On May 7, the Bitcoin price created a bullish engulfing candlestick, increasing by more than $1,000 throughout the day. This caused the price to move above a descending resistance line that had been in place since December 2017.

The breakout occurred with significant volume, but not particularly extraordinary. The price is approaching the next resistance area, found between $10,300-$10,400. This zone served as a top for two upward moves in October 2019 and March 2020.

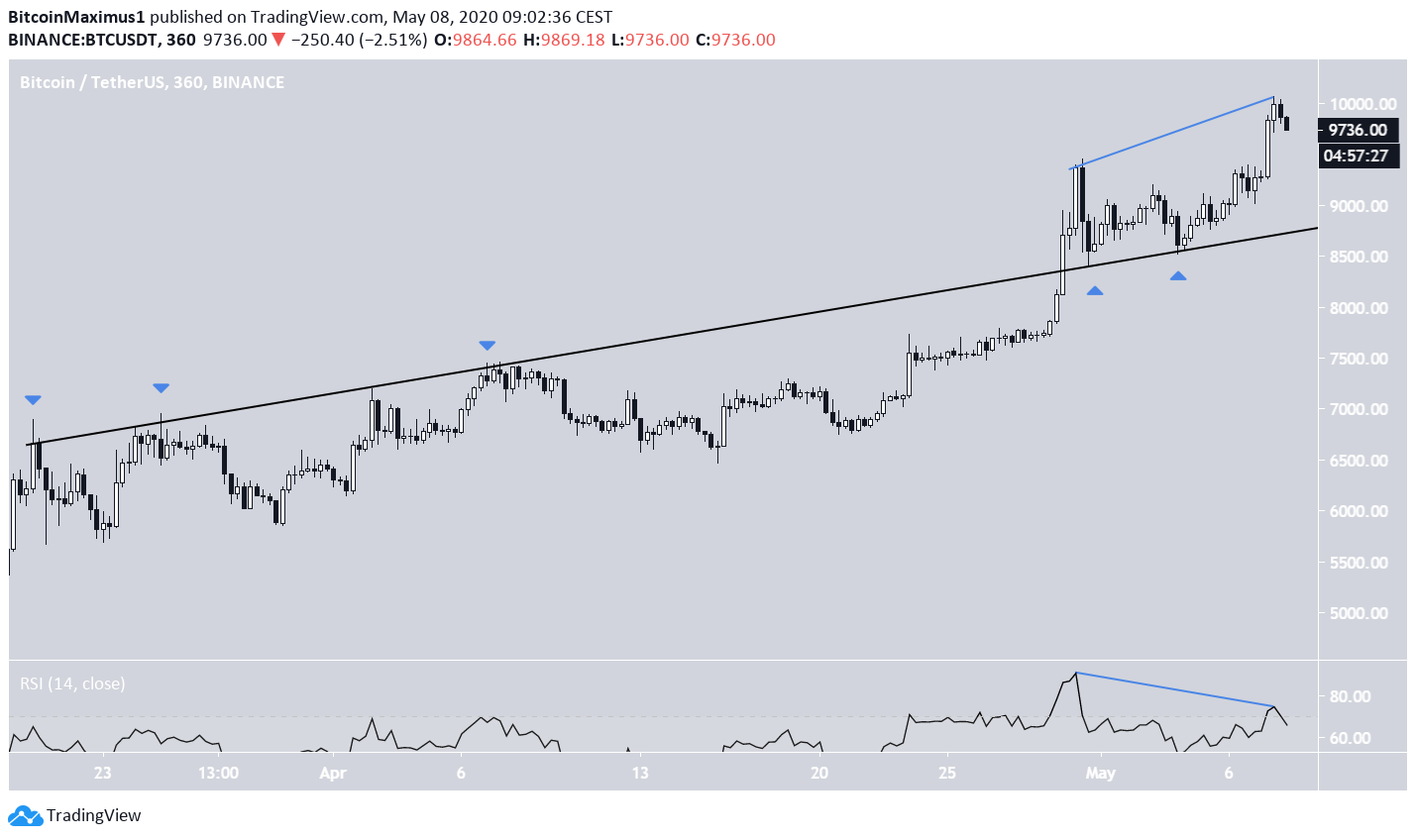

Bitcoin Support Line

When looking at the six-hour time-frame, we can see that the BTC price is following an ascending support line, having validated it twice. This same line acted as resistance before April 28, but after breaking out, it has been validated as support. As long as it is staying above this line, it’s outlook can be considered bullish. However, the RSI has generated very significant bearish divergence when looking at highs reached on April 30 and yesterday. This suggests that the price is likely to decrease, at least to validate this ascending support line once more.

Long-Term Movement

The weekly chart better reveals the resistance line the price just broke out from. The most likely move from here would be a touch of the $10,300 resistance area, followed by a decrease to validate this line and another upward movement towards $12,000. BeInCrypto has previously outlined a wave count that fits with this possible scenario. However, the bearish possibility that the price will create a very long upper wick similar to what was seen in July 2019 and will decrease below the resistance line. A weekly close above this line would mostly invalidate this possibility.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored