Europe has hit an all-time high when it comes to Bitcoin ATMs, with the figure standing at 1,459. The all-time high arrives amid the wide-ranging MiCA regulations.

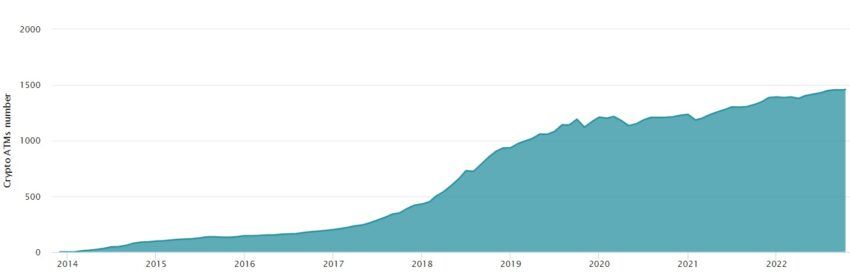

The number of Bitcoin ATMs in Europe has reached an all-time high, according to data from Coin ATM Radar. The figure stands at 1,459 as of Oct. 12, with worldwide installations at 38,604. The all-time high in Bitcoin ATM installations comes at a time when the European Union is looking all set to approve the landmark MiCA regulations.

The growth in ATM installations in Europe is at 5% year-to-date and 10% year-over-year. At the same time last year, the number of ATMs was roughly 1,324.

The use of Bitcoin ATMs appears to be increasing in Europe, and Greece, in particular, is seeing a lot of activity. The country has about 64 ATMs in use, and some tourists who are crypto enthusiasts have been making good use of them. Greece does have a fair few crypto meetups and an active crypto community.

Another European country, Austria, has also been seeing more crypto ATMs installed. Earlier this year, electronic retailer MediaMarkt installed ATMs in 12 markets across the country.

United States still leads in Bitcoin ATM count

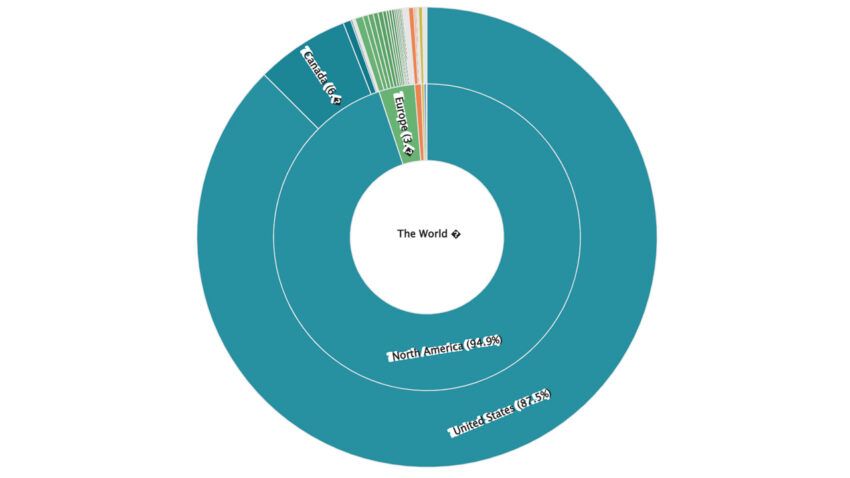

The United States, by far, has the most Bitcoin ATM installations, with 33,779 ATMs. Canada follows with 2,541 ATMs, with Europe third. The latter might still be far away from other countries, but there is a noticeable interest, as seen in Greece.

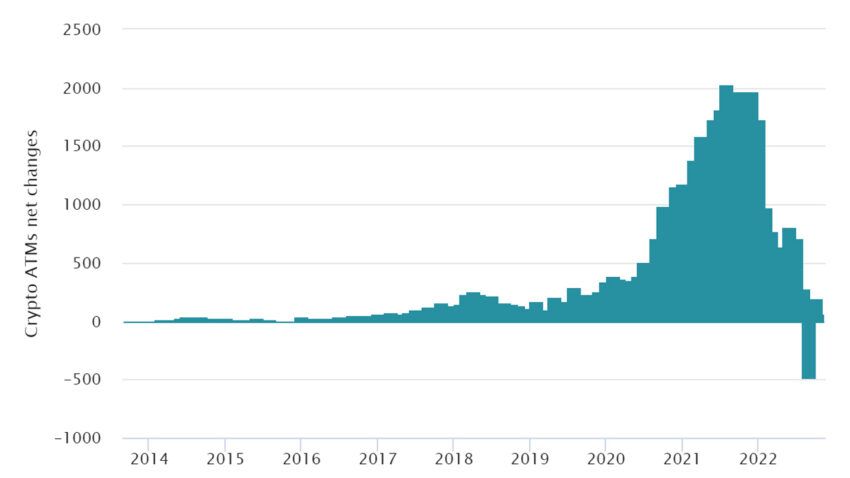

Of interest is the fact that global Bitcoin ATM installations actually reduced for the first time ever. Nearly 500 ATMs were removed. It’s unclear why exactly this might have happened, but regulations and growing scrutiny by authorities may be playing a part.

The United States Federal Bureau of Investigation said in a public service announcement published on Oct. 3 that scammers were using crypto ATMs to defraud individuals. They state that losses range from tens of thousands to millions of dollars.

Europe moves closer to comprehensive crypto regulation

One of the most discussed headlines this week has been the MiCA regulations that the European Union (EU) has been working on. It recently received approval from the economic division of the EU and will see a final vote in a parliament session later this year.

The bill is wide-ranging and covers several aspects of the crypto market, including consumer protection, the prevention of money laundering, and stablecoins. Analysts expect it to have an impact on the market, and the EU is also examining the DeFi market for potential regulations.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.