Be[in]Crypto takes a look at Bitcoin (BTC) on-chain indicators that relate to miners, more specifically the difficulty ribbon compression and hash ribbon.

Difficulty ribbon compression

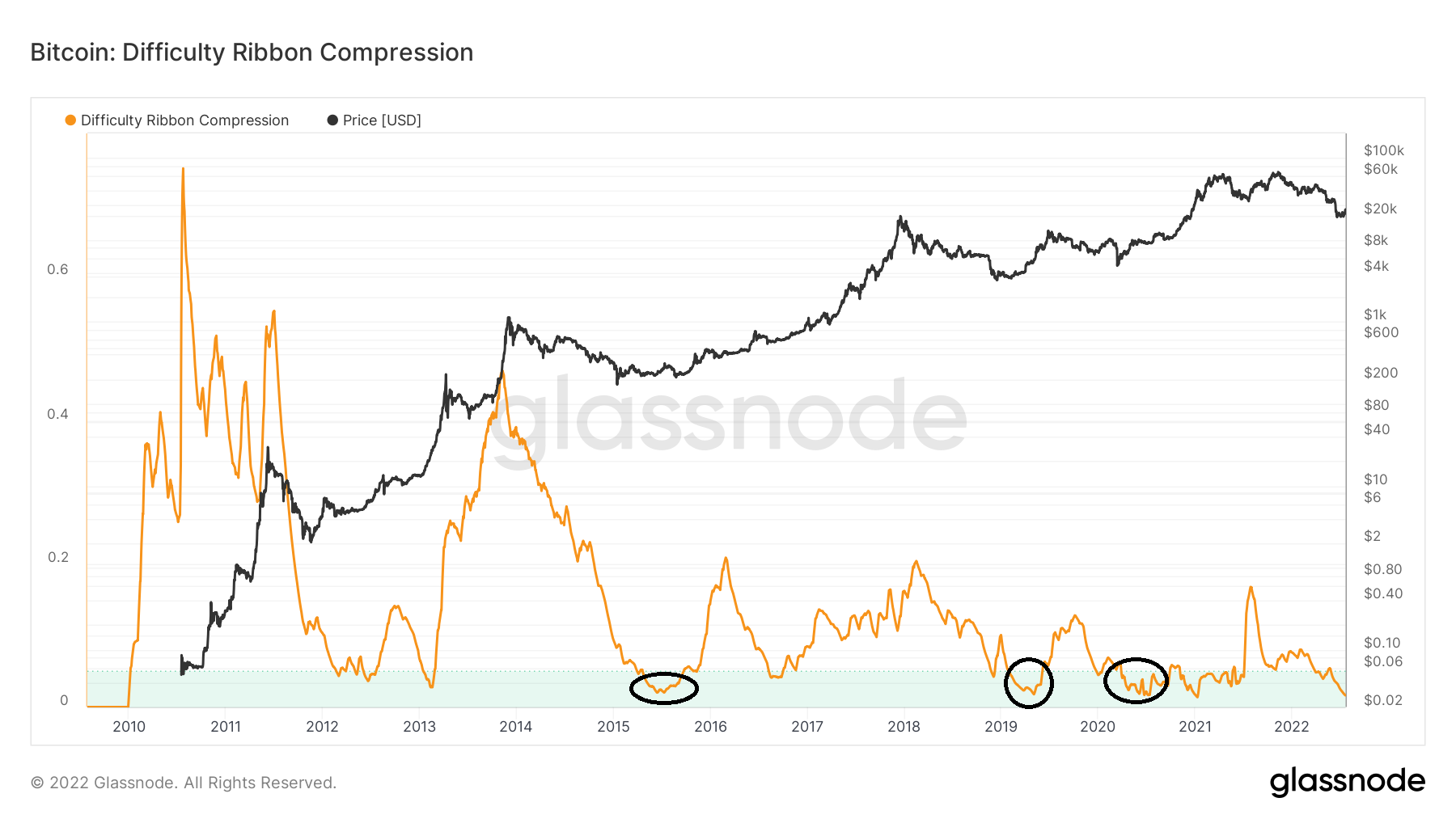

The difficulty ribbon is an on-chain indicator that employs moving averages (MA) of the Bitcoin mining difficulty. Then, the difficulty ribbon compression adds a standard deviation on top of this in order to better determine if the market is close to bottoming.

Throughout its history, values between 0.01 and 0.02 have been associated with bottoms.

In 2022, the indicator crossed into oversold territory (<0.05) in May and is currently at 0.0162. The only other time it as lower than this was in Jan 2021 at 0.0137.

Interestingly, all three previous market cycle bottoms (black circles) were reached at higher values.

More specifically, the 2015 bottom was reached at 0.024, the 2018 bottom was reached at 0.019 and the 2020 one at 0.020.

As a result of these readings, the difficulty ribbon compression indicator suggests that BTC is close to a bottom.

BTC hash ribbon

The hash ribbon indicator uses the hash rate to determine if miners have capitulated. Miner capitulation occurs when mining rewards are lower than costs.

In the chart, this is represented when the 30-day moving average (MA, green) crosses below the 60-day one (blue). This creates a light red area which turns to dark red when there is a bullish cross.

Historically, these crosses have been followed by significant upward movements.

A closer look at the movement shows that a bearish cross occurred on June 7. So, a cross has been in place for 42 days. The current price bottom was made 11 days after the cross, more specifically on June 18.

In 2015 (black circle), the cross was in place for 40 days. However, the bottom was reached 25 days after the cross.

In 2018 (blue circle), the cross was in place for 61 days. However, the bottom was reached after 45 days.

Finally, in March 2020 (yellow), the cross was in place for 36 days. Interestingly, the bottom was reached five days prior to the cross.

So, when using this data for the current movement, it is possible that the cross will continue to be in place for at roughly 20 more days, but it is possible that a bottom has been already reached.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here