wedge, completing what a potential ending diagonal (black). The sub-wave count aligns with this possibility.

If correct, BTC would likely break out above this ascending wedge and reach a slightly higher high relative to the Dec. 1 price before decreasing sharply.

Due to the rule that wave 3 cannot be the shortest, an increase above $20,442 would invalidate this particular pattern and suggest that the price is likely going to increase all the way to $21,700 as outlined in the previous chart.

Conclusion

While Bitcoin is expected to move above $20,000, the possibility of an ending diagonal puts a limit to the potential increase if a breakout occurs. An increase above $20,442 would likely take the price towards $21,700.

For BeInCrypto’s previous Bitcoin analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.