The number of Bitcoin ATMs worldwide has more than doubled from the same time last year, reaching nearly 17,000.

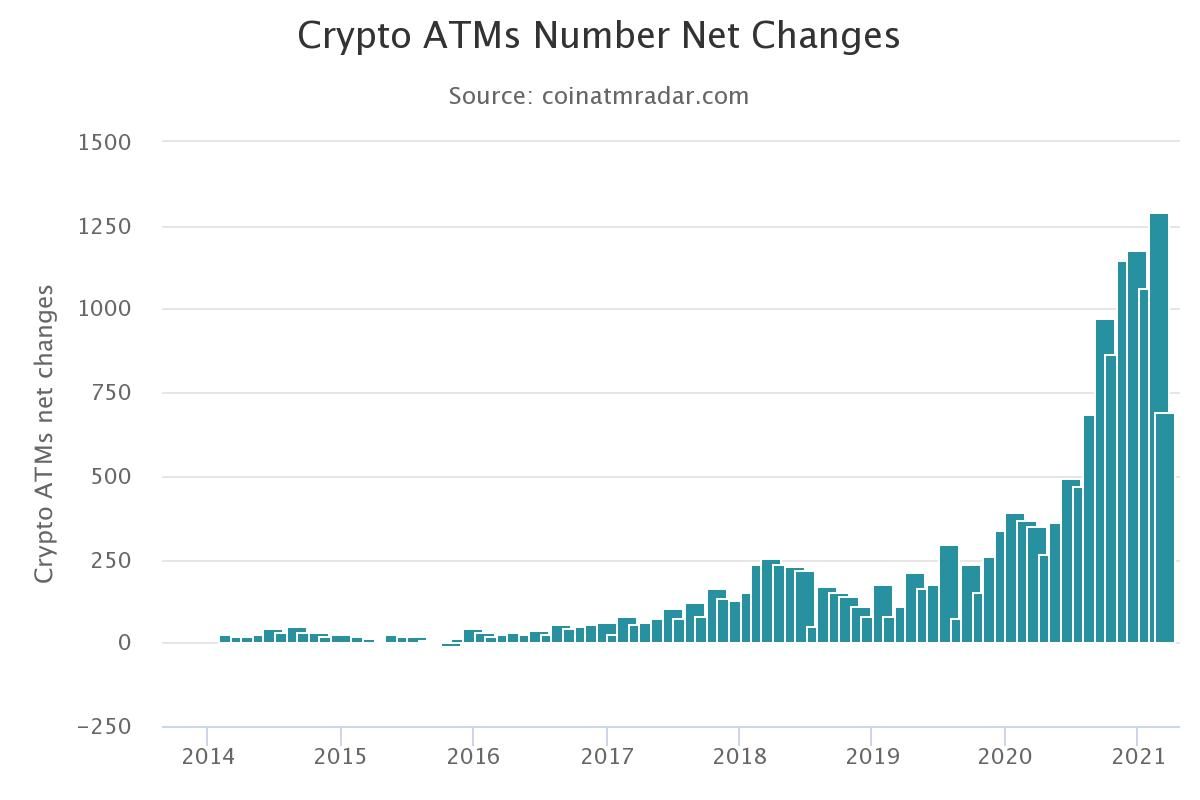

The number of Bitcoin (BTC) ATMs increased by more than 20% in 2021, marking a strong jump alongside the market rally. The increase comes as Bitcoin hovers a few thousand dollars below its all-time high of approximately $61,000.

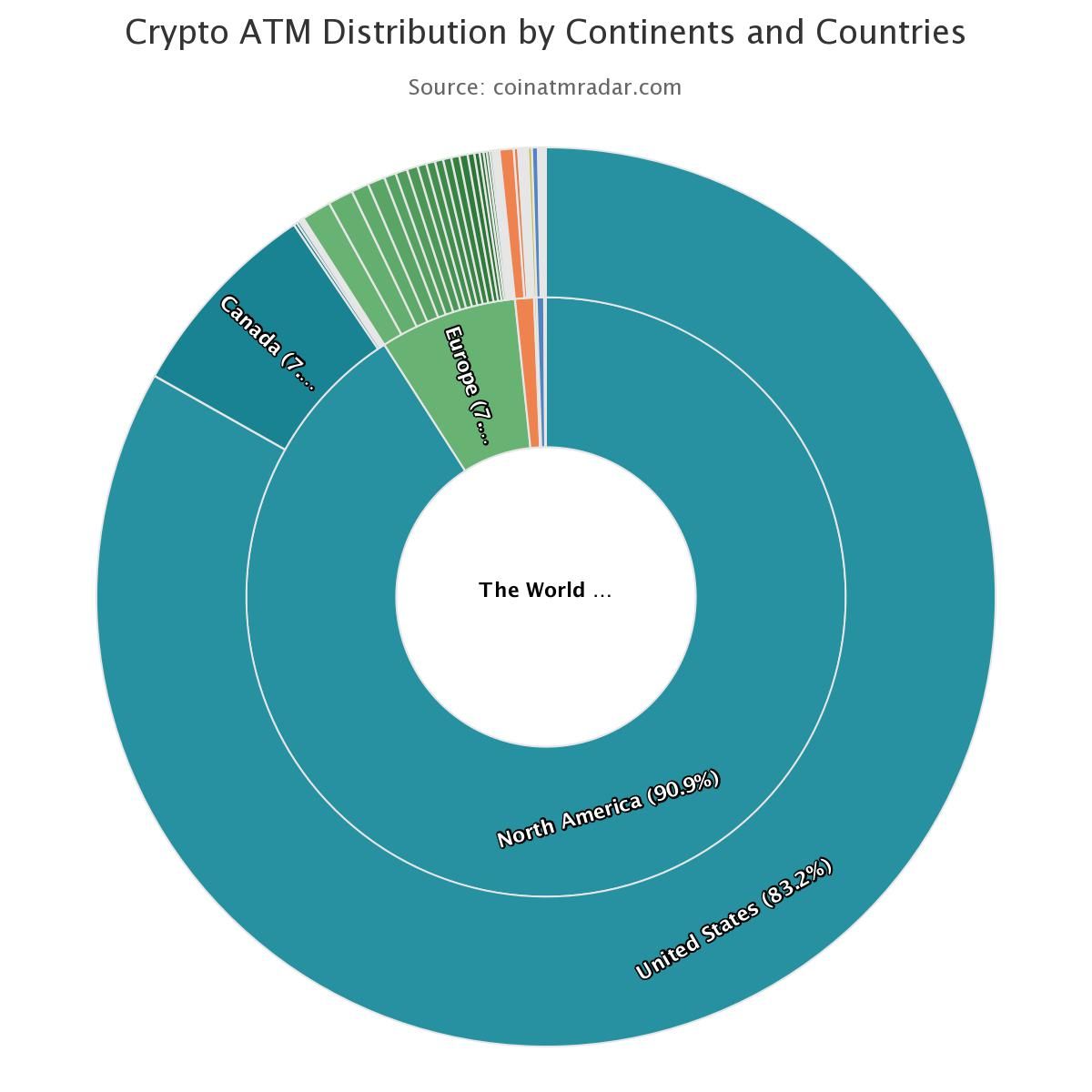

Data from Coin ATM Radar shows a significant increase in Q1 2021, especially in the North American continent. The total number of Bitcoin ATMs worldwide stands at 16,966, about 2.5 times as much as it was at the start of 2020.

The US accounts for over 80% of all Bitcoin ATMs, but the numbers show that it is growing in Europe too. Genesis Coin is the largest Bitcoin ATM manufacturer, with 38% of the market share. General Bytes comes next with 27% of the market share.

Bitcoin ATMs, while convenient and allowing anyone to purchase the asset, has a disadvantage in that it charges relatively high fees. However, the growing number indicates that there is a demand for it, which can only help adoption. Users can use both debit and credit cards to purchase it.

Market Rally Continues

The increase in the number of ATMs unsurprisingly coincides with the market’s current rally, which saw Bitcoin touch $61,000. The crypto market’s top asset has gained tens of thousands of dollars in the space of a few months. It looks as though BTC will hold well above the $20,000 all-time high that it was seeking to breach last year.

This puts in line to reach the targets set by analysts from major banks, including JPMorgan Chase and Citibank. The former had set a price of $146,000, while Citibank issued a target of over $300,000 by 2023. Investors like Tim Draper also believe that it will hit similar prices, with Draper saying that it would reach $250,000 by 2023.

At the same time, governments around the world are mulling over how to regulate the asset class, which is a very novel one. Some countries are focused on banning privacy coins to prevent money laundering and terrorism financing, like South Korea, while India is considering a total ban on private cryptocurrencies.