After breaking down below the $44,000 support area, Bitcoin (BTC) found support just above the $40,000 level and rebounded.

If BTC has not reached its low already, it’s likely to complete the pattern with one more small decrease.

Bitcoin breaks down

On Sept 20, BTC broke down from the $44,000 horizontal support area amid a large bearish candlestick. The next day, it resumed its descent and briefly fell below $40,000 before bouncing.

The first support area is found at $40,800, which is the 0.5 Fib retracement support level. While BTC initially fell below this level, if the current bounce holds, it would mean that the area has been validated as support.

However, technical indicators are firmly bearish. The RSI and MACD are decreasing and the Supertrend line is bearish.

While the $40,800 level is a Fib retracement support level, there is stronger support at $38,000, created by both the 0.618 Fib retracement support level and a horizontal support area.

Wave count

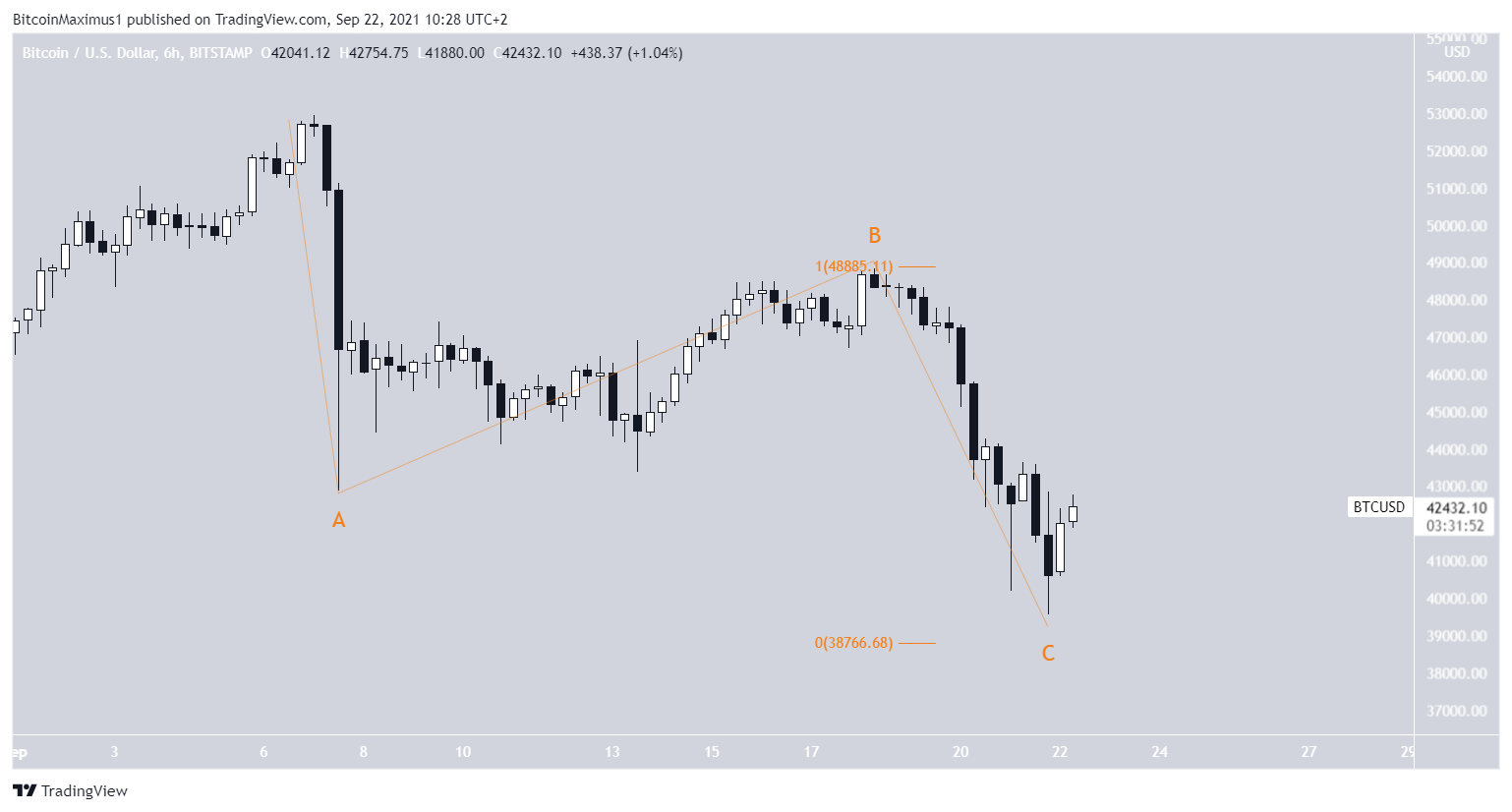

The most likely wave count indicates that BTC is nearing the bottom or has already completed the C wave of an A-B-C corrective structure (orange).

The $38,766 target that would give waves A:C a 1:1 ratio was barely missed yesterday. The target also coincides with the previously outlined 0.618 Fib retracement support level.

While the sub-wave count (black) shows a completed five wave impulse, wave five does not have any relation to the preceding waves.

Therefore, it’s possible that the drop was part of an extended wave three, and another drop towards the previously outlined support area could still occur.

However, it seems that BTC is rapidly approaching its low if it has not reached it already.

The sub-wave count (black) indicates that the current drop and bounce were most likely part of sub-wave three (black), and BTC is currently in sub-wave four.

Another drop toward the previously outlined target near $38,000 could complete the entire impulse.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.