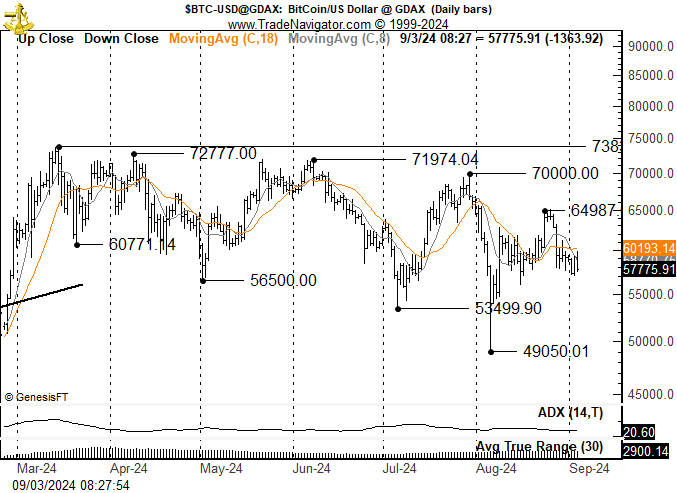

Bitcoin’s (BTC) price is currently at $56,500 after forming lower lows on the macro timeframe and failing to form a new all-time high despite the halving.

Experts are now expecting a short-term decline for BTC, which will likely be followed by a recovery, presenting a solid buying opportunity.

Looking Beyond Bitcoin’s Potential Decline

According to a report from Bitfinex, analysts are expecting Bitcoin’s price to drop to the range of $40,000 to $50,000. The reason given for this drop is the upcoming potential interest rate cut.

“If we were to speculate, we would caution to expect a 15-20 percent decline when rates are cut this month, with a bottom of $40,000-50,000 for BTC. This is not an arbitrary number but is based on the fact that the cycle peak in terms of percentage return reduces by around 60-70 percent each cycle and the average bull market correction has reduced as well,” the Bitfinex analysts noted.

According to the report, a 25 basis point cut could initiate an easing cycle. This cycle is typically followed by long-term price appreciation. Ryan Lee, Chief Analyst at Bitget, supports this view and noted that the upcoming rate cuts differ from those during the 2007-2008 financial crisis.

“Today’s rate cuts are aimed at preventing potential economic slowdowns rather than responding to a crisis that has already occurred. As a result, the market may react more mildly to these ‘preventive’ rate cuts, which is why the analysts anticipate less volatility,” Lee explained.

He substantiated the possibility of a short-term pullback, while in the long run, the market will recover and benefit from more accommodative monetary policy.

Looking at the short-term potential of Bitcoin’s price, a drop is on the cards, notably because BTC is showing a lack of energy, as noted by analyst Peter Brandt. Brandt highlighted that the king crypto has been forming consistent lower highs and lower lows, which typically signals extended bearishness.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

Bitcoin Price Prediction: Buying Opportunity Incoming?

Bitcoin’s price has been forming a right-angled descending broadening wedge over the past five months. This reversal pattern is generally noted to be bullish, and while this is possible for BTC, it would come only after a drop to $55,883.

Forming the support floor for BTC, this price point would provide two decisive outcomes for Bitcoin: either a bounce back toward $60,000 or a breakdown from this pattern.

This scenario could lead to a 28% drop, pushing Bitcoin’s price below $40,000. Such a decline would align with the Bitfinex analysts’ projection. If trading volume surges around the breakdown point, this outlook will be confirmed.

Read more: Bitcoin Halving History: Everything You Need To Know

However, since the volumes are rather weak at the moment, BTC might bounce back from $55,883. This could lead to a gradual recovery to $58,986. Breaching this level could set Bitcoin’s price on track to reach $60,000, invalidating the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.