Bitcoin (BTC) neutralized a bearish candlestick pattern on March 10 but has failed to initiate any type of significant and sustained rebound.

Bitcoin has been increasing above an ascending support line since Jan. 22. So far, the line has been validated seven times (green icons), most recently on March 11.

Between March 9-10, BTC was close to creating a bearish engulfing candlestick but created a small lower wick instead of closing below $38,600. Therefore, the pattern was not confirmed.

BTC looks to be currently in the process of creating another lower wick, which can be considered a sign of buying pressure.

Nevertheless, support lines get weaker each time they are touched. Therefore, a breakdown from the line seems to be the most likely scenario.

Short-term BTC movement

The two-hour chart shows that BTC deviated above a descending resistance line (red icon) on March 9 before falling back below it. Now, the line is expected to act as resistance once again.

Currently, the resistance line is near $40,450, a zone that also coincides with the 0.5 Fib retracement resistance level.

Due to the confluence of these levels, it’s likely to act as strong resistance.

Wave count analysis

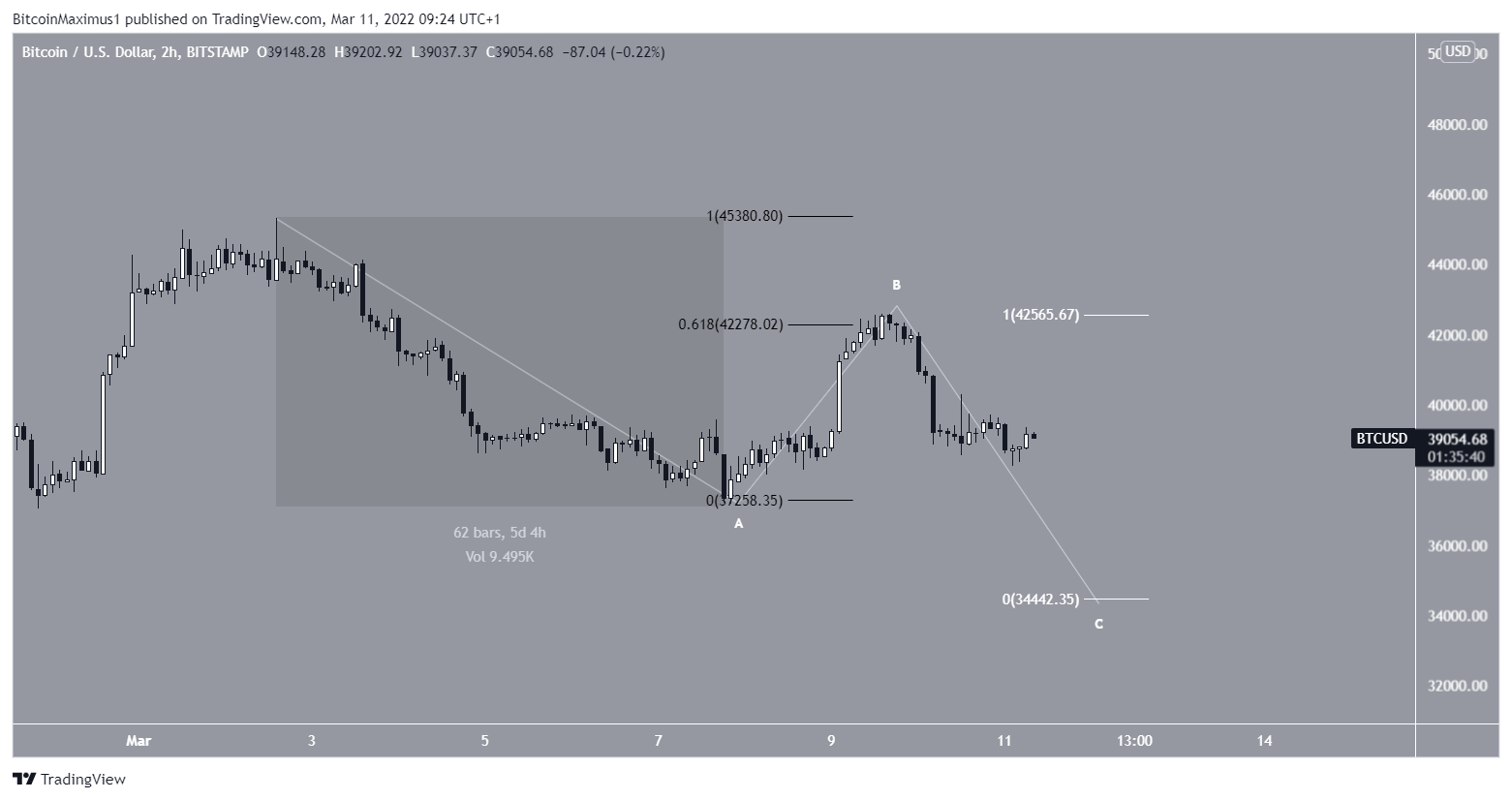

The decrease that took place between March 2 and 7 looks like a five-wave downward movement (highlighted). The rebound rally that followed ended right at the 0.618 Fib retracement resistance level.

Therefore, it’s likely that it was a corrective B wave, after which another downward move would be expected.

If waves A and C have an exact 1:1 ratio (white), the downward move would lead to a low of $34,440. This would be slightly below the Feb 24 lows.

Following this, an upward move would still be likely but the long-term wave count still remains unclear.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here