Bitcoin (BTC) has retreated to the $68,000 range after hovering around $70,000 for several days. BTC is currently trading at $69,100, marking a recent decline.

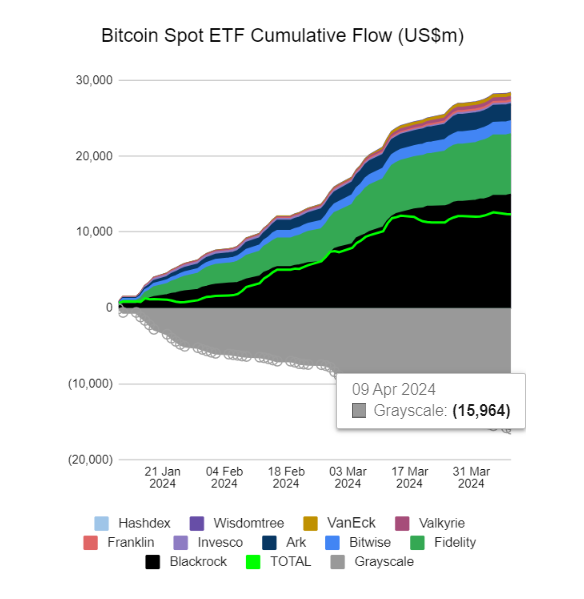

This downturn aligns with two consecutive days of negative outflows for US-traded spot Bitcoin exchange-traded funds (ETFs).

Spot Bitcoin ETFs See $242.4 Million Outflow in Two Days

Farside data reveals that the US spot Bitcoin ETFs experienced outflows totaling $223.8 million on April 8, 2024, followed by $18.6 million on April 9, 2024.

Grayscale Bitcoin Trust (GBTC) remains the primary driver of these outflows, with a total of $458.2 million over the two days.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Macroeconomic factors may be contributing to this trend. Today’s release of the US Consumer Price Index (CPI) data for March 2024 is highly anticipated.

The median estimate for year-over-year CPI is 3.4%, representing the largest annual increase since December 2023. February 2024 saw a 3.2% year-over-year CPI increase, surpassing the median estimate of 3.1%.

Considering these developments, it’s plausible that the crypto market remains in a “wait and see” mode. Investors may be awaiting further actions based on the economic indicators.

Meanwhile, news from the Asian market offers a glimmer of bullish sentiment for Bitcoin. According to Tencent News, Hong Kong plans to announce its first four spot Bitcoin ETFs on April 15. The Hong Kong Stock Exchange is preparing for their release approximately two weeks later.

However, the Securities and Futures Commission (SFC), the regulatory body in Hong Kong, has yet to confirm the news officially.

Despite this positive development, the Hong Kong ETF news has not significantly impacted Bitcoin’s price in the short term. Nonetheless, the official launch of spot Bitcoin ETFs in Hong Kong could be a long-term catalyst, driving increased demand for Bitcoin.

Previously, BeInCrypto reported on CryptoQuant analysts highlighting that post-halving price rallies are likely fueled by growing Bitcoin demand, particularly from whales. Additionally, the demand for Bitcoin from long-term holders outpaces new issuance for the first time in history.

Read more: Bitcoin Halving Countdown

“Demand growth from large holders or whales has historically spiked during previous cycles, leading to price increases. Right now, demand growth is close to its all-time high, around 11% month over month,” a CryptoQuant analyst explained to BeInCrypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.