Bitcoin (BTC) created another bullish candlestick on the weekly time frame, continuing its ongoing ascent toward a new all-time high price. BTC is expected to break out above the $57,150 resistance level, which is the final one prior to the all-time high.

The weekly bitcoin chart is shifting toward a bullish outlook. This has occurred mainly because of technical indicator readings rather than the price action.

Firstly, the Supertrend line has turned positive. The Supertrend is an indicator that uses absolute high and low prices in order to determine the direction of the trend. If the BTC price is higher than the indicator line, the Supertrend is considered to be bullish. Since BTC just moved above the Supertrend resistance line (green circle), the indicator has turned bullish.

In addition to this, both the RSI and MACD are bullish.

The RSI, which is an indicator used to measure momentum, has moved above the 50-line (green icon). This usually means that the trend is bullish, and put an end to a 77-day period in which the indicator was below 50. The previous time the RSI crossed above 50 was in April 2020, preceding the rally to $64,000.

The MACD, which is created by short and long-term moving averages (MA), is positive and moving upwards. Furthermore, its histogram is almost positive. This means that the short-term trend is moving faster than the long-term trend.

While BTC has yet to reclaim the ascending support line from which it previously broke down, the indicator readings. counteract the relatively bearish price action.

Ongoing bitcoin breakout

The outlook from the daily chart is in alignment with that from the weekly chart, showing similar RSI, MACD, and Supertrend readings.

In addition to this, the price action is bullish in this time frame.

BTC is in the process of creating a bullish candlestick inside the wick from Oct 10. This is a sign that the selling pressure is dissipating.

Furthermore, BTC is approaching the $57,150 resistance. This is both the 0.786 Fib retracement level and a horizontal resistance area.

If a breakout occurs, BTC should have little in the way to stop it from increasing toward its all-time high price.

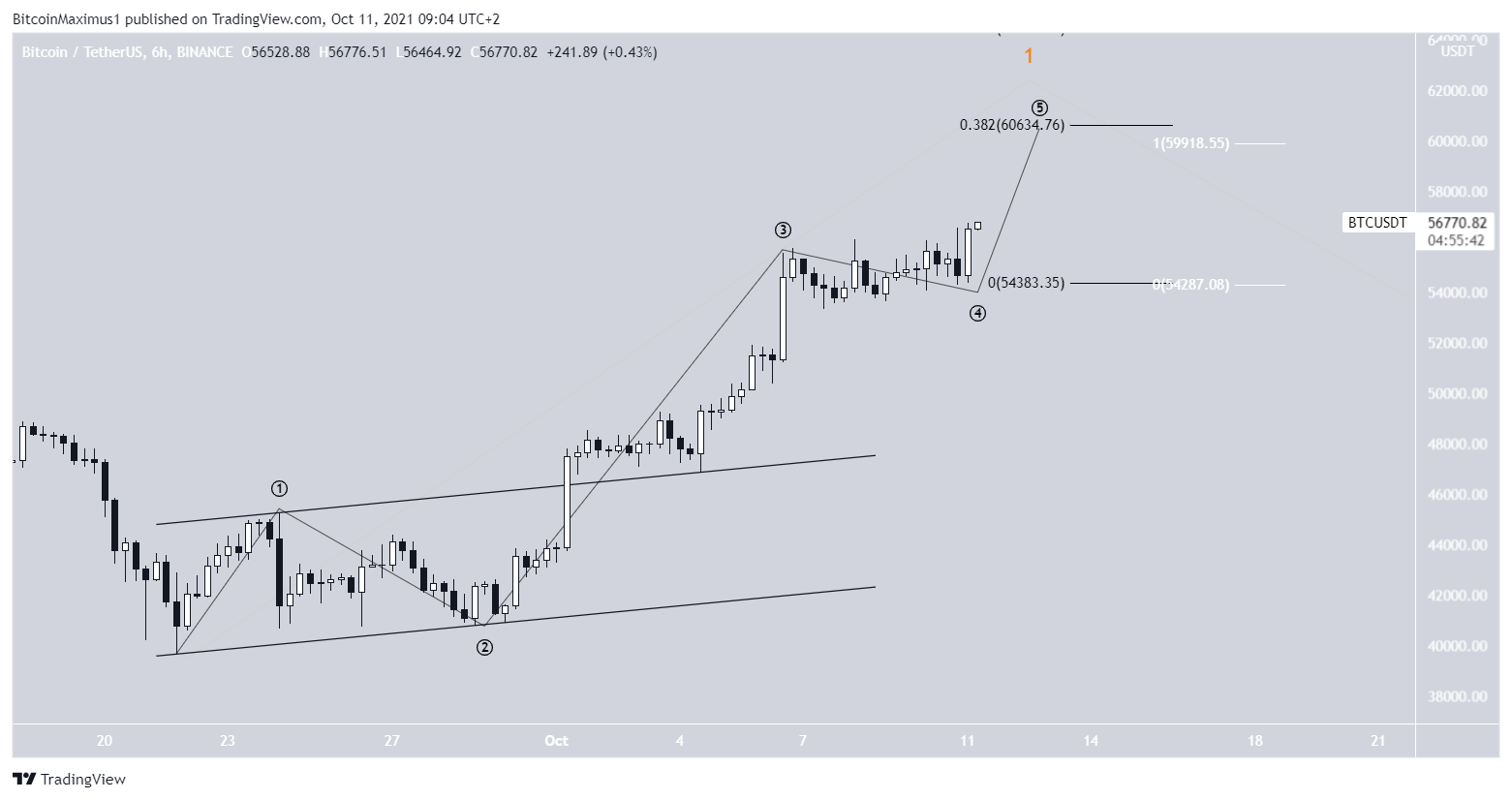

The six-hour chart also gives a bullish outlook. Firstly, it shows a breakout from an ascending parallel channel, a sign that the trend is bullish and the previous correction has come to an end.

In addition to this, while BTC consolidated below the $57,150 resistance area, the RSI generated a hidden bullish divergence. This is a strong sign of trend continuation. Therefore, a breakout would be the most likely scenario.

Wave count

Finally, the long-term wave count is bullish. It indicates that BTC is currently in a 1-2/1-2 wave formation. This means that the current increase is only the first portion of the upward move, which will accelerate considerably after.

Secondly, the short-term count shows that BTC is in the fifth and final sub-wave of the current increase.

The most likely target for the top falls between $59,900-$60,650. This target range is found using the length of wave one (white) and the lengths of waves 1-3 (black).

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.