Be[in]Crypto takes a look at bitcoin (BTC) on-chain indicators that relate to lifespan in order to determine the age of the coins that are currently being transacted.

HODL waves

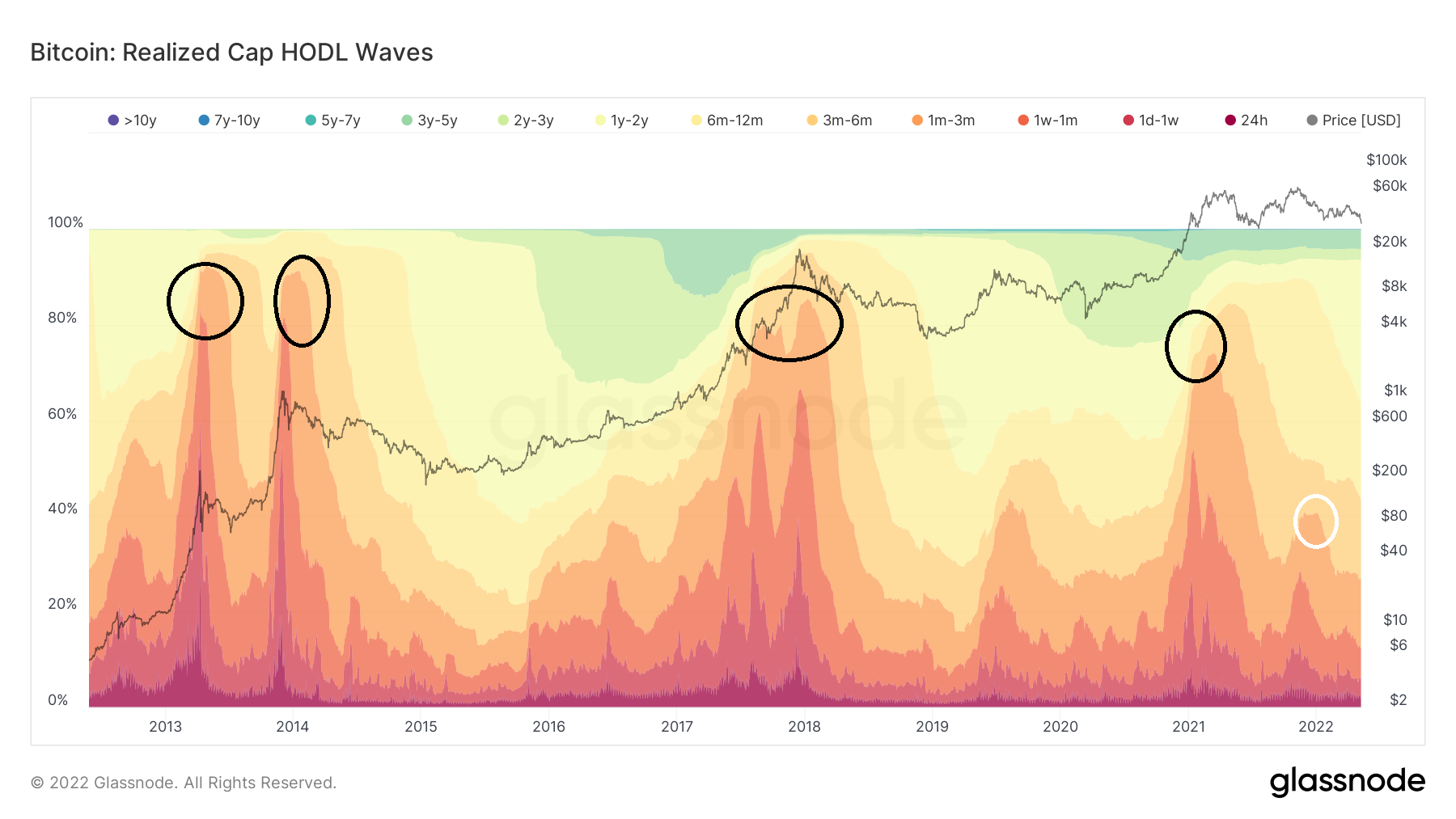

The HODL wave shows the percentage of the total BTC that has moved in a specific period of time. Afterward, the realized cap HODL wave weighs these values with the realized price. More specifically, if the HODL waveband of one to two years has a width of 28%, it means that 28% of the total BTC supply previously moved between one and two years ago.

In the case of the HODL wave, short-term bands increase significantly once the price approaches a market cycle top. The reason for this is that long-term holders are distributing their coins to new market participants. This was clearly visible in the 2013, 2017 and 2021 market cycle tops (black circle). However, it was not as visible during the Nov 2021 all-time high BTC price (white).

Band swells

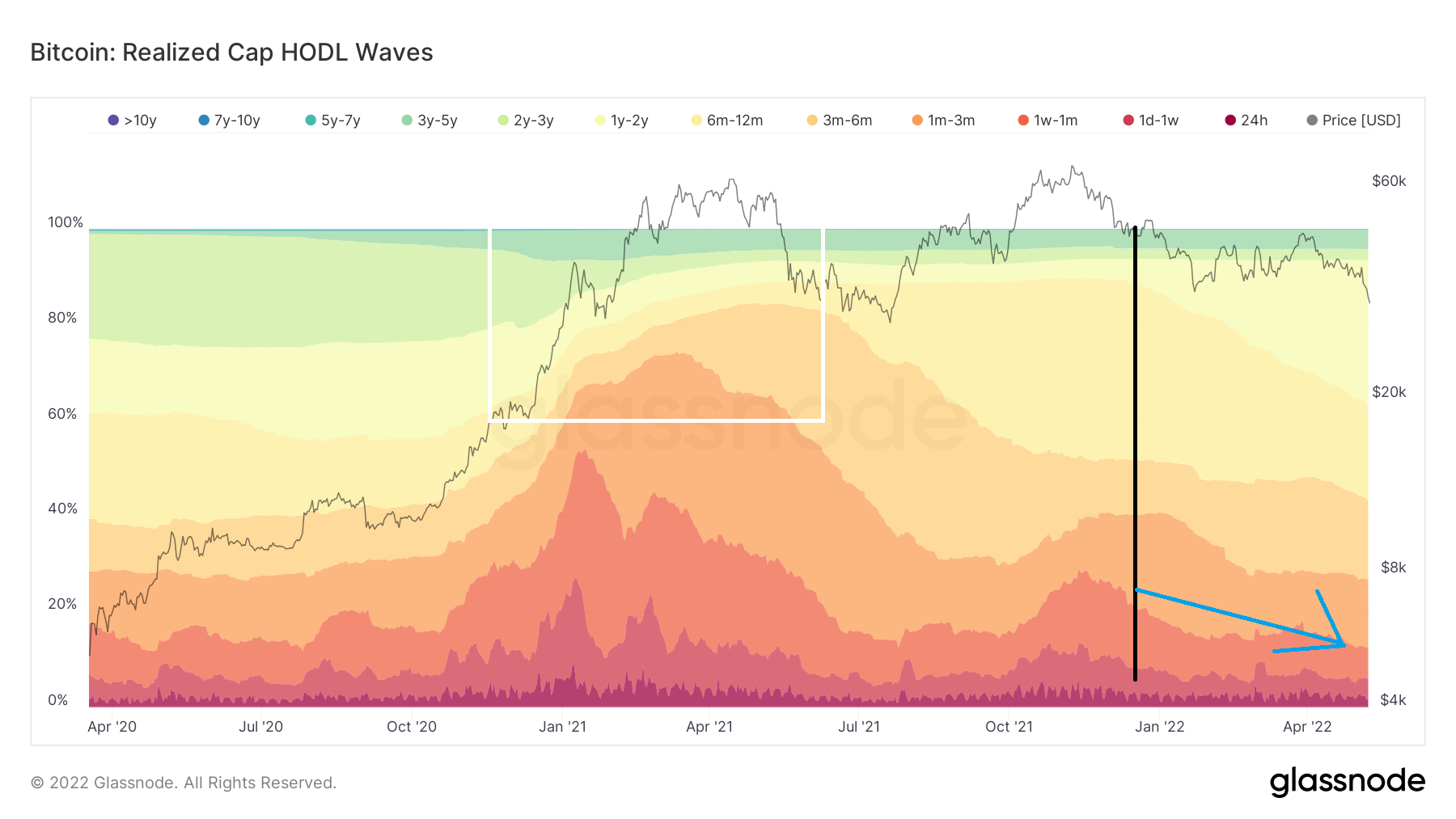

The most interesting development is the increase of the one to two-year band (light yellow). In Dec 2021 (black), the band had a width of only 5%. This means that 5% of the total BTC in existence previously moved one to two years ago.

Until now, the band has swollen to 30%. A large portion of this is caused by the decrease in the six to 12-month band, which during this same period fell from 36% to 16%.

Therefore, people who bought between Dec 2020 and May 2021 (white circle) have held and their tokens have since passed into the one to two-year band.

The other 5% likely came as a result of the decrease from short-term bands with lifespan under one month, which have decreased from 23% in Dec 2021 to 11% currently (blue arrow).

Previous history

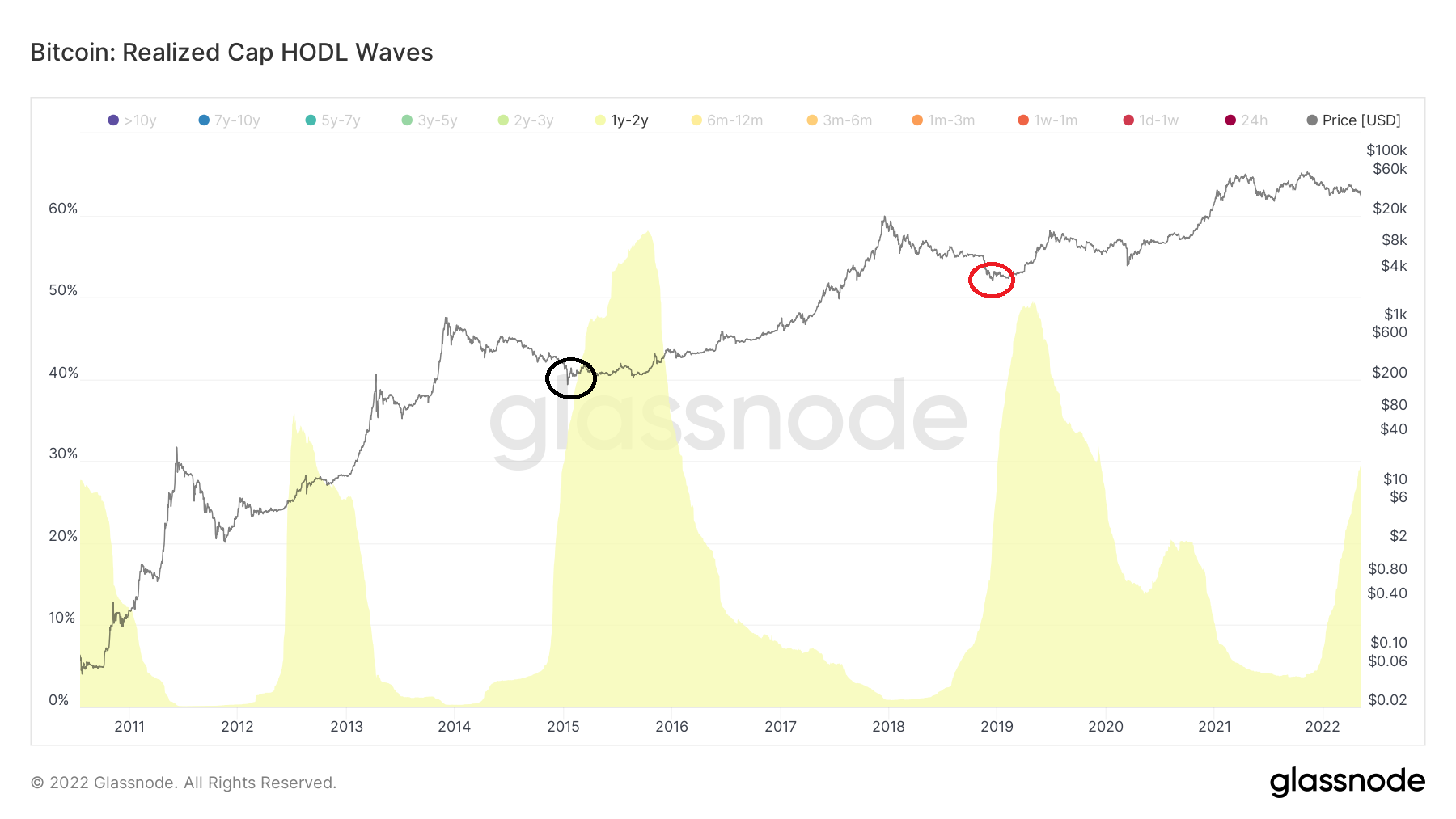

Historically, the one to two-year band has swelled this much right after a bottom was reached, during periods of accumulation.

During the Jan 2015 bottom (black circle), the one to two-year band comprised of 33% of the entire number of BTC transactions. Afterward, it increased all the way to 55% during the accumulation phase.

During the Dec 2018 bottom (red circle), the band was at 20%, but afterward increased all the way to 50%.

Therefore, the current reading of 28% is similar to those in 2015 and 2018 and suggests that the market is likely close to reaching a bottom, and an accumulation phase will occur soon.

For Be[in]Crypto’s previous Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.