Bitcoin (BTC) failed to sustain the upward move that pushed it over $42,000 and initiated a bearish trend reversal on March 9.

Bitcoin has been trading above an ascending support line since Jan. 22. The support has been validated numerous times, most recently on March 7 (green icon). This led to an upward move that took BTC to a local high of $42,594 on March 9.

However, the price decreased considerably the next day, virtually negating the entire previous increase. BTC is currently in the process of creating a bearish engulfing candlestick (highlighted). This is a bearish candlestick pattern that could lead to a lower price. If confirmed, this would likely also cause it to break down from the ascending support line.

BTC rejected above resistance

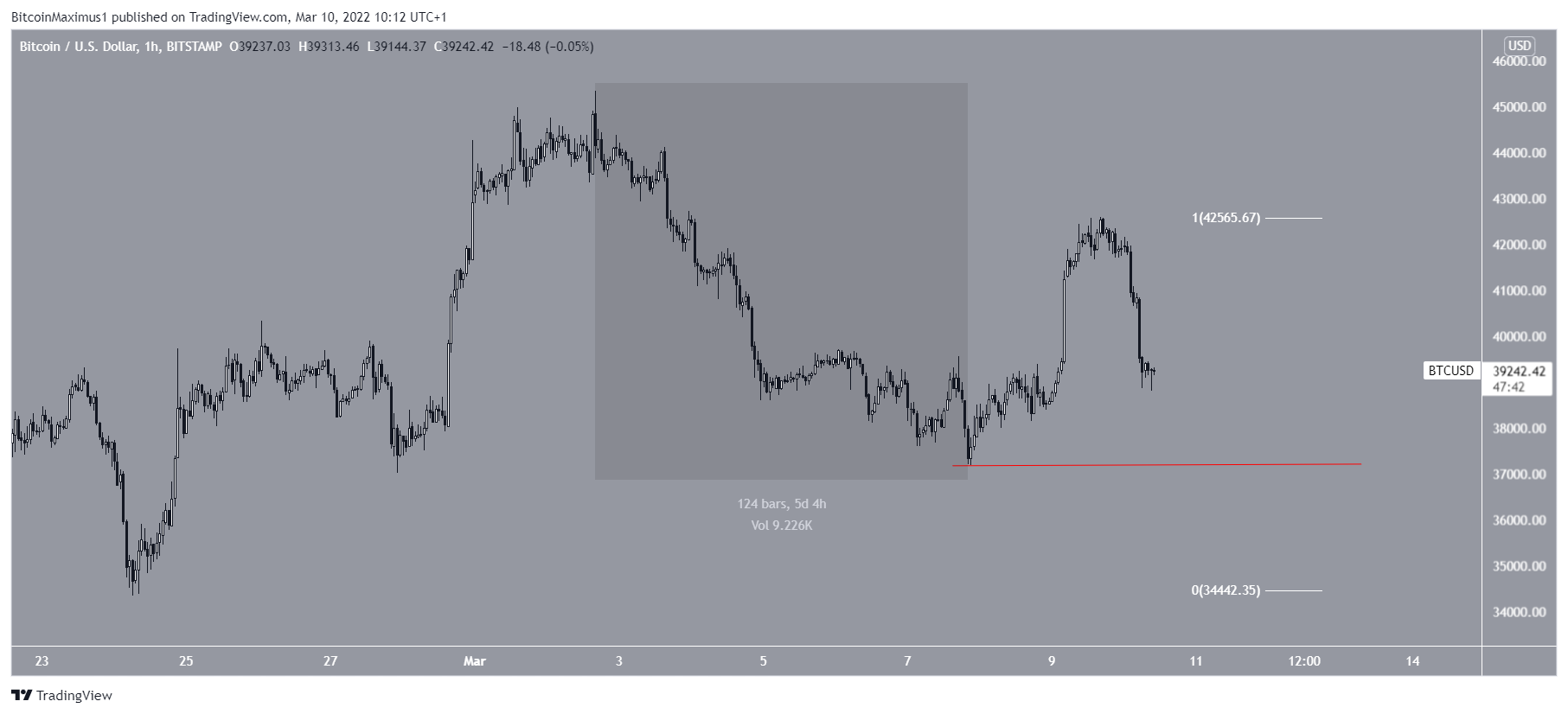

On March 9, BTC appeared to have broken out from a short-term descending resistance line. However, it turned out to be a fakeout (red circle), since the price fell back sharply not long after.

BTC reached a top right at the 0.618 Fib retracement resistance level at $42,270. This is the most common Fib level that acts as resistance during a retracement. Currently, BTC is trading slightly above the minor support area of $39,050.

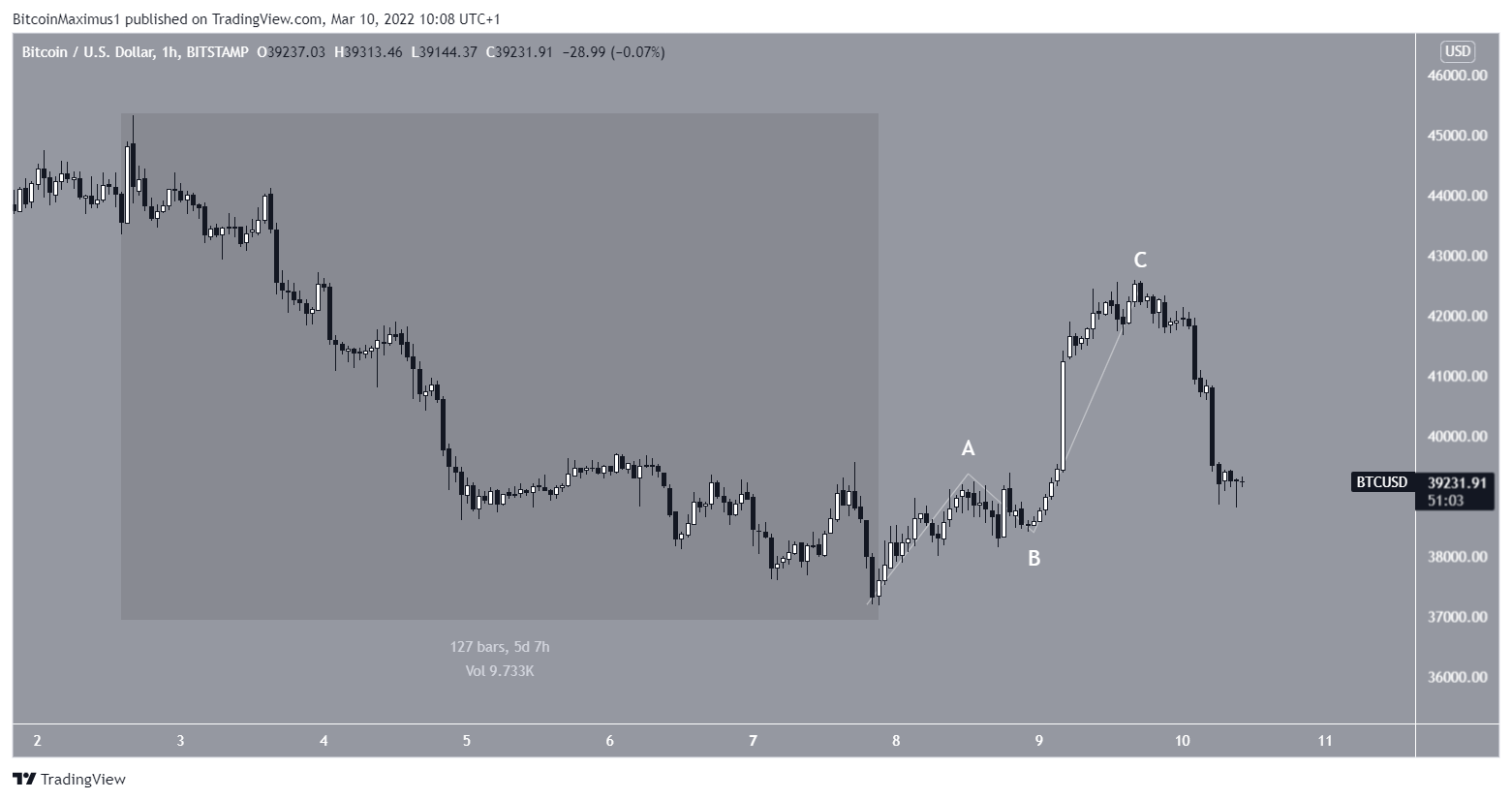

Wave count analysis

When looking at the short-term wave count, it’s clear that the March 2-7 decrease (highlighted) is a five-wave downward move.

The increase that followed is a three-wave upward move (white). This means that the underlying trend is bearish since the short-term increases are corrective.

As a result, a dip with the magnitude of the preceding rally (highlighted) could follow. This would take BTC to a low of $34,440 — very near to its February lows.

Even at a minimum, BTC could fall back to sweep the March 7 lows (red line) at $37,193.

The long-term wave count still remains unclear.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here