Be[in]Crypto takes a look at Bitcoin (BTC) on-chain indicators, focusing this week on the Reserve Risk, Balanced price and the Cumulative Value-Days Destroyed (CVDD).

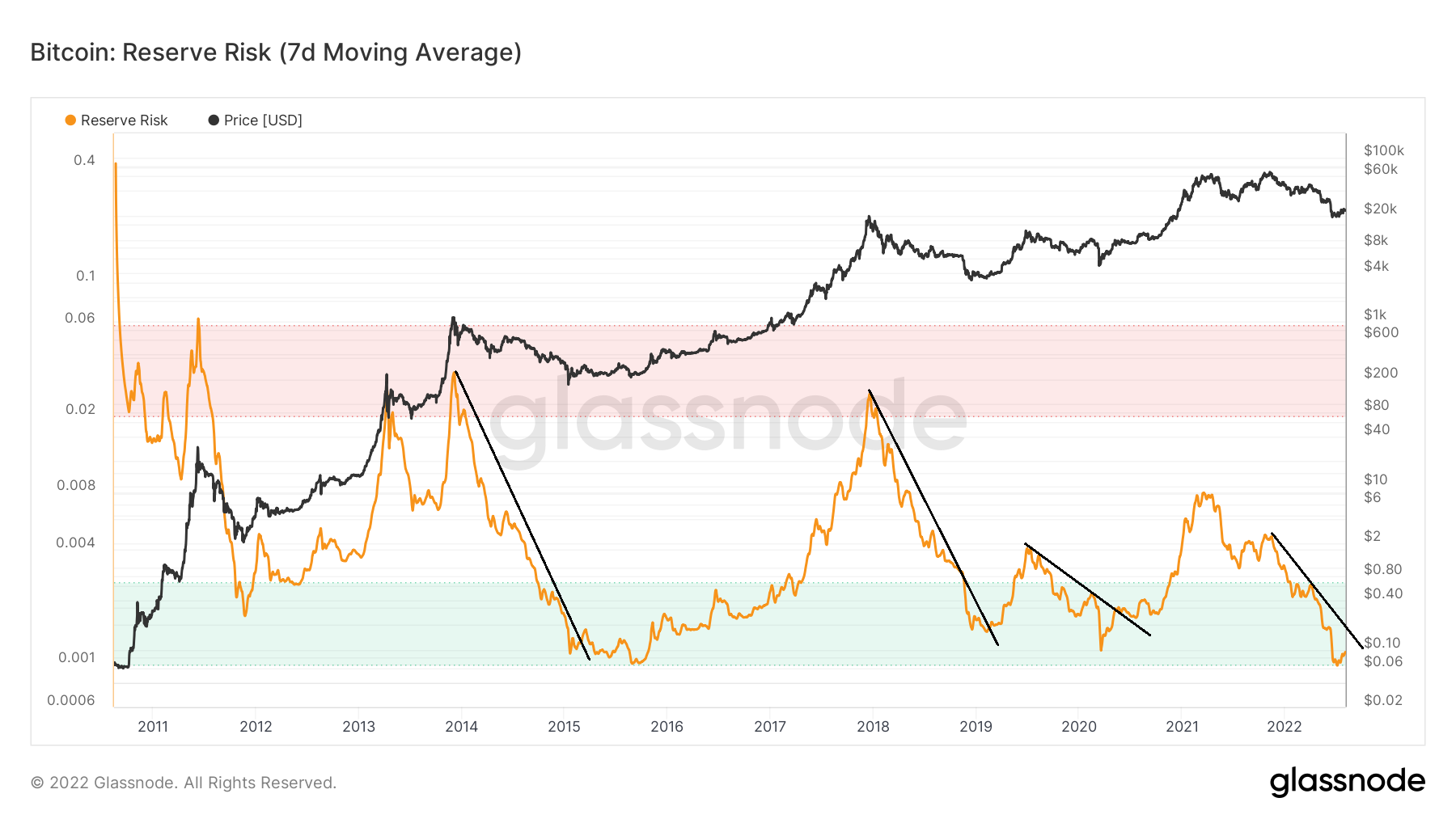

Reserve Risk

The Reserve Risk is a cyclical BTC on-chain indicator that measures the confidence of long-term holders relative to the current asset price.

When confidence is high but the price is low, reserve risk gives low values. These times have historically offered the best risk to reward ratios.

The Reserve Risk indicator fell to a new all-time low of 0.00099 on July 6. This is the first time in history that the indicator has fallen below 0.001. Therefore, it is possible that a low has been reached.

Historically, the BTC bottom has been confirmed once the indicator breaks out from its descending trend line (black). In order for the breakout to be confirmed, Reserve Risk has to move above 0.002.

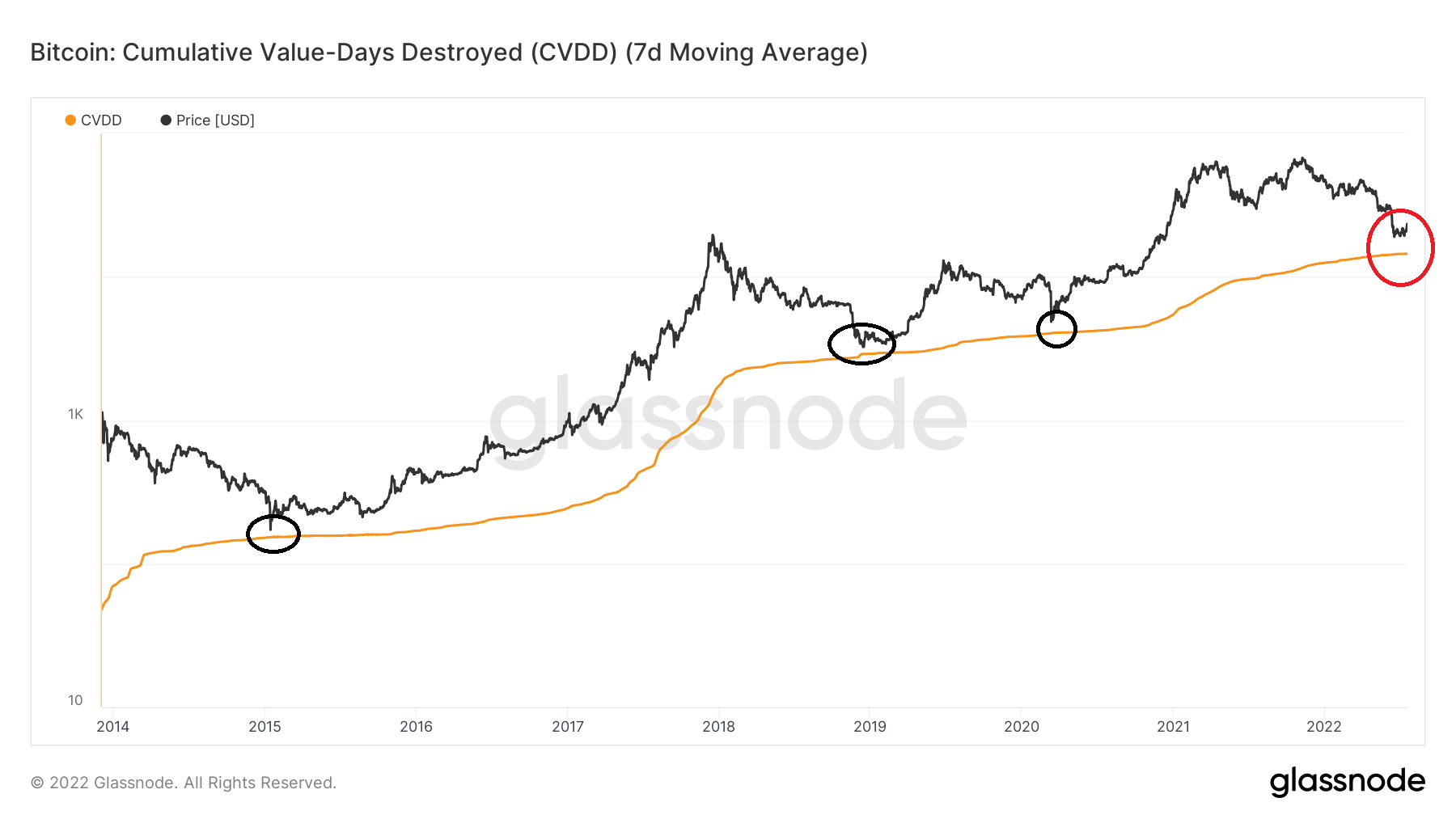

CVDD

Cumulative Value-Days Destroyed (CVDD) is the ratio of the cumulative USD value of Coin Days Destroyed and the market age (in days). Historically, the indicator has been an accurate indicator for absolute market bottoms. This was the case in the 2015, 2019 and 2020 bottoms (black circle).

Interestingly, the price never decreased below CVDD, rather bounced prior to reaching it.

The line is at about $15,000, which is only slightly below the current bottom of $18,700 (red circle).

So, when comparing this to previous bottoms, this means that either a bottom has been reached or BTC will decrease towards $15,000 once more prior to bottoming. However, a touch of the $15,000 is unlikely, since BTC has historically bounced prior to reaching the CVDD line.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.