In this article, BeInCrypto takes a look at on-chain indicators for bitcoin (BTC), specifically, the percentage of Unspent Transaction Outputs (UTXO). The current reading is dissimilar to that of the 2017 market cycle top. This indicates that the current increase is likely not a relief rally, but rather the continuation of a bullish trend.

The UTXO model native to cryptocurrencies is unique relative to other currency systems. Each input consumes existing UTXOs, which then are created through an output.

SponsoredFor example, an address has two UTXOs, with values of 0.8 and 0.5 BTC. If it makes a transaction for one BTC, it consumes both UTXOs and creates another one for 0.3 BTC.

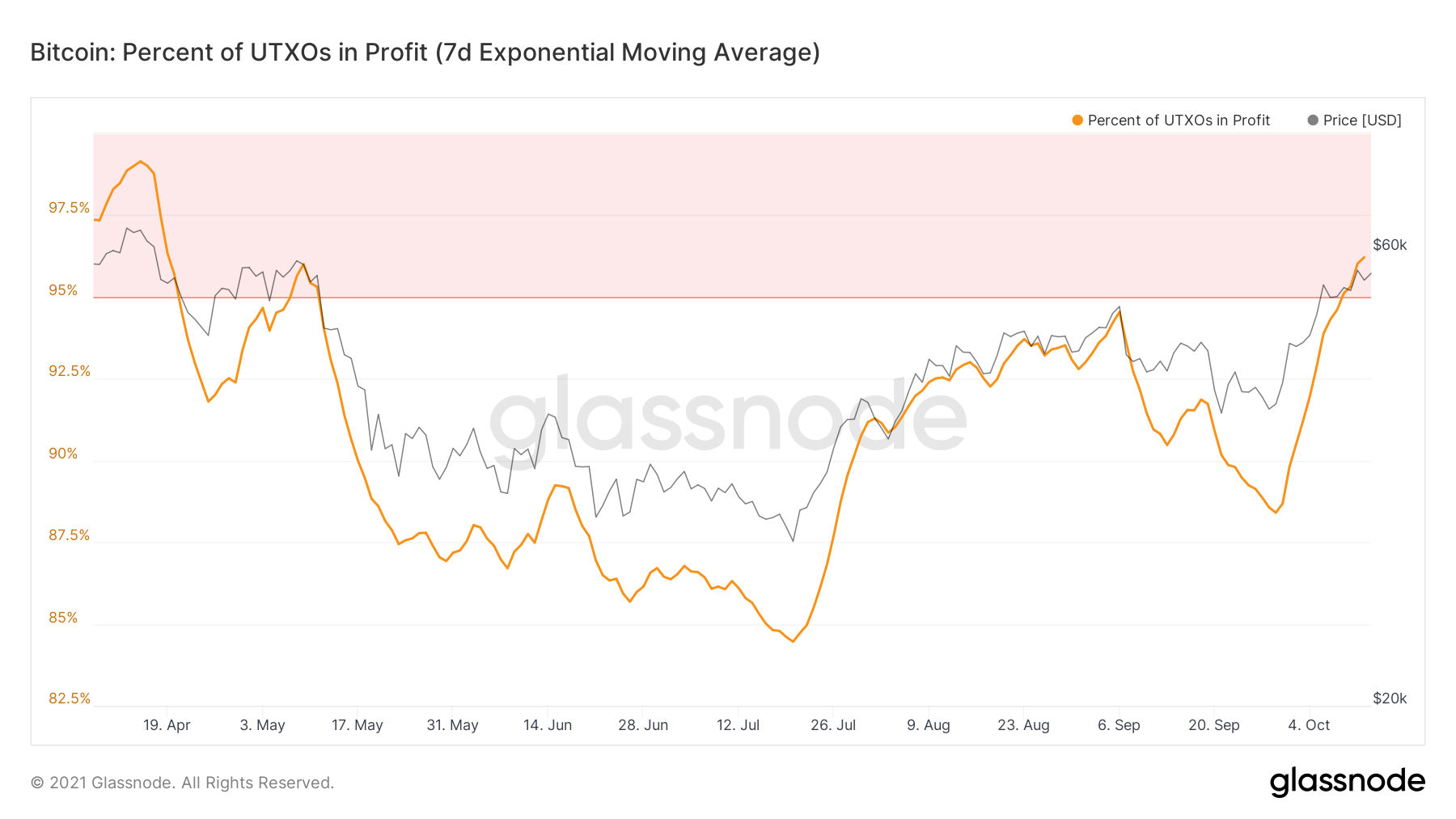

Therefore, current UTXOs are used in a transaction while new ones are created based on the leftover. The price at the time of the UTXO is recorded. So, when the price is at an all-time high, then clearly 100% of all UTXOs are in profit. Currently, that percentage stands at 95.31%.

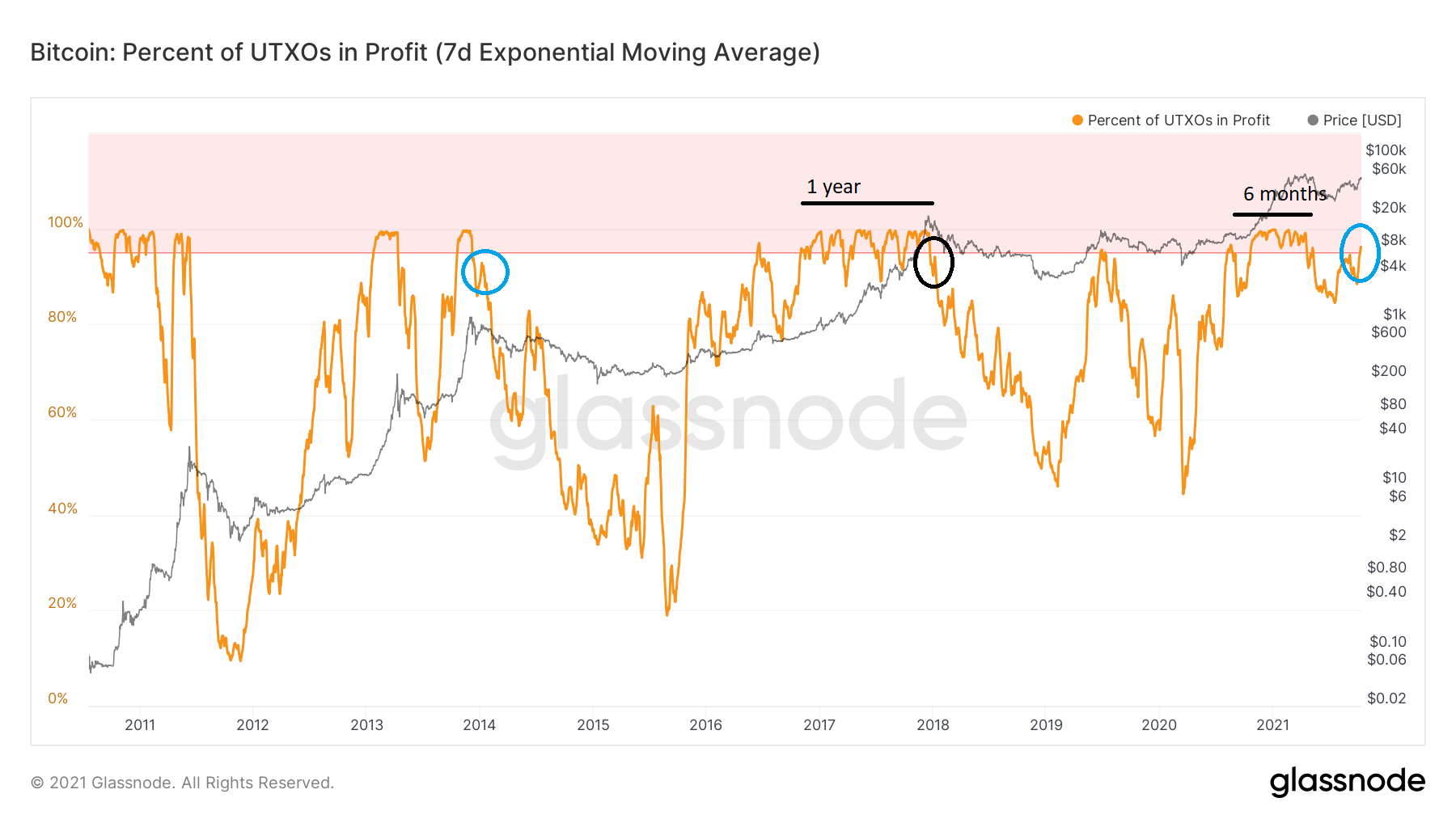

An interesting way to look at the indicator is by measuring the length of time in which more than 95% of UTXOs were in profit (red line).

In the 2016 BTC bull run, the indicator stayed above this level for roughly one year, with three sharp dips below it. In this current bull run, values remained above the 95% mark for six months prior to dropping sharply in April.

The indicator is now back above 95% (blue circle). In the 2016 bull run, the bounce was weak and the indicator failed to even approach the 95% line. The same thing occurred during the 2013 bull run (black circles).

In technical terms, this shows that the relief rallies after the 2013 and 2016 BTC crashes were much weaker than the current bounce. This makes it unlikely that the bitcoin is experiencing a relief rally, but rather continuing its bullish trend.

SponsoredGradual BTC descent

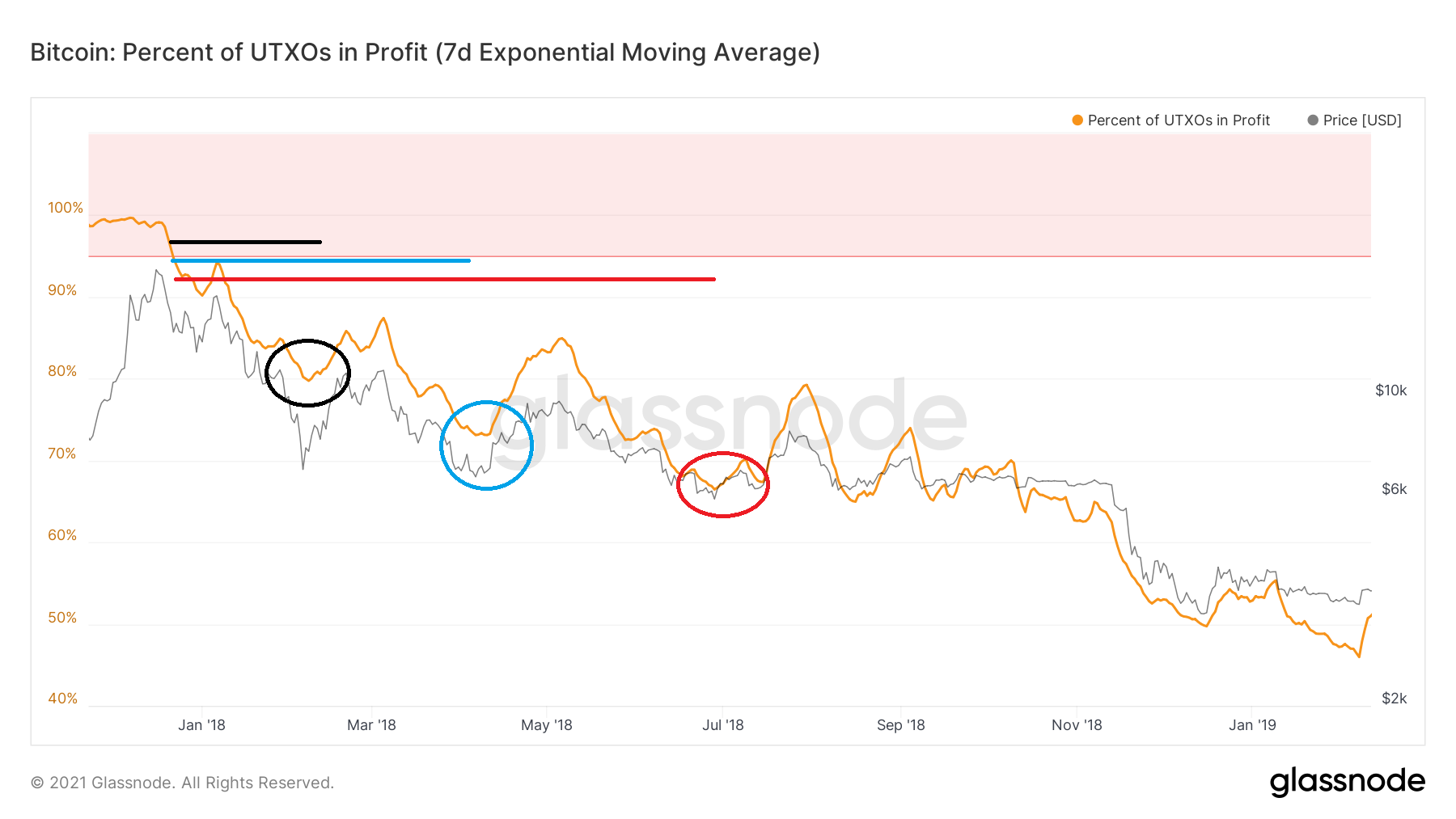

When comparing the downward move in 2018 to the most recent retracement, what immediately catches the eye is how sharp the former was compared to the latter.

The percent of UTXOs in profit fell to 80% only two months after first decreasing below 95% (black circle).

Then, it fell to 75% after four months (blue circle) and below 70% after six months (red circle).

The downward move eventually culminated with a low of 45.96% in February 2019.

The movement has been much more gradual in 2021. The local low of 84.49% in July 2021 was much higher than in 2017.

The indicator reversed its trend and is now back above 95%. This is not similar to previous cycle tops.

Therefore, unlike in 2017, the percent of UTXOs in profit never fell below 80% and is now back above 95%.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.