Bitcoin (BTC) is currently trading below $60,000, starting the month on a downward trend. Despite this, experts suggest September could be a prime buying opportunity.

Based on Bitcoin’s performance history, September is the worst-performing month, with a track record of less-than-desirable returns.

Why Experts Say Buy Bitcoin in September

Michael van de Poppe is among those predicting a potential bullish turn for Bitcoin. He believes that a quiet market often signals the final phase before a rally.

“Dull market, which is usually the end stage before the party begins. Regarding price action on BTC: You’d need to get a breakout above $61K to get the momentum back in the markets, otherwise, we continue to have this downward trend for a while,” Van de Poppe said.

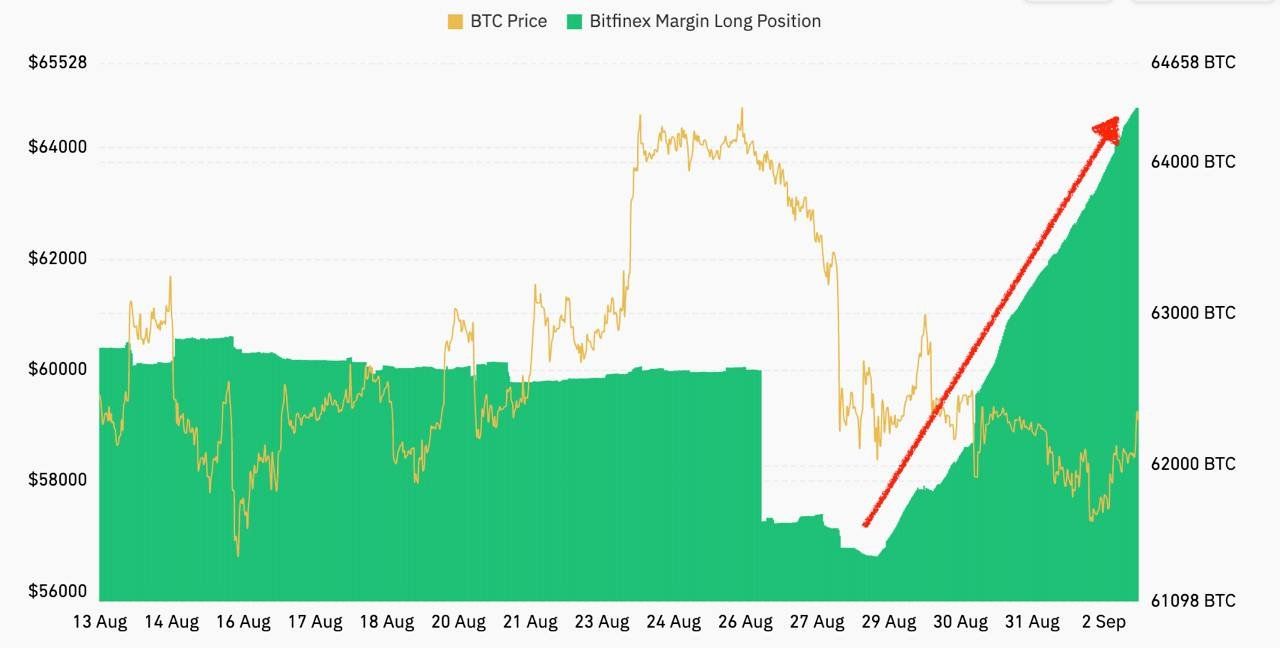

Additionally, Greeks Live’s analysts noted opportunities with annualized interest rates on Bitfinex’s lending market starting in late September. They also reported increased long positions for Bitcoin, a common signal of bullish sentiment, with whales entering the market and taking long positions through block calls.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

In a recent Telegram broadcast, QCP Capital researchers noted that September tends to be a bearish month for Bitcoin, crypto, bonds, and gold. However, they pointed to October as having the strongest bullish seasonality, with Bitcoin delivering positive returns in eight of the last nine Octobers, averaging a 22.9% gain.

QCP attributes the recent call buying activity to this seasonal trend, suggesting that investors accumulate Bitcoin during September’s dip and consider taking profits in October or by year-end if this pattern holds in 2024. Their report also highlighted key support for Bitcoin at $54,000, though analysts warn that conditions may deteriorate before improving due to ongoing uncertainty surrounding US macroeconomic events.

Indeed, there is a lot of uncertainty in the market this month, with several US economic events lined up on the calendar. Nevertheless, whales are already ramping up their positions.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Lookonchain recently reported several large transactions. One whale withdrew 1,100 BTC from Binance, while another purchased 1,000 coins. In the latest move, a whale bought $19 million worth of BTC on Tuesday.

Over five days, this whale acquired 2,322.37 BTC, valued at $136 million, and now holds 8,881 Bitcoin, worth $523 million. According to BeInCrypto data, Bitcoin is trading at $56,286, down nearly 5% since Wednesday’s opening.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.