Bitcoin (BTC) has made several attempts at breaking out from a short-term descending resistance line. If successful, it could increase the nearest fib level at $21,700.

Bitcoin has been decreasing underneath a descending resistance line since reaching a local high of $25,211 on Aug. 15. The downward move has so far led to a local low of $19,520 on Aug. 28.

During the two most recent lows, the six-hour RSI generated a significant bullish divergence (green line). Such divergences often precede significant upward moves. However, the indicator is still struggling to move above 50.

If a breakout above the line occurs, the next closest resistance area would be found at $21,700. This target is the 0.382 Fib retracement resistance level when measuring the entire downward movement.

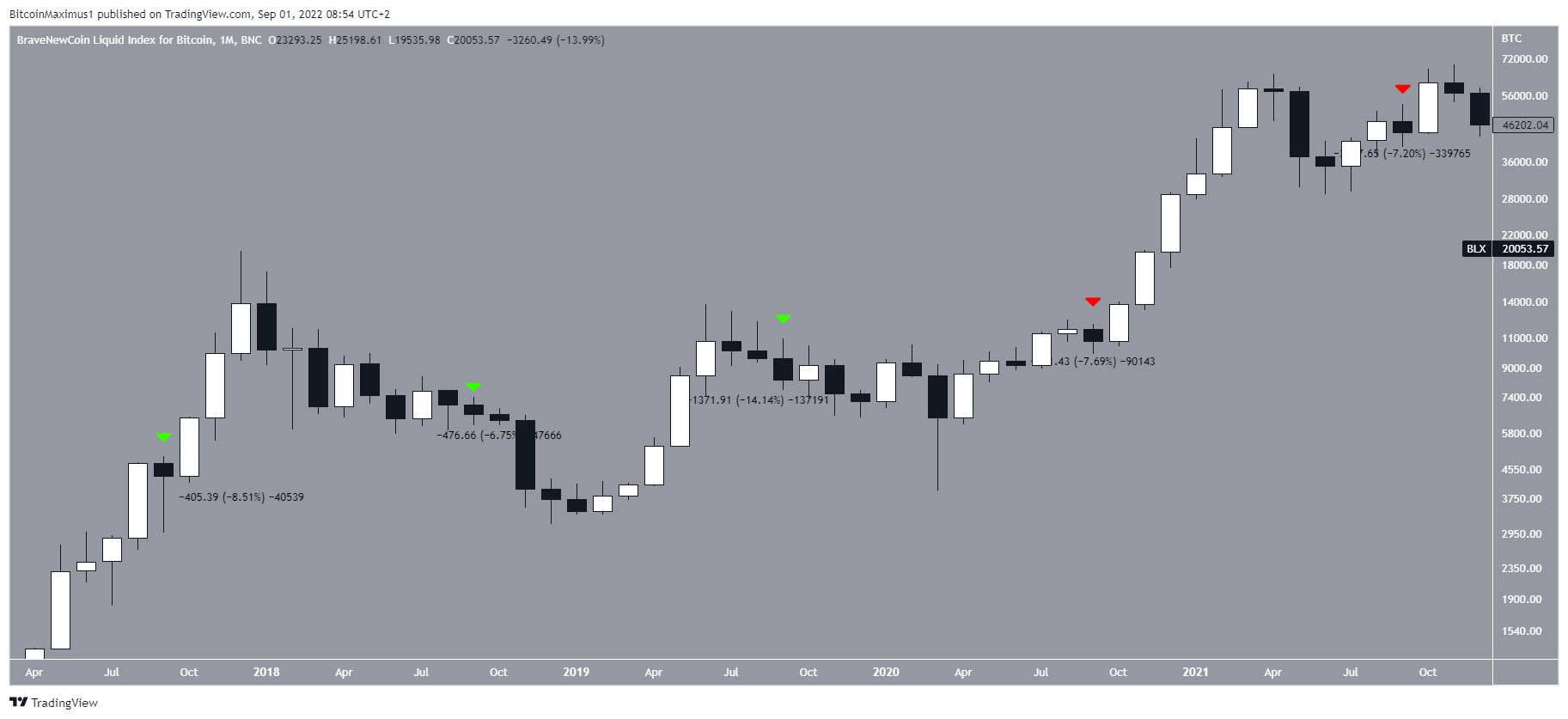

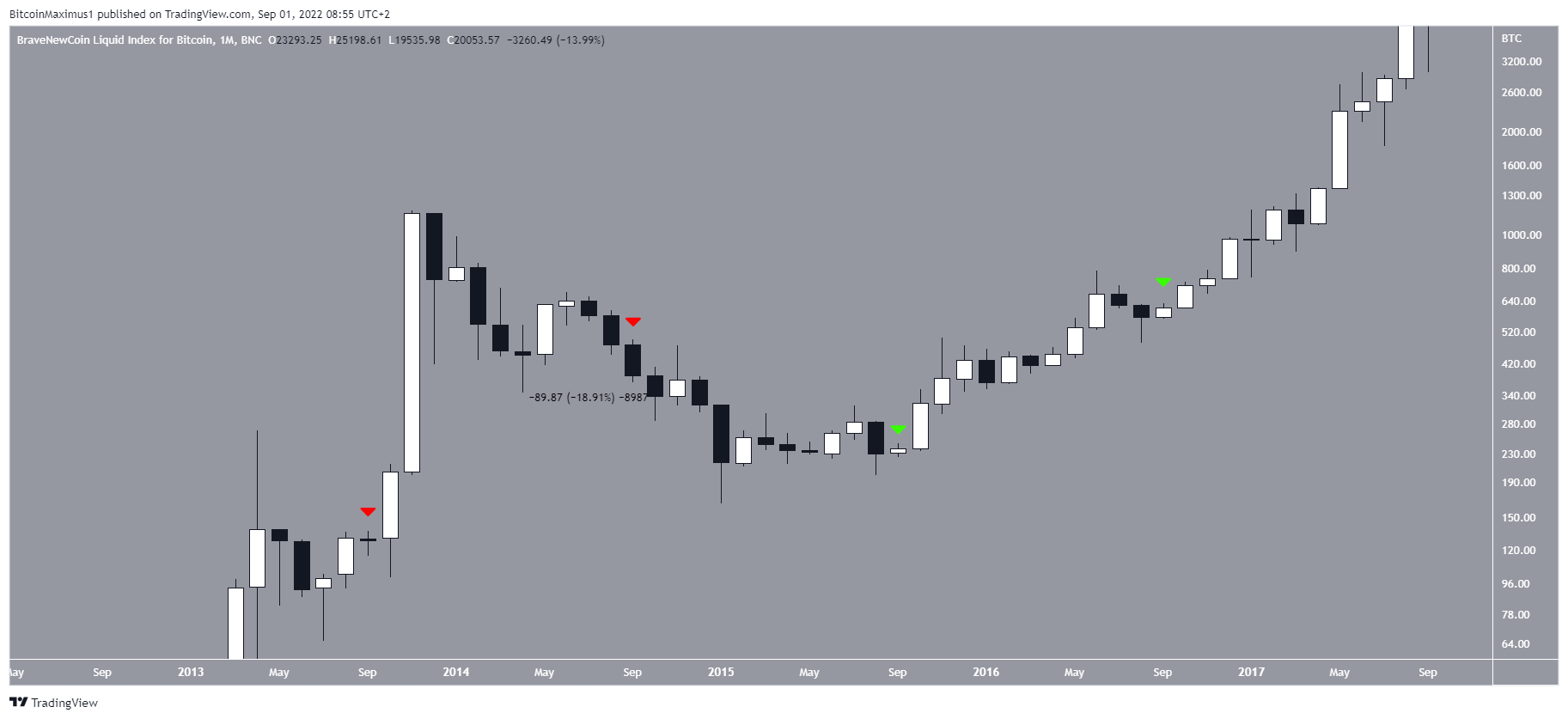

Historical Bitcoin trends in September

Historically, September has been a bearish month for BTC. In September 2020 and 2021 (red icons), the Bitcoin price decreased by slightly more than 7%. However, what is interesting in these candlesticks, is that they were surrounded by large bullish candlesticks. This is especially evident in 2020, when the September candlestick was followed by six bullish monthly candlesticks.

The 2017, 2018, and 2019 candlesticks (green icons) showed decreases of 8.50%, 6.75%, and 14.14%, respectively, meaning that the last five September candlesticks have been bearish. The 2018 and 2019 candlesticks occurred in indeterminant trends, but the 2017 candlestick was extremely similar to the 2020 and 2021 ones, where it was surrounded by bullish candlesticks inside a bullish trend.

While the decreases in the month of September have not been particularly large, they have been consistent even in the midst of a significant long-term bullish trend.

2015 and 2016 (green icons) had bullish September candlesticks, though they were relatively small. 2014 gave us the largest ever September drop of 19%, while 2013 also saw some losses in the month.

Realized cap and market cap

The bearish September perspective is also supported by on-chain metrics, more specifically the market cap (MC) and the realized cap (RC). The former is created by multiplying the total number of coins that are minted with the current BTC price. The latter uses a slightly different formula, using the price at the time a transaction last occurred rather than the current price.

As a result of this modification, it can be seen as a more precise representation of the current value of BTC, since it devalues coins that have not moved for a long time and those that are lost.

Ratio between the two for BTC

The most interesting aspect of the MC and the RC is the relationship between them. Historically, periods in which the MC has fallen below the RC have been associated with bottoms. Additionally, these periods have not lasted long. The maximum amount of time in which MC has fallen below RC was an 11-month period that began back in January 2015 (black circle).

Following this, the 2018 correction also marked a five-month period in which the MC was lower than the RC (red circle), while in 2020 this same occurrence lasted for a short two-week blip (red arrow).

With the exception of a very slight reclamation during the end of the 2015 bottom, once the MC reclaims the RC, it does not fall below it again for a long length of time.

This however has not been the case in 2022. The MC first decreased below the RC on June 18 (red circle), before reclaiming the line exactly one month later (green circle). After this, it decreased once again on Aug. 18 (red circle).

This has previously never occurred in the price history of BTC.

It is worth mentioning that in 2015, the bottom was reached 15 days after the MC first decreased below the RC. In 2018, it was reached 25 days after this cross first occurred.

Considering the first cross in 2022 occurred on June 18, this would be by far the longest period for such an occurrence if a bottom has not been reached yet.

To conclude, when combining on-chain metrics with the historical performance in September, it is possible that BTC will post a slightly bearish monthly close in 2022.

For Be[in]Crypto’s previous Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.