The Bitcoin (BTC) price reached an all-time high price of $49,707 on Feb. 14 but dropped shortly after.

Despite the drop, it is still likely that the Bitcoin trend is bullish and the price will continue higher.

Bitcoin Shows Weakness

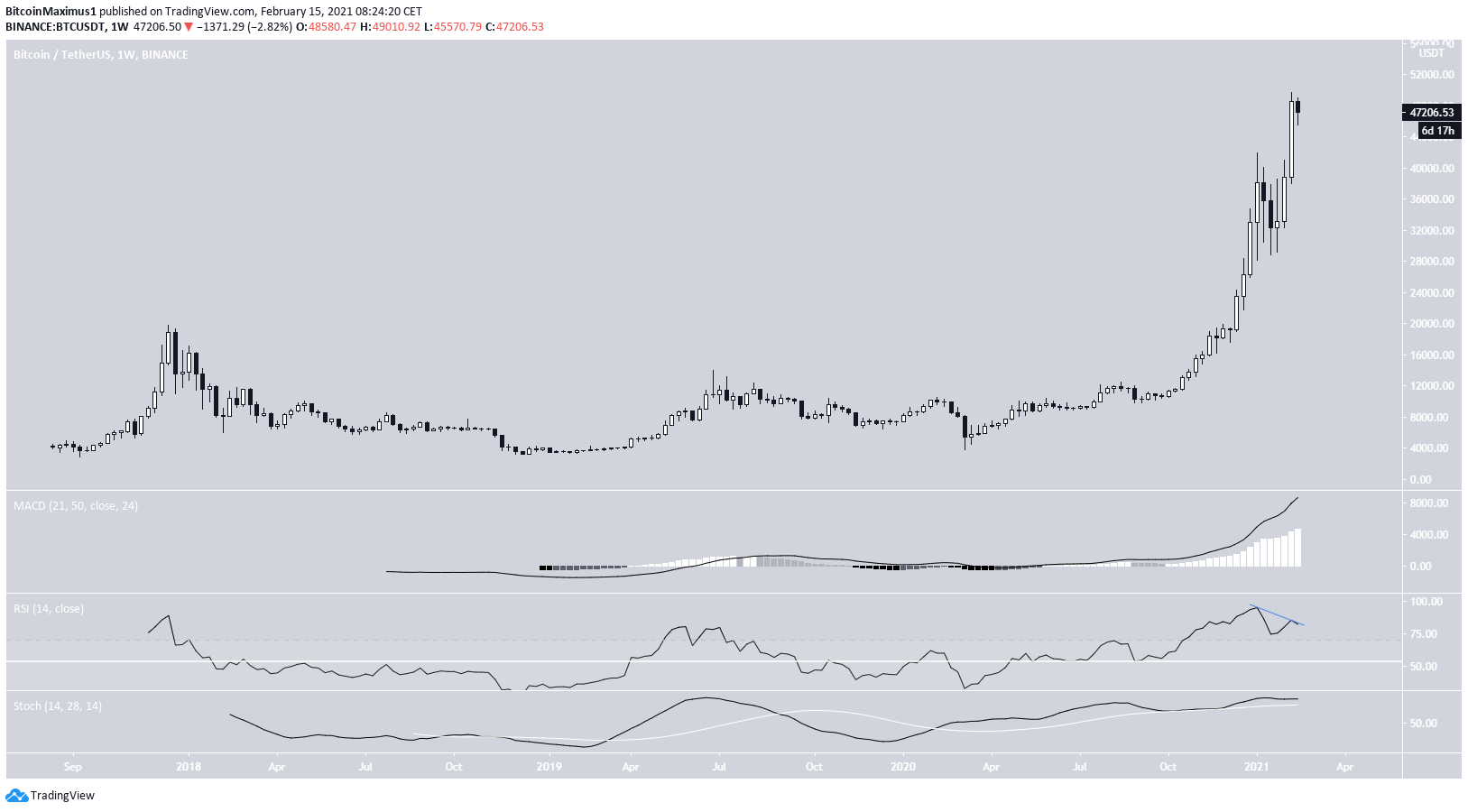

During the week of Feb. 8-15, the BTC price created a bullish candlestick in the weekly time-frame, reaching an all-time high price of $49,707 on Feb. 14.

While the weekly close was decisively bullish, the weekly RSI has generated a significant bearish divergence, a sign of a possible trend reversal.

Nevertheless, both the MACD and Stochastic oscillator are still bullish, suggesting that the trend is also positive.

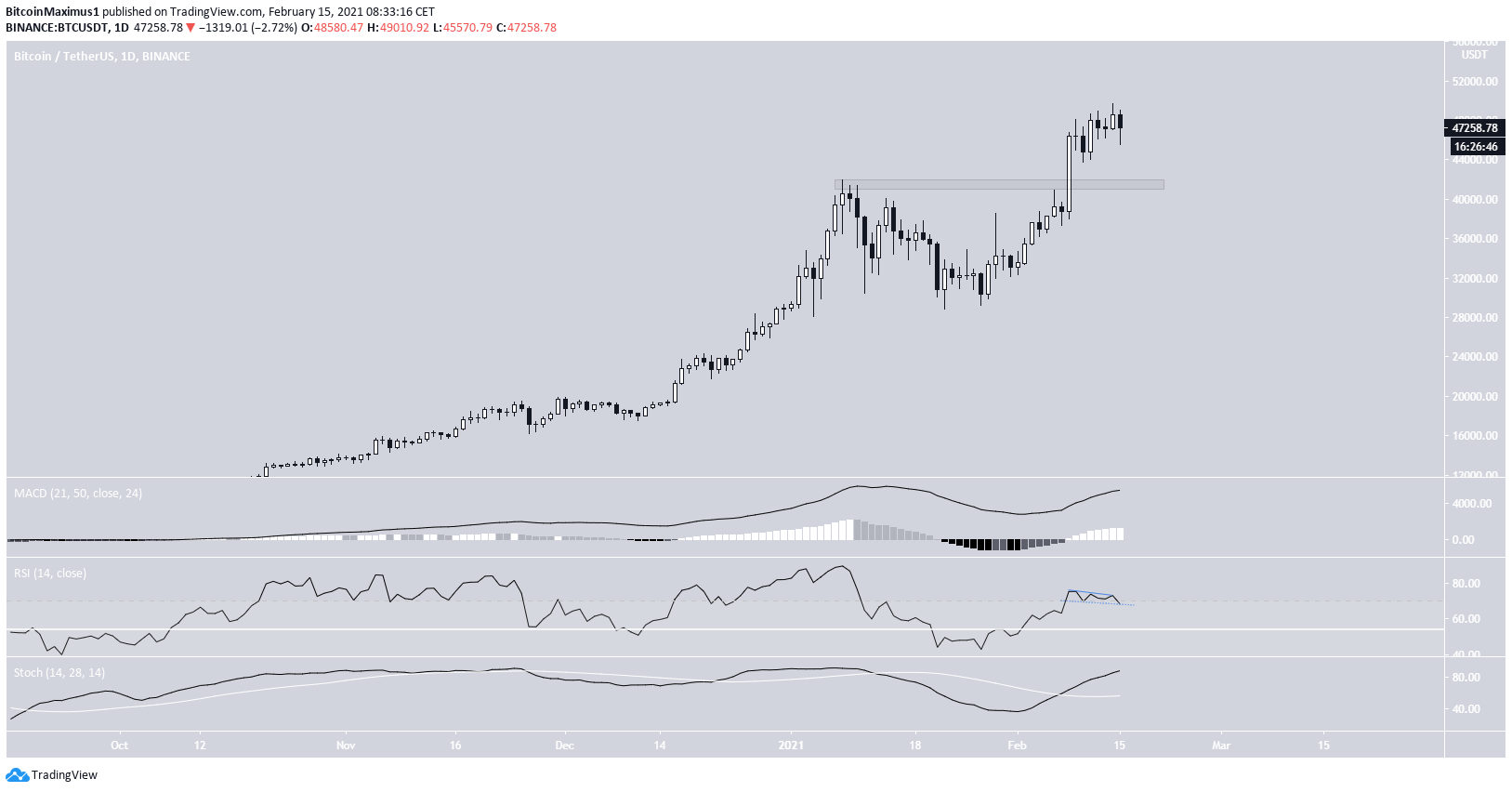

The daily time-frame provides a similar outlook. The daily RSI has generated a bearish divergence, but the MACD & Stochastic oscillator are moving upwards.

Furthermore, depending on the close, it’s possible that the RSI will generate a hidden bullish divergence (dashed), invalidating the previous bearish divergence.

Therefore, while there is a bearish divergence in both the weekly and daily time-frames, it’s not sufficient to confirm a trend reversal.

If BTC were to continue to drop, the closest support area would be found at $41,300.

BTC Wave Count

The wave count suggests that the drop was part of sub-wave four (black). BTC is likely to increase and complete sub-wave five soon, which has a target near $53,500. This increase would complete wave three (orange), which is part of a longer-term bullish impulse.

A decrease below the wave one high at $38,620 (red line) would invalidate this particular count.

For the longer-term wave count (white), click here.

The shorter-term count suggests that this is a running flat correction. This is evidenced by the possible parallel channel. BTC will likely increase after another possible drop towards $46,000.

Alternate Scenario

An alternative scenario suggests that wave three has been completed and BTC has just begun a corrective wave four. At the time of press, we cannot determine the shape of this corrective structure.

The end result of the count would still be the same, as would the invalidation level at $38,620.

Conclusion

After a possible short-term drop towards the support line of the channel, Bitcoin is expected to initiate another upward move that takes it above $50,000.

An alternative wave count would suggest a more significant decrease towards the support at $41,400 before the upward move commences.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here