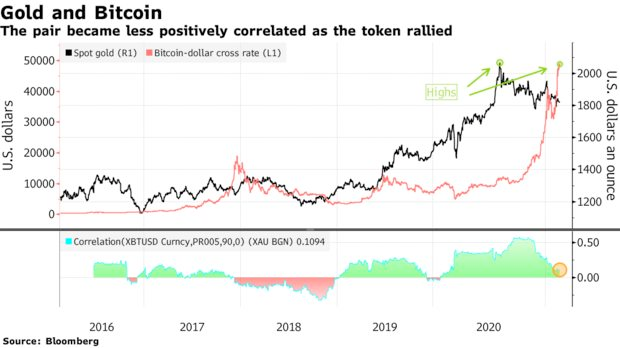

As bitcoin (BTC) breaks the $50,000 milestone, its correlation with gold and stocks continues to decline, according to an analysis by Bloomberg.

This Bitcoin divergence supports arguments for portfolio diversification that includes cryptocurrencies.

Low Correlation to Bitcoin, More Diversification

According to the analysis, the 90-day correlation between BTC and the S&P 500 index has recently dropped from 0.5 in October to 0.21.

The higher the correlation between securities, the similar their performances are, therefore portfolios with low-correlated assets are more diversified. According to a report from investment research company Morning Star, such diversified portfolios are known as allocation funds or those that combine stocks, bonds, and other investments.

One reason average investors captured a higher return, as Morningstar puts it, is that:

“by virtue of their diversified approach, allocation funds tend to have more stable performance and are easier to own than funds that are subject to more-dramatic performance swings.”

Investors Warming to Diversifying Effects

Bloomberg spoke with Benson Durham, head of quantitative global policy analytics at Cornerstone Macro LLC, a broker-dealer firm, who said,

“In terms of Bitcoin, as well as other digital coins, versus other traditional risky asset classes, the diversification benefits remain intact.”

Last year, he and colleague Roberto Perli suggested adding cryptocurrencies to an all-stock portfolio to reduce volatility. Institutional investors have been wary of BTC due to its extreme volatility. They are now, however, investigating its potential to improve a portfolio’s risk-adjusted returns.

According to Durham, acquiring rivals like ethereum (ETH) helps lend to the effect since the average correlation among cryptocurrencies is dropping. Diversification across digital assets also “makes good sense,” he said.

However, in spite of the recent enthusiasm for BTC, Durham warns that “there may be no place to hide” if cryptocurrencies take a dive.

Past Correlation

In May 2020, BeInCrypto reported that BTC’s correlation with the S&P 500 was more pronounced by the upward moves of the S&P 500. And on the other end of the spectrum is BTC’s correlation with gold, where price movements had a larger magnitude.