He outlined a short-term descending channel in which the price has been trading in for a while. Let’s take a closer look at the Bitcoin price movement and see where BTC is heading to next.I'm always hesitant to predict prices in the short term [as opposed to the medium term] as I think the shorter the TM the more random/ less probable the prediction becomes. Nevertheless, wouldn't surprise me to see price move sideways and volatile in the short term. pic.twitter.com/2eKRzM7d0T

— dave the wave🌊🌓 (@davthewave) November 28, 2019

Bitcoin in a Descending Channel

The Bitcoin price has been trading inside a descending channel since June 24. It initiated a rally once it reached the support line on November 25. There are two main areas of interest that are found at $7100 and $8700. A movement below/above these areas would indicate a breakdown/out from the pattern — which we do not think is very likely. Therefore, we could see the Bitcoin price trading between these two areas for the foreseeable future.

Logarithmic Curve

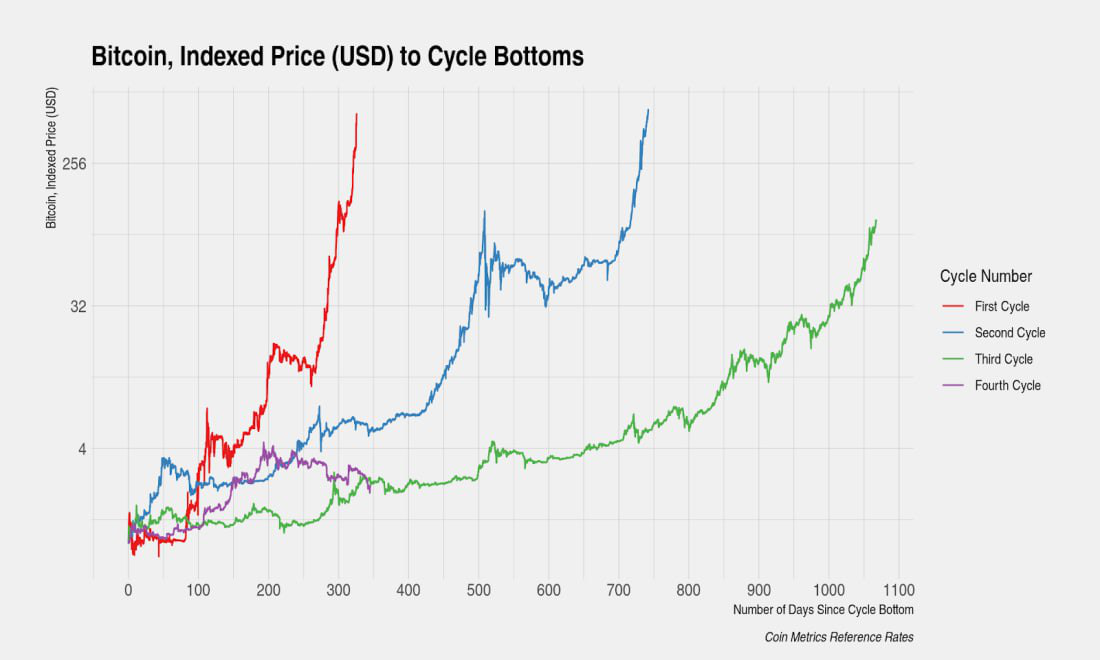

On the other hand, long-term analysis is often more accurate, since the predictions are made on a range instead of an exact price. Additionally, we can draw more accurate trend-lines that have been verified numerous times in order to limit the scope of price movement. Bitcoin has always traded inside the confines of the resistance and support lines outlined below, currently being very close to the latter. However, in a logarithmic growth curve, gains are diminished as time goes by. This is evident in the chart below, in which we can see the magnitude and length of all four Bitcoin cycles until now.

However, in a logarithmic growth curve, gains are diminished as time goes by. This is evident in the chart below, in which we can see the magnitude and length of all four Bitcoin cycles until now.

While the first and second cycles had the same rate of increase, the second one took more than twice longer since it had a more gradual rate of increase. Afterward, the third cycle was the longest and had the lowest rate if increase.

The fourth cycle is still in its early phases, but it looks even more gradual than the preceding three. All the cycles are outlined in the graph below.

While the first and second cycles had the same rate of increase, the second one took more than twice longer since it had a more gradual rate of increase. Afterward, the third cycle was the longest and had the lowest rate if increase.

The fourth cycle is still in its early phases, but it looks even more gradual than the preceding three. All the cycles are outlined in the graph below.

To conclude, Bitcoin is likely to trade in a range for the next few weeks, being confined inside its current pattern. Additionally, since gains are diminished in logarithmic growth curves, the ensuing market cycle is likely to have a smaller magnitude than the ones preceding it.

To conclude, Bitcoin is likely to trade in a range for the next few weeks, being confined inside its current pattern. Additionally, since gains are diminished in logarithmic growth curves, the ensuing market cycle is likely to have a smaller magnitude than the ones preceding it.

Disclaimer: This article is not trading advice and should not be construed as such. Always consult a trained financial professional before investing in cryptocurrencies, as the market is particularly volatile.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.