The Bitcoin price possibly began a new market cycle in December 2018. However, it is likely in the accumulation phase and will trade sideways in the near future.

A Bitcoin investor in 2011 would have received a 250,000 percent rate of return on the original investment. Bitcoin’s massive increase has outperformed almost every other asset class throughout its existence. If we look at long-term charts, this looks set to continue.

However, due to diminishing returns, the next cycle is likely to have a lower rate of increase than the ones preceding it. Beyond technical analysis, the main reasons for the beginning of the new cycle are the fact that the hash rate has been constantly increasing along with institutional investors in the market. Also, the Bitcoin block reward halving is expected in May 2020 — making the asset scarcer. This could help to propel the price higher.

Charter and investor @davthewave stated that, even though he does not prefer short-term analysis, he would not be surprised if the Bitcoin price continued trading inside a range for the foreseeable future.

I'm always hesitant to predict prices in the short term [as opposed to the medium term] as I think the shorter the TM the more random/ less probable the prediction becomes. Nevertheless, wouldn't surprise me to see price move sideways and volatile in the short term. pic.twitter.com/2eKRzM7d0T

— dave the wave🌊🌓 (@davthewave) November 28, 2019

He outlined a short-term descending channel in which the price has been trading in for a while. Let’s take a closer look at the Bitcoin price movement and see where BTC is heading to next.

Bitcoin in a Descending Channel

The Bitcoin price has been trading inside a descending channel since June 24. It initiated a rally once it reached the support line on November 25.

There are two main areas of interest that are found at $7100 and $8700. A movement below/above these areas would indicate a breakdown/out from the pattern — which we do not think is very likely.

Therefore, we could see the Bitcoin price trading between these two areas for the foreseeable future.

Logarithmic Curve

On the other hand, long-term analysis is often more accurate, since the predictions are made on a range instead of an exact price. Additionally, we can draw more accurate trend-lines that have been verified numerous times in order to limit the scope of price movement.

Bitcoin has always traded inside the confines of the resistance and support lines outlined below, currently being very close to the latter.

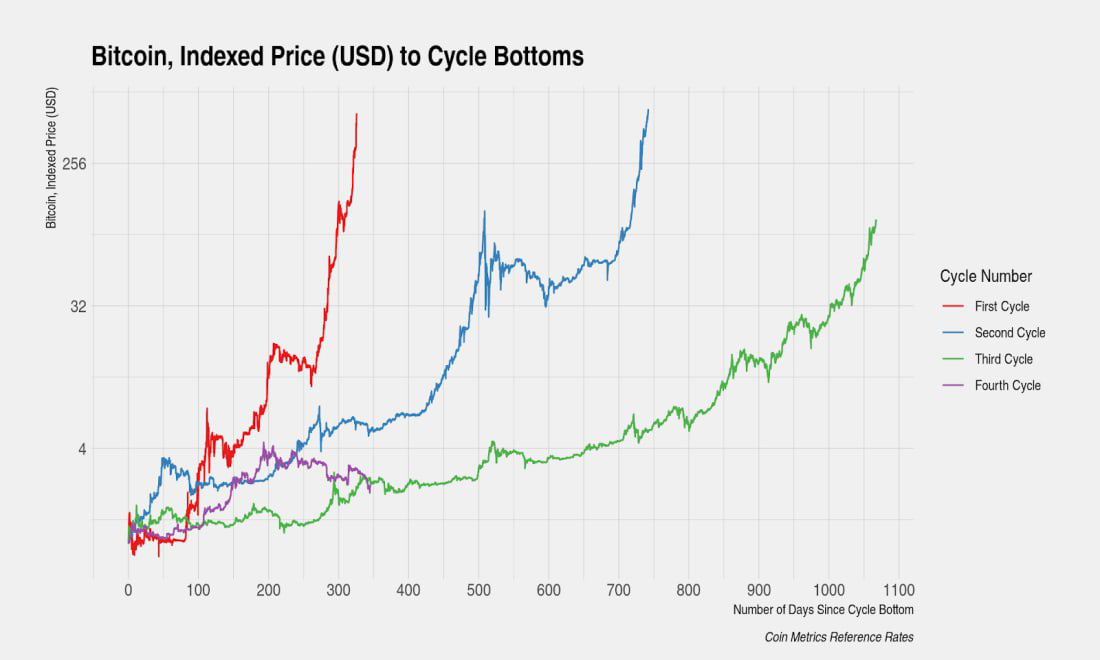

However, in a logarithmic growth curve, gains are diminished as time goes by. This is evident in the chart below, in which we can see the magnitude and length of all four Bitcoin cycles until now.

While the first and second cycles had the same rate of increase, the second one took more than twice longer since it had a more gradual rate of increase. Afterward, the third cycle was the longest and had the lowest rate if increase.

The fourth cycle is still in its early phases, but it looks even more gradual than the preceding three. All the cycles are outlined in the graph below.

To conclude, Bitcoin is likely to trade in a range for the next few weeks, being confined inside its current pattern. Additionally, since gains are diminished in logarithmic growth curves, the ensuing market cycle is likely to have a smaller magnitude than the ones preceding it.

Disclaimer: This article is not trading advice and should not be construed as such. Always consult a trained financial professional before investing in cryptocurrencies, as the market is particularly volatile.