Bitcoin (BTC) is showing strong signs of a bullish trend reversal after increasing considerably on April 18.

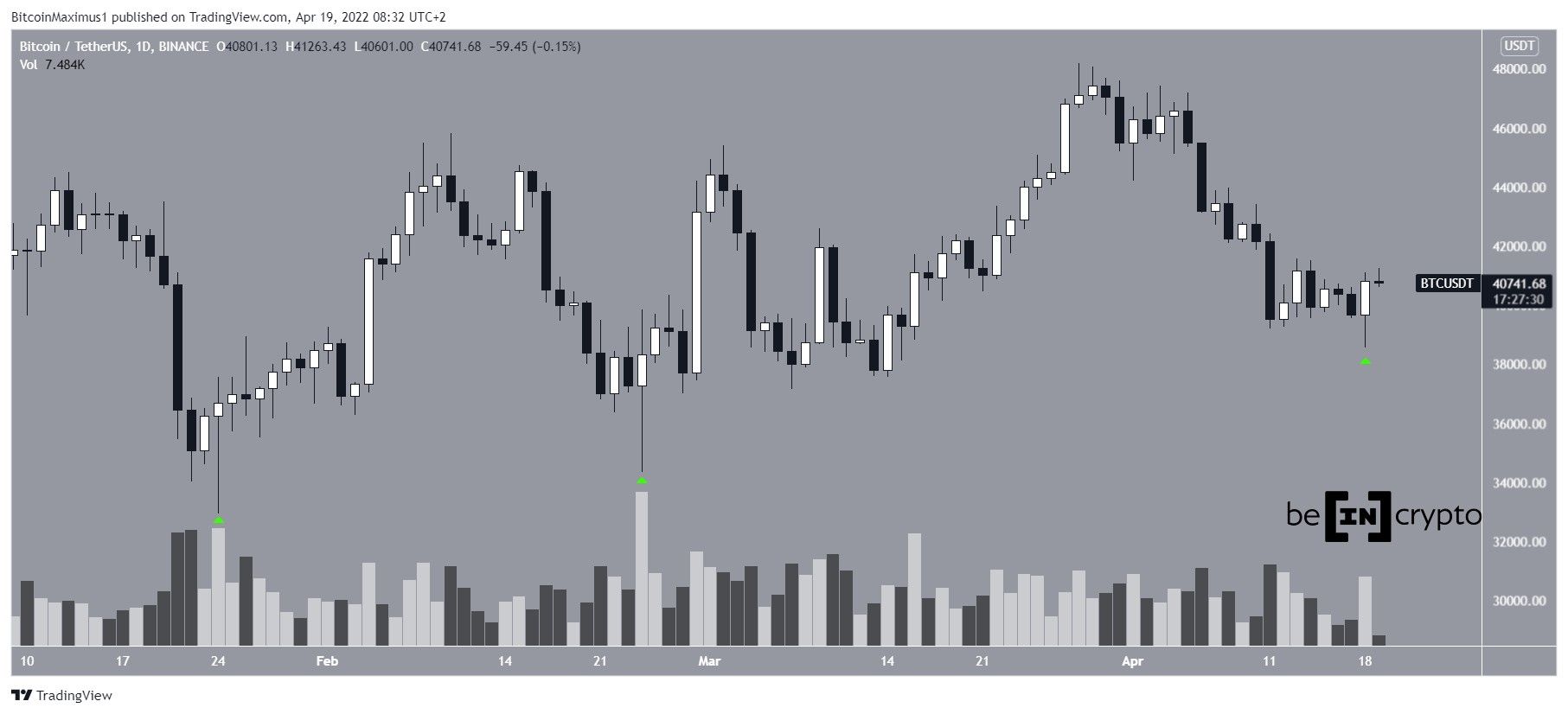

On April 18, Bitcoin reached a local low of $38,536 but bounced and created a bullish engulfing candlestick. This is a candlestick pattern in which the entire previous day’s decrease is negated within the next day’s movement. In addition to this, the pattern had a long lower wick, which is considered a sign of buying pressure.

When comparing it to the previous price movement, the pattern is very similar to the candlesticks of Jan. 24 and Feb. 24 (green icons). In both instances, significant price increases followed. All three were also combined with higher than average volume.

Short-term BTC bounce

A closer look at the daily chart shows that the price has been moving above an ascending support line since Jan. 24. The line has been validated numerous times so far. The aforementioned wick lows initially took BTC below the line, but it was reclaimed shortly after.

Despite this seemingly bullish price action, technical indicators are decisively bearish. The RSI has been decreasing since April 2, broke down from an ascending support line, and is below 50.

Similarly, the MACD is decreasing and is in negative territory. These are both considered signs of a bearish trend.

The six-hour chart on the other hand is a bit more bullish.

The main reason for this is the fact that the RSI has broken out from a descending resistance line and has generated a bullish divergence after (green line).

If the ongoing rebound in price continues, the closest resistance would likely be reached between $43,480 and $44,510. This area is created by the 0.5-0.618 fib retracement resistance levels and also coincides with a descending resistance line (dashed) that’s been in place since March 28.

Wave count analysis

The wave count suggests that BTC is nearing the bottom of what is likely a C wave (red). The sub-wave count is shown in yellow.

An approximate target for the bottom of this move is found between $37,000 and $37,250. This would give waves A and C a 1:1 ratio, and is a projection of the length of sub-wave one (yellow).

The alternate count suggests that wave C is already complete. However, due to the fact that there are no proportions between the waves, it’s less likely to transpire.

In any case, the bottom seems to be close and the long-term wave count suggests that an eventual move above $50,000 would be likely to follow.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here