The Bitcoin (BTC) price reached $30,000 for the first time since June 2022. It is now approaching a long-term resistance level.

The weekly outlook for Bitcoin is strongly bullish due to several reasons. These include the BTC price breaking out from a descending resistance line that had been present since its all-time high and validating this breakout with a long lower wick and a bullish engulfing candlestick the following week. Additionally, the weekly RSI moved above 50 for the first time (black) since June 2021.

Consequently, the weekly timeframe suggests that the price is likely to move toward its long-term resistance level at $31,700. If a rejection occurs from there, the digital asset could again drop to $24,600.

How Long Will the Bitcoin (BTC) Price Continues Increasing?

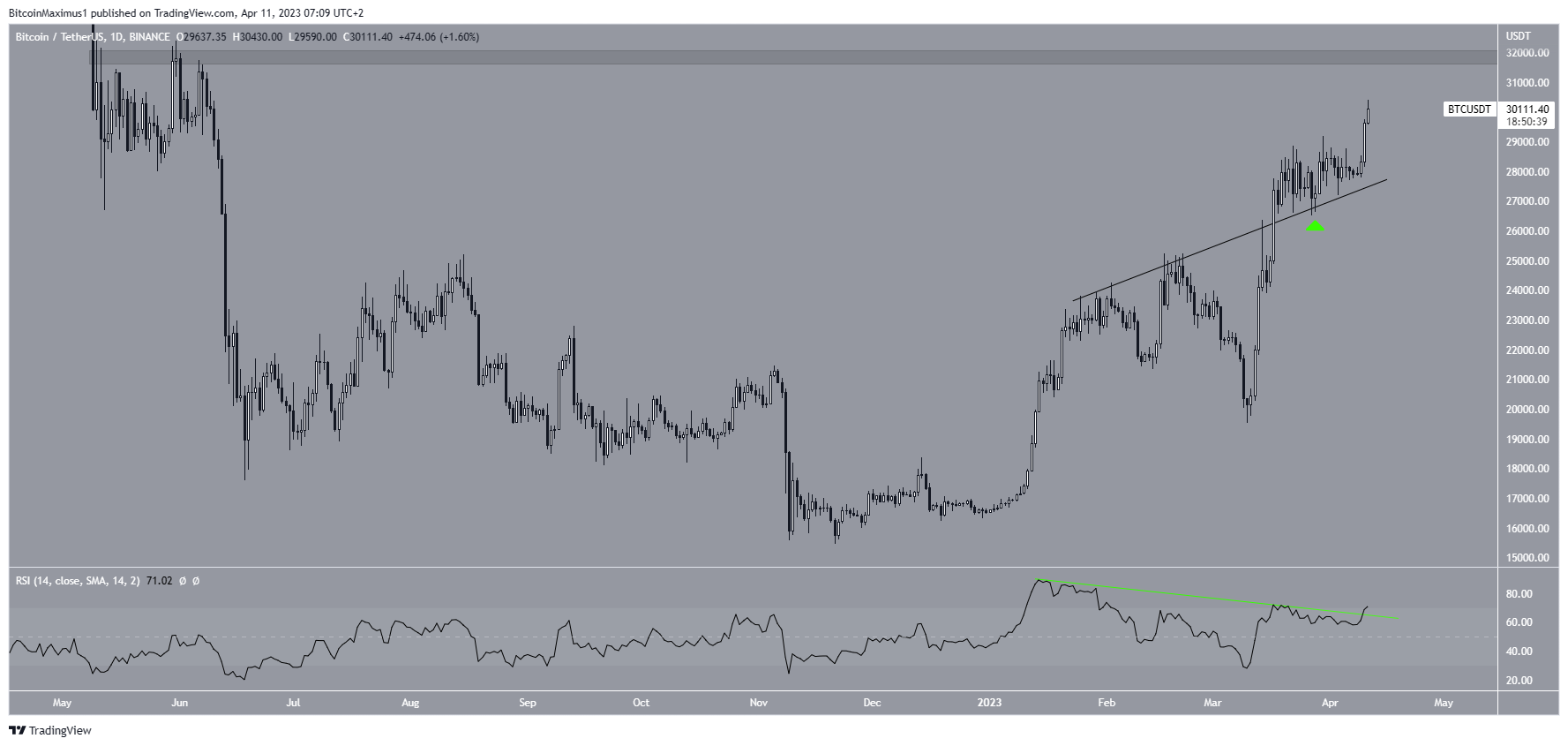

The technical analysis from the daily time frame also provides a bullish outlook. The most telling sign of this is the daily RSI movement. The indicator is in the process of breaking out from a bearish divergence trendline (green). This means that a bearish reversal will not occur and that the BTC trend is bullish.

Moreover, the price broke out from an ascending resistance line and validated it as support (green icon). Over the past 24 hours, the price moved above $30,000 for the first time since June 2022.

If the increase continues, the closest resistance area in the daily time frame is at $31,800. While this is the most likely future price scenario, a close below the ascending support line would invalidate it and could lead to a decrease toward $25,000.

Wave Count Supports Increase

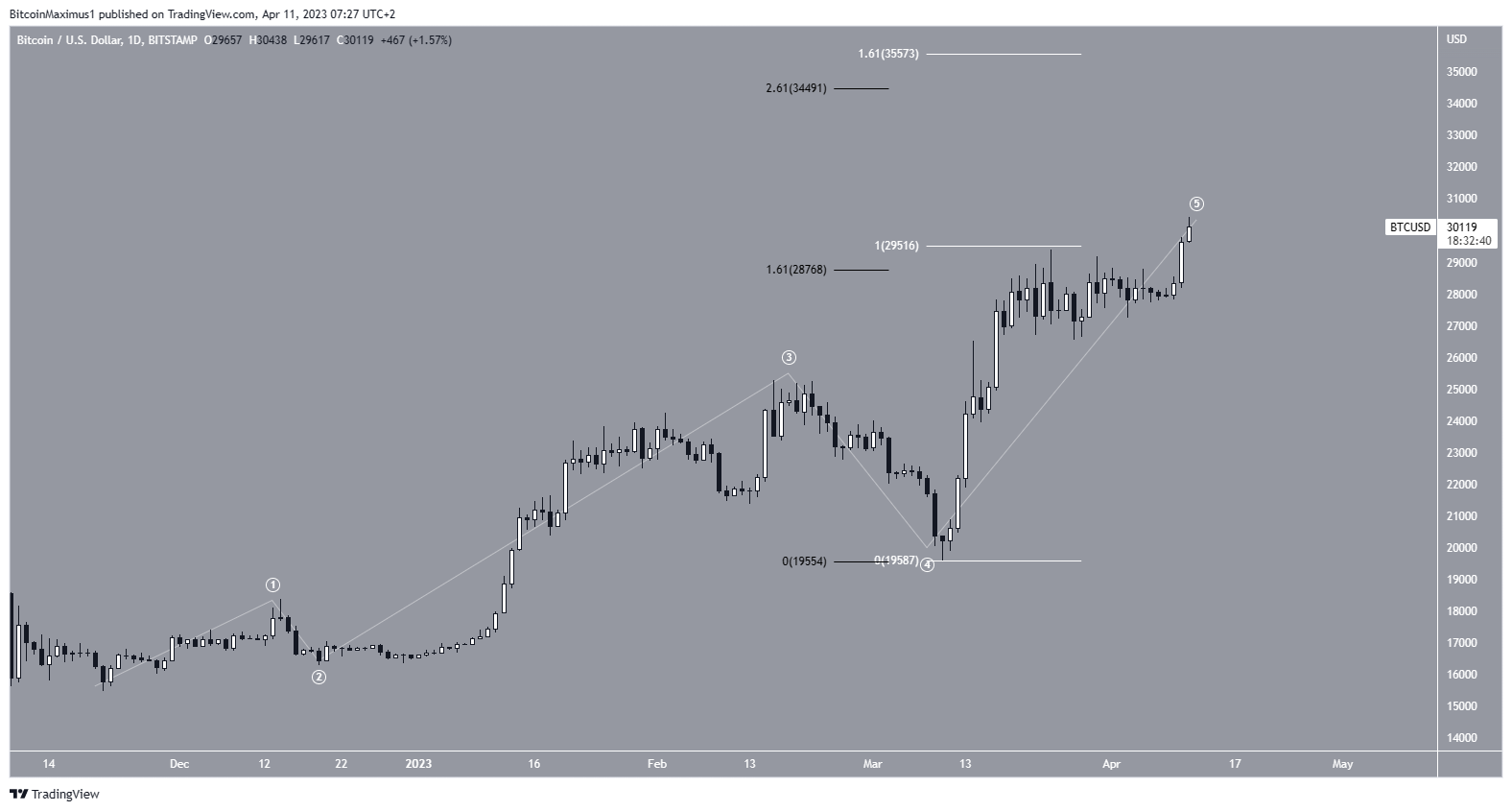

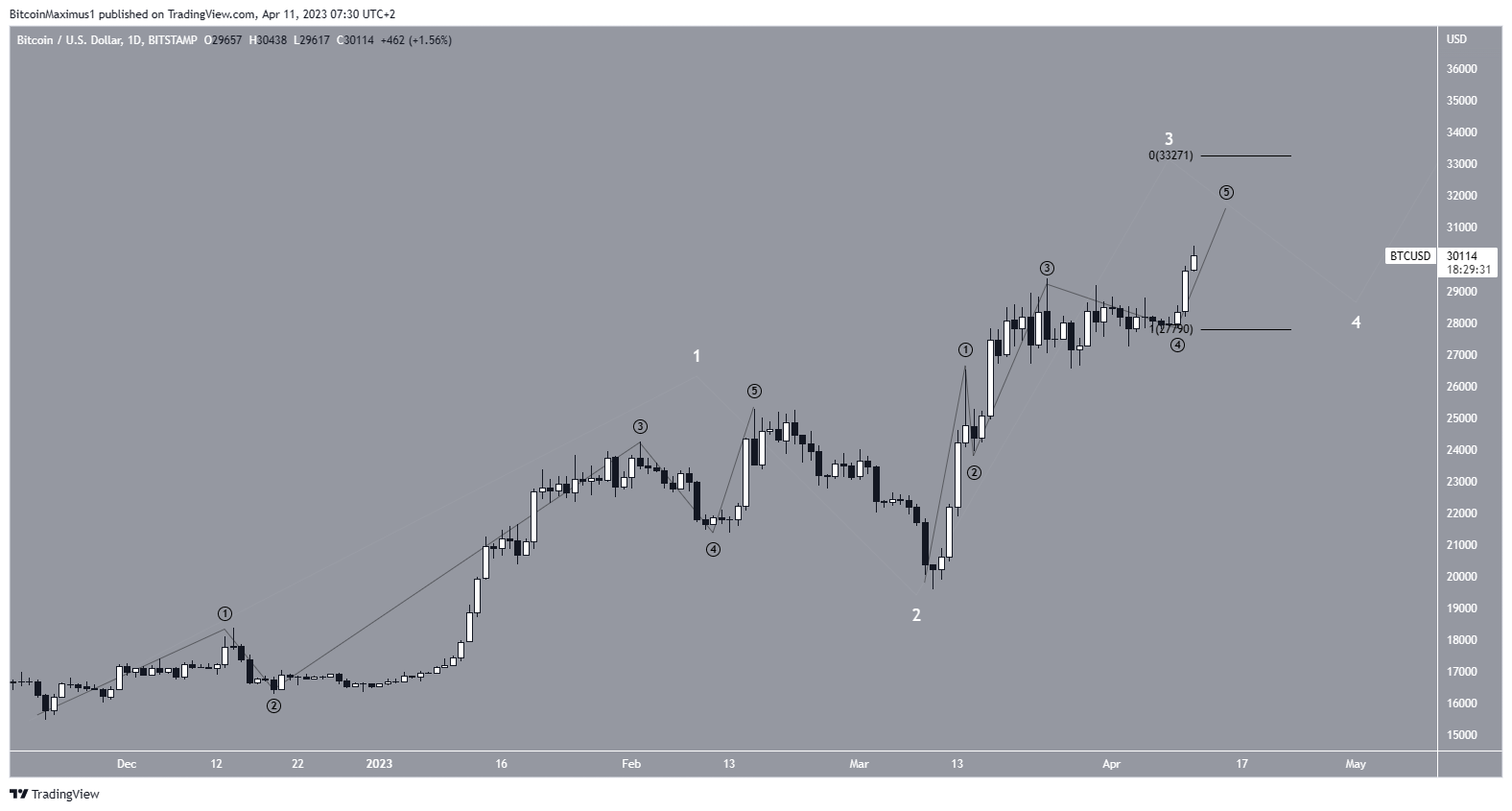

There are two possibilities for the wave count. While both support a short-term increase, the long-term outlook differs.

The first one indicates that the BTC price is currently in the fifth and final wave of a bullish impulse (white). Wave five has extended and moved above the length of waves one and three (white) and the 1.61 external Fib of wave four (black). Therefore, the next likely target is between $34,500 and $35,500.

The second one suggests that BTC is still in wave three of a five-wave increase (white). The sub-wave count is given in black. While this would bode better for the long-term future price, possibly leading to a new all-time high, an initial correction would be expected before the upward movement eventually resumes.

In this case, BTC would increase to a maximum of $33,270 before correcting. Then, the upward movement could resume.

To conclude, the most likely Bitcoin price forecast is an increase toward at least $33,200 and possibly $33,500. Falling below the ascending resistance line would invalidate this bullish outlook and could cause a drop to $24,600.

For BeInCrypto’s latest crypto market analysis, click here.