Bitcoin (BTC) has once again reached the resistance line of its current short-term trading pattern. At the moment, a breakout appears to be the most likely scenario.

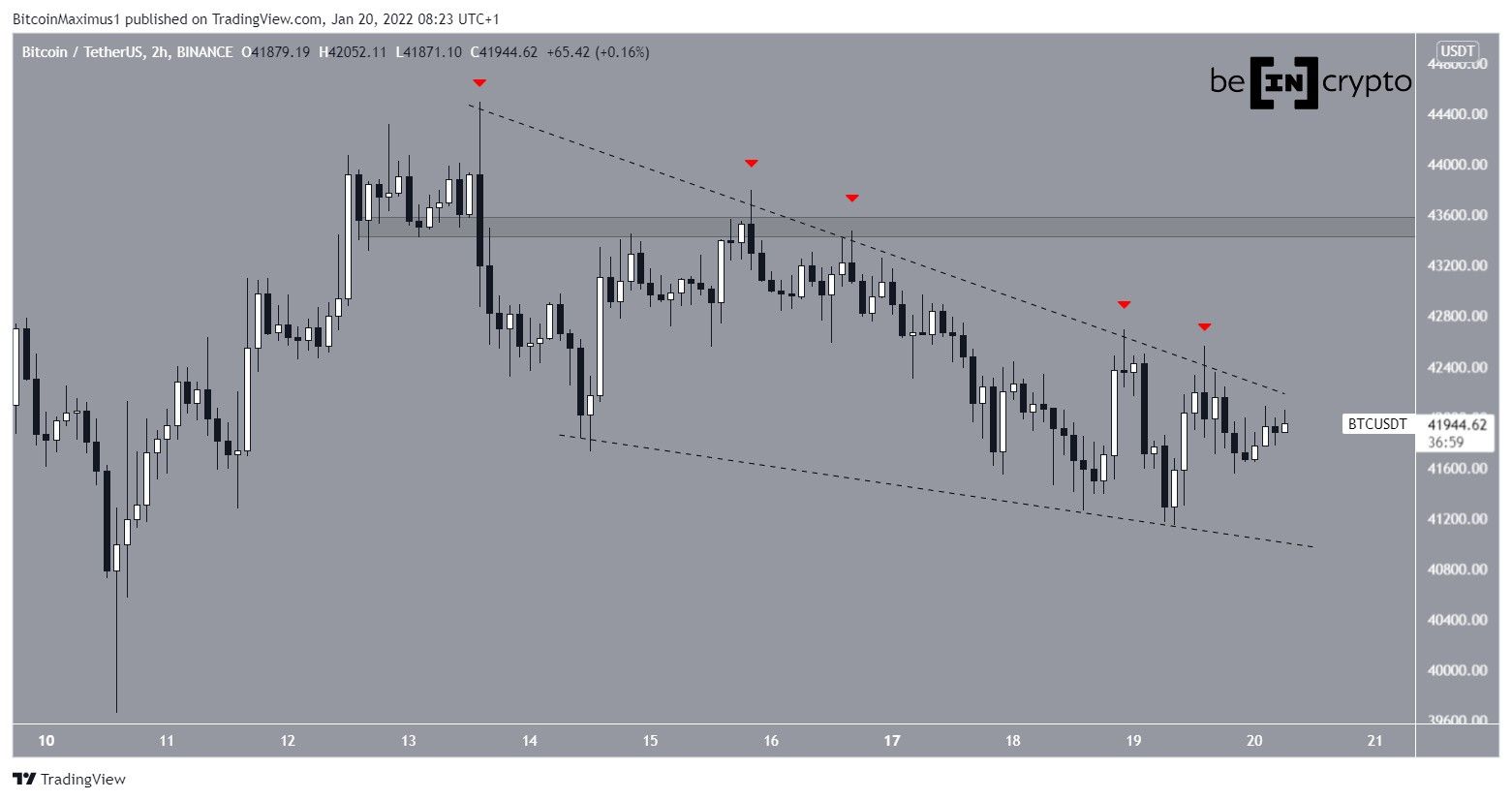

BTC has been trading inside a descending wedge since Jan 13. The descending wedge is often considered a bullish pattern.

Up to this point, it has made five breakout attempts (red icons). Since resistances get weaker each time they are touched, a breakout from this pattern seems to be the most likely scenario.

If this occurs, the next closest resistance area to consider would be near $43,500. This is a horizontal level that has intermittently acted as both support and resistance.

Future BTC movement

A look at the six-hour chart shows that prior to trading inside the descending wedge, BTC had broken out from a longer-term descending resistance line. Therefore, the current wedge could be considered a consolidation pattern after a breakout.

In addition to this, the consolidation is transpiring just above the $41,200 horizontal support area.

If BTC manages to break out from the wedge, the next closest resistance area would be found at $45,850. This target is the 0.5 Fib retracement resistance level and a horizontal resistance area.

Wave count analysis

The short-term wave count supports an upward move towards $45,950. This high would be in line with the previously outlined resistance area.

However, it’s not yet certain if the current increase is part of an A-B-C corrective structure (black) or if it is a new bullish impulse.

In the case of the former, giving waves A:C a 1:1 ratio would lead to a high of $45,950. This seems to be the minimum target for any upward move. In the case of the latter, BTC could break through this target and move straight up towards $50,000.

The long-term count suggests that BTC is completing wave four and supports this short-term bullish move.