During the week of March 16-23, the Bitcoin price increased significantly, at one point reaching a high of $6,900. However, it decreased considerably over the weekend. Since the price failed to reclaim this important resistance area, this week’s movement will likely see a bearish re-test of support, rather than the beginning of an upward move.

Well-known cryptocurrency trader @LomahCrypto outlined a Bitcoin price chart stating that the weekly outlook looks quite bearish since the price is facing very close resistance from numerous levels. However, he is waiting for a breakdown of the $5,800 area before looking to initiate shorts.

Waiting for Bitcoin to lose $5,800 before I start opening up more shorts.

— Loma (@LomahCrypto) March 22, 2020

Weekly looks like absolute garbage though. I've been predominantly looking for shorts and this is why. pic.twitter.com/KyBjfZNAZo

Bitcoin Weekly Levels

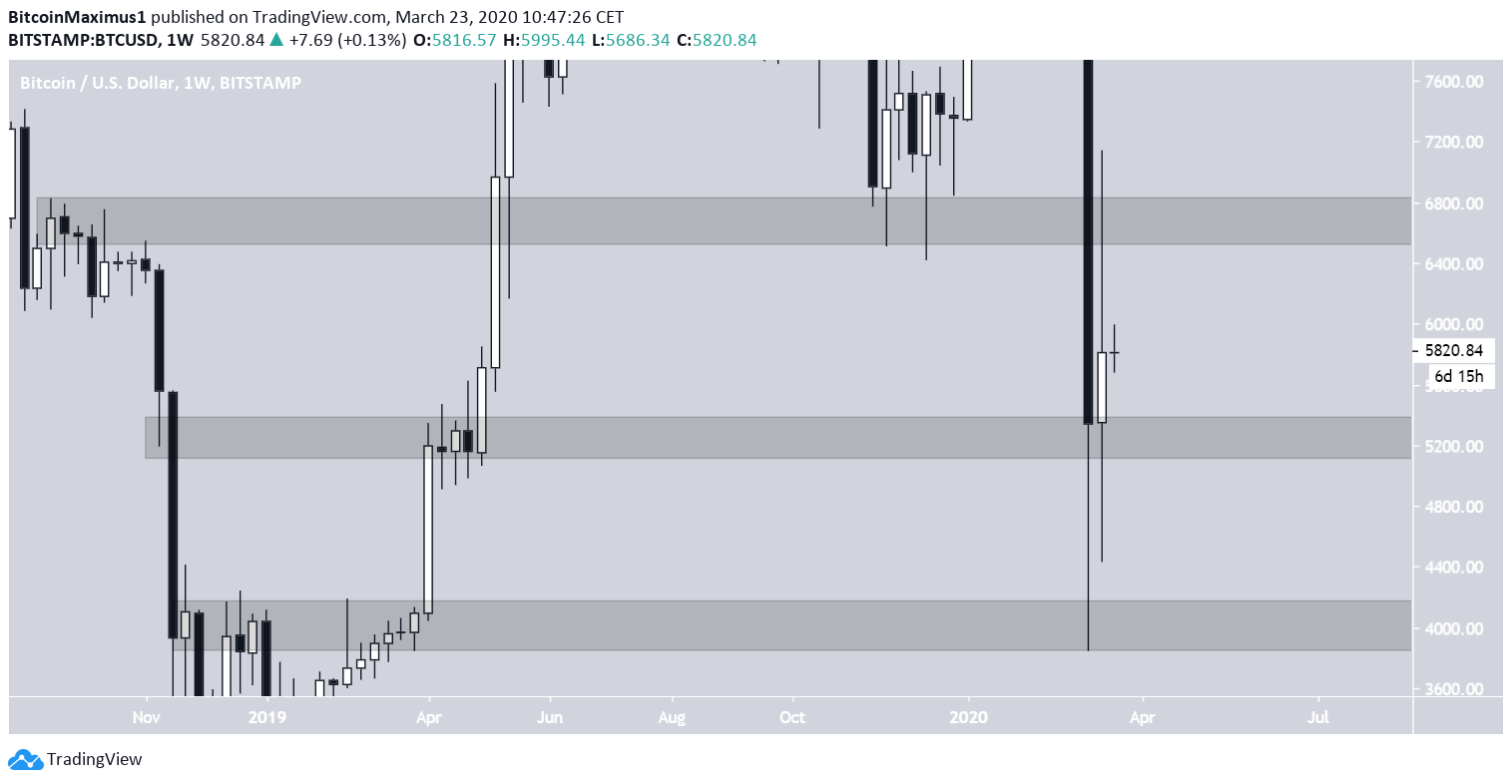

When looking at the weekly chart, there are three important areas, which are broadly drawn in the chart below: There is a strong resistance area at $6,700, which the price just recently validated. This is an area that previously acted as support in November 2019. Therefore, last week’s rally was only a bearish re-test.

Next comes the minor support area at $5,200. The price traded at this level throughout April 2019 and validated it as support over the past week. However, besides these instances, Bitcoin has not reacted to this area.

The next support area is found at $4,000. This area acted as resistance during the December 2018 bottom. In addition, the rapid decrease of March 12 caused the price to reach this area and bounce strongly upwards.

While the price is still trading in the upper portion of the range, the outlook is bearish.

There is a strong resistance area at $6,700, which the price just recently validated. This is an area that previously acted as support in November 2019. Therefore, last week’s rally was only a bearish re-test.

Next comes the minor support area at $5,200. The price traded at this level throughout April 2019 and validated it as support over the past week. However, besides these instances, Bitcoin has not reacted to this area.

The next support area is found at $4,000. This area acted as resistance during the December 2018 bottom. In addition, the rapid decrease of March 12 caused the price to reach this area and bounce strongly upwards.

While the price is still trading in the upper portion of the range, the outlook is bearish.

Possible Short Opportunity

The tweet indicates that a loss of the $5,800 level would be a signal to initiate shorts. The level likely varies slightly from exchange to exchange. The loss of this level and its subsequent re-test would provide an optimal entry to initiate shorts with the anticipation of further decreases, which at the current time seems likely. To conclude, the Bitcoin price is trading above the minor long-term support area at $5,200. The short-term movement indicates that the price will likely soon revisit this level and possibly break down further.

To conclude, the Bitcoin price is trading above the minor long-term support area at $5,200. The short-term movement indicates that the price will likely soon revisit this level and possibly break down further.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored